- Home

- Aggregate Demand

- Is-lm Model

The IS-LM Model Step by Step (with Criticisms)

The IS-LM model forms the cornerstone of the Keynesian economic model at the undergraduate level. It is not difficult to understand, but it is important to approach it from a step-by-step approach because there are quite a lot of moving parts involved.

To easily grasp this model, make sure that you understand the following pages in the order given:

Once you've mastered those pages, the rest of the model falls into place quite easily and this page will complete the basic model. That's not the end though, after having built the IS-LM Model I'll be adding links to complications and criticisms of it.

The second part of this page is devoted to those complications and criticisms that come from alternative schools of thought in economics. Keynesian economics has dominated government policy for many decades now, and on a website called 'Dying Economy' you wouldn't expect me to give it a pass and just rubber stamp it!

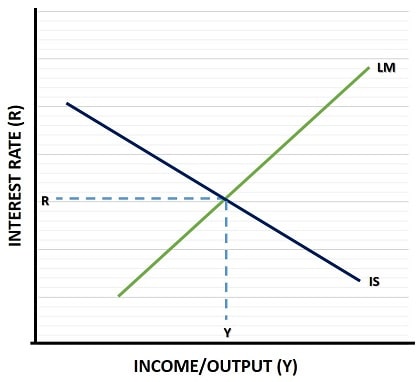

The IS-LM Diagram

The IS-LM diagram gives us a simple framework to understand Keynesian theory once you have mastered the concepts behind it - but again, you'll need to read my other pages to get the background information on that.

Putting the two component curves of the IS-LM model together gives us the Keynesian short-run model of economic management. The intersection of the two curves gives us the equilibrium level interest rate and output rate in the economy i.e. stability in both the goods/services market and the money market.

It helps to keep in mind that the price level is held constant in this diagram with short-run aggregate supply thought to be horizontal (indicating the there is spare capacity available such that output can expand without causing price level increases.

I should point out here that whilst the IS-LM model forms a fundamental basis of Keynesian economics, it wasn't actually developed by Keynes himself. It was developed in 1937 by Sir John Hicks - one year after Keynes' great work 'The General Theory of Employment, Interest and Money', as an interpretation of some loose ends in that work.

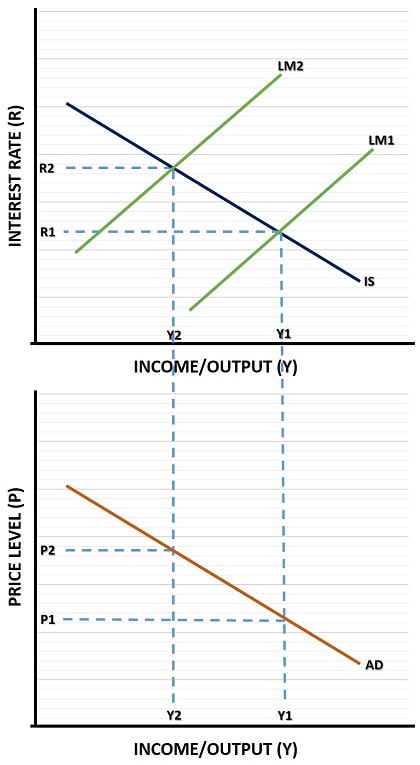

From this basic model of the economy, we can derive aggregate demand - control of which is the key requirement in the Keynesian toolbox for managing short-run economic fluctuations.

In the diagram below, the derivation of aggregate demand is illustrated.

If you have read my page about the LM curve, you'll be aware that each of these curves is drawn for a constant price level. That's because any increase in price will dilute the purchasing power of the nominal money stock, and that would require a new curve to be drawn.

The aggregate demand diagram on the other hand gives us various levels of income/output combinations against different price levels.

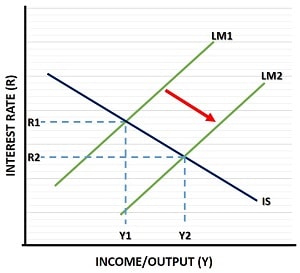

In simple terms, an increase in the price level (from P1 to P2 in the diagram) will reduce the purchasing power of the nominal money stock and thereby cause the LM curve to shift to the left. Then, by comparing the old equilibrium point in the IS-LM model to the new one, we can connect two different points on the aggregate demand curve.

This is illustrated in the diagram. A monetary contraction from LM1 to LM2 caused output to fall from Y1 to Y2 and caused the interest rate to increase from R1 to R2. Since we now have two different price level points, and two associated national income/output levels, we have two points along the aggregate demand curve.

Repeating this process for all the price level points etc will reveal the full aggregate demand curve.

Of course, for this illustration to work we need to hold all other variables constant. If not then the higher interest rate that resulted from the price increase and real money supply contraction would have knock-on effects, especially for investment.

The higher interest rate would lead to a fall of investment spending, and thereby cause a leftward shift of the IS curve and aggregate demand curve. This implies a further reduce income/output levels, whilst offsetting some of the interest rate & price level increases. Ultimately, a new equilibrium point would be reached with output below Y2, interest rates between R1 and R2, and prices between P1 and P2.

