Creeping Inflation

(Definition, Causes & Examples)

Creeping inflation refers to the first categorization of inflation that economists sometimes use to describe inflation in terms of its magnitude. There is no formal definition that applies to these categorizations, but as a general rule creeping inflation means some rate above zero but no higher than about three percent per year.

For most western countries, the official target rate for inflation falls within this 0-3% range, and so our central bankers are usually quite happy for our economies to experience creeping inflation, but there is no universally acceptable amount of inflation. Austrian economists in particular regard any inflation at all as damaging.

We should note that the mere presence of creeping inflation tells us little about the future direction of inflation. It may be that a period of higher inflation is coming to an end and has fallen within this category, or it may be that a period of deflation or zero inflation is coming to an end, and prices are heading higher in future.

For this reason context matters a great deal; the existence of creeping inflation may itself be manageable (even if it is not desirable), but the expected direction of inflation will be more consequential for determining economic policy.

The Categories of Inflation Severity

As mentioned above, there are no formal ranges for which each inflation measure is defined, but the following ranges give an idea of what is meant.

- Creeping Inflation: 0-3%

- Walking Inflation: 3-6%

- Running Inflation: 6-10%

- Galloping Inflation: 10-13,000%

- Hyperinflation: 13,000%+

The percentages here are usually estimated by the Consumer Price Index (CPI) which is the internationally accepted standard by which we measure inflation. I should point out here that the CPI is open to manipulation by government officials who may wish to conceal high or rising inflation for political reasons, and this criticism has certainly been leveled at western governments in recent years.

You may also wonder why galloping inflation and hyperinflation are split at around 13,000% per year, this is because hyperinflation is a situation so severe that it is measured monthly rather than annually, and 13,000% per year is the figure arrived at when inflation is running at 50% per month.

What Causes Creeping Inflation?

The causes of creeping inflation are identical to the causes of more severe measures of inflation, but we should be clear at this point that there is some confusion in terms of monetary inflation and cost push inflation. Since creeping inflation simply refers to a measure of rising prices as determined by the CPI, it may not be the result of an expanding money supply and could be caused by fluctuations in aggregate supply or aggregate demand.

From a technically precise definition, price level changes resulting from anything other than monetary expansion are not defined as inflation because such fluctuations are thought to be temporary (or 'transitory'). Inflation is a term applied to a persistently rising price level, and this is thought to occur only as a result of monetary expansion.

Of course, if aggregate supply and demand factors keep deteriorating then we can get multiple periods of rising prices, so the distinction becomes blurred. In any event, the causes of creeping inflation may be monetary expansion based or aggregate supply/demand based because it is simply defined by the extent of CPI.

Creeping Inflation Examples

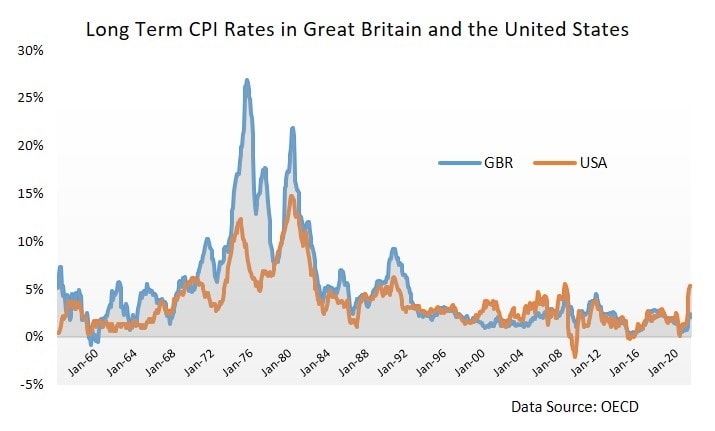

By now you should be aware that examples of creeping inflation are widespread, and are more the norm than the exception. As the graph below shows, most of the last 20 years has seen CPI rates at around the 2% level in both Great Britain and the United States, with the only significant exception being the run up to the 2008 financial crisis.

The 1970s and early 1980s was a period of much higher CPI rates, the root causes of which were loose monetary policy in the 1960s, and supply-side shocks in the form of oil price rises in the 1970s.

More recently, in the aftermath of the 2020-22 global pandemic, overly loose monetary and fiscal policy has brought inflation way higher and is a major economic threat going forward.

Final Thoughts

Arbitrary classifications of inflation in terms of its severity are of little use and can be quite confusing when determined by simple measures of the CPI. The CPI is actually a cost of living measure rather than an inflation measure, and the distinction does matter because a rising price level may be caused by many things.

Inflation is a specific problem that requires a specific solution, and a general failure to recognize that does create an environment which can be manipulated by governments for their own selfish motivations.

A creeping inflation target of around 2% CPI is widely pushed as desirable, but there is no evidence whatsoever to support that claim.

Sources:

Related Pages:

- What is Inflation, and why is it bad?

- Hyperinflation

- Galloping Inflation

- The Non-Accelerating Inflation Rate of Unemployment

- Does Quantitative Easing Cause Inflation?

- The Quantity Theory of Money

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.