- Home

- Cyclical Unemployment

Cyclical Unemployment & Stabilization Policy

The management of cyclical unemployment via an active economic stabilization policy has been a key objective of successive governments throughout the western world, and beyond, for almost 100 years - ever since the aftermath of the 1930s Great Depression.

Much of the controversy in economics today boils down to differences of opinion regarding the theory that was developed in the wake of the depression, i.e. what caused it, what could have been done to mitigate it, and how can we avoid any recurrence of it in future.

First of all, let's be clear about what we mean by 'cyclical unemployment'. We are talking here about the people who are thrown into unemployment because of the boom/bust business cycle that periodically brings an economic recession. A recession is characterized by falling consumer spending, falling business sales, loss of profits, and inevitable cut-backs in jobs as an output gap between GDP and potential GDP develops.

There are other forms of unemployment, some of which are more serious than others, but it is cyclical unemployment that dominates the agenda due to its destructive nature.

The depression had been a period of such economic hardship for regular people, with the unemployment rate in the United States soaring to almost 25% of labor force, that voters ever since have tended to demand that governments take action to prevent any recurrence of such an event.

Competent handling of the economy, by which we mean perceived competent handling of the boom-bust business cycle, is arguably the single biggest factor in swaying voters in an election. As James Carville (a strategist in the Bill Clinton presidential election campaign in 1992) famously quipped, "it's the economy, stupid" in reference to the ongoing recession under the incumbent president George Bush, and what would be the main focus of the Clinton campaign in beating him.

However, the issue of government intervention in the economy is not exactly free of controversy, and economists from differing schools of thought have debated the pros and cons of stabilization policy for many decades.

For the most part, the Keynesian view has prevailed, at least in terms of its popularity with government officials. A big part of the reason for the popularity of Keynesian economics among government circles comes down to the fact that, rightly or wrongly, it offers solutions and actions to take in pursuit of a desired outcome, e.g. discretionary fiscal spending to stimulate recovery and social welfare payments to support the unemployed. These are visible actions that the politicians can show to the people.

By contrast, the main alternative to Keynesian policy has, for many years, been those of the Monetarist camp, i.e. supporters of Milton Friedman. The key starring role of economic policy stabilization here is played by the money-supply.

Monetarists believe that if the money supply can be kept to a stable low growth rate, then the economy too will not deviate significantly from its growth path, and therefore there will be no excessive cyclical unemployment. The problem with this idea, as demonstrated by the failed monetarist policies of the 1980s, is that it is not possible to control the money supply with any degree of precision in a fractional reserve banking system.

Experiments with targeting monetary aggregates i.e. M1, M2 etc failed because of 'Goodhart's Law which states that: "when a measure becomes a target, it ceases to be a good measure" meaning that targeting any given measure of money is like playing a game of 'whack a mole' whereby the other measures react to offset any policy action on the target measure. Only interest rates can effectively control the money supply. Unfortunately, this is quite a blunt tool, and especially so during a liquidity trap such as the one that the west is currently experiencing.

The Austrian school of economics has never been considered mainstream, but it is gaining a great deal of attention at the current time given the mess that more orthodox policy prescriptions have gotten us into. The Austrians are guided by the writings of Ludwig Von Mises, Friedrich Hayek, Murray Rothbard and many other fine economists. They are staunchly committed to 'free-market' principles, coupled with the adoption of a 'sound money' rather than the fiat money currently in use.

Causes of Cyclical Unemployment

The early Keynesian economists regarded the control of aggregate demand as the key to maintaining a healthy economy, and argued that cyclical unemployment occurs when demand is deficient. This supports fiscal policy instruments as the best means of stabilizing aggregate demand, but that is partly on account of the fixed exchange rate system that existed at the time (see my article about the Mundell Fleming Model for clarity on that).

After Friedman counter-argued that it was actually the contraction of the money-supply during the Great Depression that had made the economic depression so severe, there was broad acceptance of his ideas. Today, both monetary policy and fiscal policy are used to manage the economy.

This does not complete the history of economic science, and there are many important branches and sub-divisions that I have not mentioned, but it does give a reasonable overview. The main sticking point that remains, and that I believe will dominate economics in the near future, relates to the current global financial monetary system.

I have already outlined my criticisms of the modern banking system, and the role that it plays in exacerbating the highs and lows of the business cycle, and I have suggested what I believe to be a much better alternative.

However, the fact remains that economic stabilization is a complex issue, and the causes of frictional unemployment are not fully understood.