To add some extra realism/depth to the IS-LM model, its important to consider the implications of international trade and exchange rates, and for that I recommend my page about:

A Few Historical Notes

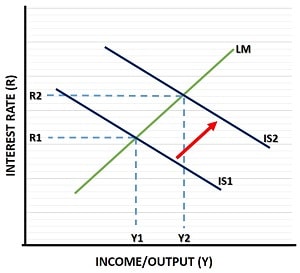

Keynes had been in favor of fiscal policy management to achieve the desired level of income/output, and that preference related to the international exchange rate system of the day, but for most of the last four or five decades the preferred policy tool has been monetary policy.

Visually a fiscal expansion would be seen as shifting the IS curve to the right when government spending in the goods market is increased - which would also directly boost the aggregate demand curve to the right. Alternatively, at times when the economy is overheating, Keynes advised that the government should cut its spending programs and instead reduce the national debt, so that funds would be available to boost the economy the next time a recession came along.

Of course, in modern times many western governments have continually held their feet on the accelerator pedals and run up massive bubbles in their economies whilst also going for a loose monetary policy that has brought interest rates to near zero levels. All of this has happened whilst racking up truly enormous levels of debt.

It seems that many government spending programs, most of which were initially intended to be temporary, have become embedded in the system and tough to remove. Politics often rears its ugly head in the world of macroeconomic management...

The government knows full well that keeping a bad project (which costs an apathetic majority a small amount of money) will usually lead to fewer votes lost than ending that project if it leads to significant loss of money for a politically motivated minority. The problem is that there are a huge number of these projects, and collectively they cost society a huge amount of resources that could be put to much better use elsewhere in the economy.

As Milton Friedman has famously quipped:

"There is nothing so permanent as a temporary government program."

IS-LM Model Complications

Monetary Policy

Real world application of the IS-LM model is complicated by the fact that some of the fundamental assumptions of the basic model don't often apply in reality.

Correct application of Monetary policy is a particularly contentious issue in economics, because there are diverging opinions about the likely affects that it will bring.

For a closer discussion of the actual process involved in delivering a monetary policy action, have a read of my page about:

- Open Market Operations

Following that, a closer examination of the disputed effects of that action is needed, and for that have a read of my page about:

Finally, we need to consider some important extreme circumstances in the IS-LM model, because one of them appears to have particular relevance to our current macroeconomic challenges. For more details, see:

Fiscal Policy

Whilst the effects of an active fiscal policy on the IS-LM model analysis are somewhat less controversial than monetary policy actions, there are still some situations that complicate matters and are hotly debated by different schools of thought.

By far the most important of these relates to the affect of extra government spending on business investment and other interest rate sensitive variables. For more information on that, see my page about:

Criticisms

As a first criticism of the IS-LM model I think it is fair to point out that there is some conflict within the operational aspects of monetary policy.

In countries that have independent central banks, monetary policy control is usually given to that central bank with the primary goal of maintaining a low and stable inflation rate - this is quite different to most Keynesian economists who regard direct control of the economy to maintain the natural rate of unemployment as a primary function.

The implication is that it is the interest rate (not the money-supply directly) that is the target of policy, because manipulation of that rate is how inflation is brought under control. It follows that if control of inflation is the primary goal of monetary policy, the IS-LM model is largely redundant since it's primary function is the maintenance of the 'perceived' correct level of unemployment.

These roles are also confused at certain times; following the 2020 pandemic governments the world over are interfering with central bank independence and forcing the coordination of both fiscal and monetary policy to the extent that there is a serious threat of hyperinflation in many of those countries. Modern Monetary Theory is the living embodiment of this insanity, and it is gaining a lot of influence.

Even in normal times, the IS-LM model assumes that boosting the real money supply will cause interest rates to fall, but that really only relates to central bank open market operations that concern the buying and selling of existing bonds (debt). The government, on the other hand, seems perfectly capable of issuing new bonds at the going rate of interest, thereby creating an LM curve shift without any significant impact on the interest rate.

There is also a great deal of reliance on the high-street banks to do the actual expansion of the real money-supply via the money-multiplier effect. However, in times of rock-bottom interest rates (meaning lower profitability from lending) and questionable levels of bank solvency, there is often significant reluctance from the banks to extend credit lines and boost the money supply. In times like these these IS-LM model fails its basic test of relevancy.

There is also a huge problem associated with time-lags in both recognizing that the economy is moving either overheating or moving into recession. Official figures are always published after a significant time delay, and are subject to revision after an even longer delay. Further more, once this 'recognition lag' has passed, there is still another delay before any active policy can take effect. This is called the 'policy lag', and combines with the recognition lag it is perfectly possible that any deviation of the economy from its desired levels will actually self-correct before demand management policies can take effect, and in that case the policies would actually destabilize the self-corrected economy by the time they took effect.

Finally, the general criticism of macroeconomic demand management made by the Austrian school of economics has to be considered. Manipulation of aggregate demand will influence the price level in almost all circumstances (contrary to the Keynesian assumption that the economy is operating on the flat section of the aggregate supply curve).

Even worse is that prices will not move uniformly, some industries will benefit more from demand management than others, meaning that some prices will rise faster than others. This will wreak havok with the efficient functioning of the price mechanism, and in turn will lead to malinvestment by firms as they chase greater profits from those ventures with artificially high prices. The Austrians argue convincingly that the malinvestment process of demand management policy actually causes the boom-bust cycle rather than mitigating it.

Sources:

Related Pages:

- Aggregate Demand

- Aggregate Supply

- The AD-AS Model

- Real Balance Effect

- Cyclical Unemployment

- The Interest Rate and Money Supply Relationship

- The Mundell-Fleming Trilemma

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.