- Home

- Aggregate Demand

- Is-lm Model

- Interest & Money

Interest Rate & Money Supply Dynamics (With Graphs)

You may find the relationship between the interest rate and money supply somewhat confusing if you have studied the standard economics text books, and I suspect the reason for that may be due to a misplaced loyalty to the standard IS-LM model that underpins much of Keynesian economics.

Even Gregory Mankiw (one of the world's most renowned experts on New-Keynesian economics) has argued, in previous years, that control of both the interest rate and money supply is possible. Well, he is correct in a sense, but as I'll show below this gives a very misleading impression of how monetary policy works.

These two variables are directly related, meaning that independent targets for both are not possible. To achieve a desired level for either one necessarily requires that the other will move to whatever level the money market dictates. In the proof below you'll need an understanding of how the the IS-LM model works, so click the link if needed.

The Interest Rate and Money Supply Relationship

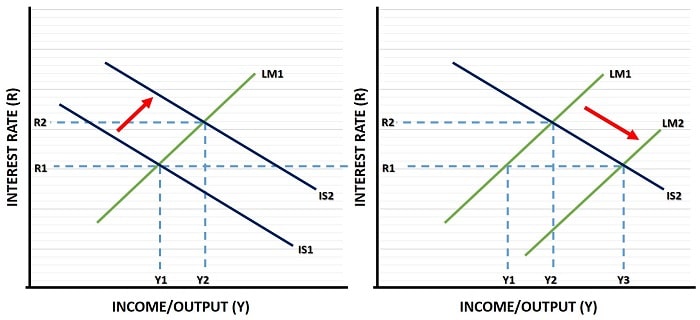

In the diagram below lets assume that we live in the Keynesian world where there is spare capacity in the economy to expand income/output without causing any upward pressure on prices. The government in this scenario is able to issue more bonds (raising national debt) and spend more money in order to boost the economy and stimulate growth.

In terms of the IS-LM analysis, the government boost causes more spending in the goods market independently of the existing interest rate, and this is represented by a rightward shift in the IS curve from IS1 to IS2.

Now, with the existing money supply there is a problem. It is impossible to maintain the interest rate at R1 given the government boost to the economy. Why is that? Because with the higher income level of Y2 resulting from the government boost, people will want to increase their bank balances in order to increase their purchasing power in the economy.

As with supply and demand for other products/assets, the increase in demand for money (with a fixed money supply) will put upward pressure on the price of money. And what is the price of money? It's the interest rate that must be paid for borrowing it (or foregone for holding it instead of investing it).

So, even in the Keynesian world, if the government wants to boost the economy then it will need to compromise on one or both of its interest rate and money supply targets. If the government settles for accepting an increased interest rate as a consequence of its fiscal expansion, then it should at least be able to maintain a constant money supply.

If, on the other hand, the government is determined to maintain the original interest rate, then the government could instruct the central bank to increase the money supply in order to satisfy the extra demand for money at the existing interest rate. However, not only would this compromise any claim of central bank independence, it would be a highly controversial move in its own right. It would constitute something called 'monetizing the debt' whereby the central bank purchases the extra bonds that the government has issued.

The controversy here surrounds what most economists would regard as a highly inflationary policy (although the MMT mob that is currently gaining influence in the corridors of power promote exactly this sort of policy).

In terms of the diagram above, an increase in the money supply would be represented by a rightward shift of the LM curve, as illustrated in the right side of the diagram. National income and output in this idealized Keynesian world-view would then grow way beyond the government boosted level of Y2 and go all the way to Y3.

What could possibly go wrong with this you might wonder? The answer is that we don't live in this sort of Keynesian world, we live in a world where inflation will result from such expansionary fiscal and monetary policy, and I turn to that in a later section. First though, we need a few words to explain the difficulty of estimating the interest elasticity of demand for money.

The Interest Elasticity of Demand for Money

We know from our derivation of the LM curve that the slope of the curve depends on the interest rate, but difficulties arise in predicting how sensitive money demand is to that interest rate. We do know that there is definite negative relationship here, but it turns out estimating this with precision is extremely difficult.

We also know that the interest elasticity of demand for money changes with financial innovation, because formerly non-liquid assets have become more liquid and more able to function as money.

Furthermore, we know that time plays a powerful role in affecting interest elasticity, and that the short-term elasticity of demand for money is much smaller than it eventual level.

All these complications make management of the money-supply very difficult in the real world.

Different Macroeconomic Perspectives

I trust that you have already grasped the inescapable fact that the relationship between interest rate and money supply policies are inextricably connected, and that having any specific target for one of these variables negates any chance of having an independent target for the other.

I continue now to build some reality into the tradeoff between interest rate and money supply objectives.

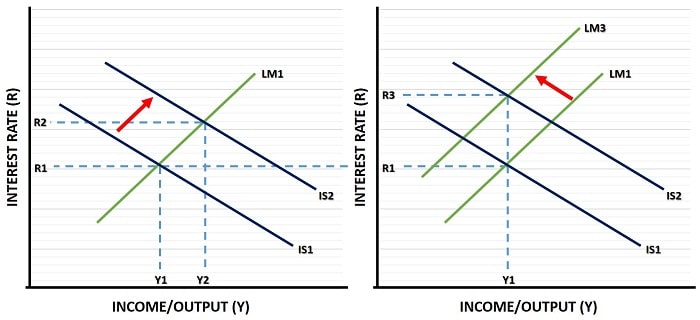

In the diagram above we start on the left side with the same position as the first diagram. However, in this model we start with the classical view of the economy and assume that there is no spare capacity to increase income/output without causing the price level to increase.

On the right side of the diagram you can see that the new IS curve that resulted from the fiscal expansion simply leads to a leftward shift in the LM curve without boosting the economy (at least not in the long-run, but there may be some short-run boost since full adjustment to the fiscal boost will take time).

Why does this LM curve shift take place? It's because each LM curve is drawn with a fixed nominal money supply and a fixed price level i.e. a constant 'real' money supply with a constant level of purchasing power.

If the economy is producing at full capacity, then any attempt to boost it further will ultimately induce a higher price level that offsets the fiscal expansion. This is precisely the process described on my page about the 'NAIRU'. In terms of the diagram above, a higher price level will reduce the purchasing power of the real money supply, and this implies a leftward shift to a new LM curve. In the long run, all that the fiscal expansion did is increase is the interest rate all the way to R3.

Ultimately, the difference between the macroeconomic points of view presented on this page boil down to a difference of opinion about the correct primary focus of government policy. The Keynesians have always preferred direct action to boost/maintain the rate of unemployment, and by extension the level of income/output necessary to achieve the desired amount of employment.

Other economic schools of thought emphasize different means of achieving the best economic outcomes.

Austrian economists prefer a hands-off approach to any sort of macroeconomic management of the economy. They believe that a free-market economy is better able to self-correct than via any sort of corrective government action.

Monetarists prefer to emphasize the control of inflation, believing that the classical model is correct and that any action to reduce unemployment will cause overheating in the economy and an increasing price level that can quickly get out of control.

If the Keynesian view is appropriate, then it would seem better to focus on interest rate policies and demand management. If the Monetarists are correct then it is better to maintain a stable money supply. If the Austrians are correct then both the interest rate and money supply should be left to settle at their natural market-driven levels.

Sources:

Related Pages:

- Types of Money

- The Money Multiplier

- The IS-LM Model

- The Consumption Function

- The Keynesian Multiplier

- The Monetary Transmission Mechanism

- The IS Curve

- The LM Curve

- Capital Mobility

- The Mundell-Fleming Trilemma

- What Happens to Interest Rates During a Recession

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.