Cyclical Unemployment Example

Data Source: OECD

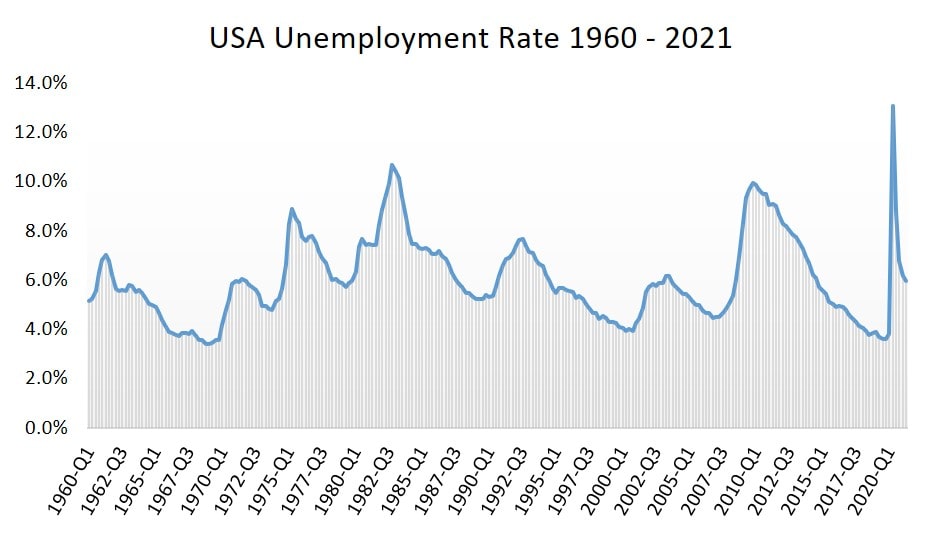

Data Source: OECDThe track record of the United States economy since the 1960s offers several examples of cyclical unemployment rising sharply above the trend level, demonstrating the practical difficulties of keeping the economy running smoothly along its growth path.

There are eight instances of high cyclical unemployment illustrated in the graph above, and some of those instances came with significant disruption. The jury is out as to whether or not there is evidence of the government having achieved any sort of smoothing out effect, but it is clear that unemployment has not reached anything like the 25% seen at the peak of the great depression.

However, the greatest test of government competence in economic management is currently underway, and we will have the results once the full repercussions of the coming financial crisis are known.

Our concurrent national debt levels, along with the twin deficits on the public finances and the trade account, not to mention the high inflation level, all suggests that a major dose of reality is about to present itself. Look out for much higher levels of cyclical unemployment in the years ahead.

How to Reduce Cyclical Unemployment

To learn about the Keynesian (and New-Keynesian) preferred model of the economy, and how to manage it in order to maintain high or full employment, you'll need to understand:

I'd also recommend digging deeper into the science behind this model as it is quite fascinating, and you'll soon gain an appreciation for what a genius John Maynard Keynes really was. For this, I'd advise you to take some time to look into the IS-LM Model and all associated pages that I've linked to in that article.

To get a better idea of Milton Friedman's view of economic stabilization, and the important role of inflation expectations in policy formulation, have a read of:

Again, for a more complete picture of Friedman's ideas about how to manage the economy, you'll need to dig a little deeper. My article about the Quantity Theory of Money (which Friedman used to build his ideas) is a good start.

Stabilization Policy Lags

The theory behind economic management may be somewhat unsettled, with significant differences between the different schools of thought, but even if we did have an agreed single best policy approach, there are still significant practical difficulties involved with carrying out that policy.

The difficulties relate to various time lags involved, the first of which is a 'recognition lag'.

Other Types of Unemployment

- Structural Unemployment - this is usually the most harmful to those who suffer it even though it usually results from some sort of technological improvement that leads to a 'creative destruction' of an existing industry in favor of a more productive industry. The unemployment results because of a mismatch between the existing skills of workers in the outgoing industry, and those needed by the incoming industry.

- Seasonal Unemployment - this happens every year in those industries that sell their product primarily at specific times of the year. The obvious example would be products that rely on warmer weather, so holiday resorts can be like ghost-towns in the winter months (excluding ski resorts) but thriving communities bustling with activity (and jobs) during the summer months. The unemployment that results in the off-season is not of much concern to economists as it is a perfectly natural and healthy cycle.

- Frictional Unemployment - this is the least problematic type and can actually be regarded favorably. It results from a process of workers moving from one job to another i.e., when an employee successfully secures a better job with higher wages. There is often a 'frictional' period of time between leaving the old job and starting the new one.

Sources:

Related Pages:

- Aggregate Demand

- Discretionary Fiscal Policy

- The Natural Rate of Unemployment

- The Phillips Curve

- The NAIRU

- The AD-AS Model

- The IS-LM Model

- Keynesian Consumption Function

- The Crowding Out Effect

- The Economics of Decline

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.