- Home

- Aggregate Demand

- Consumption Function

Keynesian Consumption Function Explained (with Graphs)

The Keynesian consumption function focuses on establishing the important link between the main component of aggregate demand, i.e. consumption, and the level of national income. Consumption (which is the sum of household spending) accounts for around 60% of national income in most developed economies.

In Keynes' own words:

"The fundamental psychological law.., is that men are disposed, as a rule and on the average, to increase their consumption as their income increases but not by as much as the increase in their income."

(John Maynard Keynes)

In other words, the marginal propensity to consume is positive but less than complete, because some portion of any increased amount of real disposable income will likely be set aside for a rainy day and saved. There are, of course, cultural differences from one country to another with regard to their preferences to consume rather than save, but the general point is solid, and it allows us to draw a simple graph to illustrate some important concepts about the function.

Keynesian Consumption Function Graph

The graph below illustrates the economics involved in the interaction of consumption function basics i.e., differing amounts of consumption with differing levels of national income. It is sometimes called the 'Output Expenditure Model'. For simplicity, lets assume for now that consumption is the only component on national income.

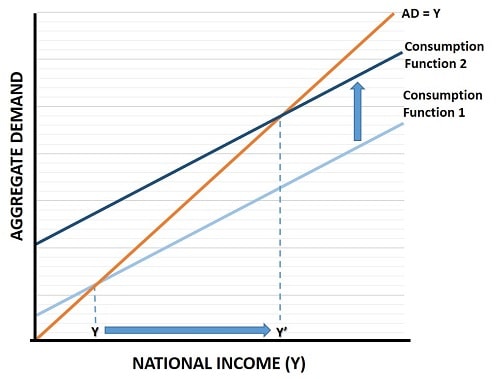

Figure 1: Keynesian Consumption Function Graph

Figure 1: Keynesian Consumption Function GraphThis consumption function graph shows how consumption increases with disposable income, with the vertical intercept representing autonomous consumption.

The graph illustrates how an increase in the non-income-related determinants of consumption leads to an increase in national income (or national output if you prefer). We needn't concern ourselves at this point with the cause of this increase in consumption, but notice how it raises the function to a higher level and elicits a higher level of output.

Let's start with the AD=Y line, this line shows all the points at which the economy can be in a stable equilibrium, but the actual equilibrium occurs at the intersection of the consumption function and the AD=Y line.

Starting with consumption function 1, the economy will achieve a stable short-run equilibrium point at an income/output level of Y, as shown. If output were lower than Y, there would be unsatisfied demand in the economy (because the function line is higher than the AD=Y line at income levels below Y) meaning that output expenditures would be driven up in order to satisfy that demand. Remember that this is a Keynesian economic model, which assumes that there is spare capacity in the economy that allows output to increase without any impact on the price level.

Similarly, if national income were higher than Y, there would be unsold goods and services in the economy, which would cause output to fall until it settles at an income level of Y.

Notice that the consumption function is always higher than zero.

The reason for this is because people need to consume some minimum level of basic necessities in order to sustain life, so even if national income were zero there would need to be borrowing and/or international aid for the economy to continue in existence. This amount of consumption is said to be 'autonomous' of income.

Marginal Propensity to Consume - the Slope of the Consumption Function

Notice from the graph that the slope of the consumption function is less steep than the AD=Y line. This is due to the effect that Keynes noted (see the quote at the top of the page) that, as income rises, what we consume also goes up but by a lesser amount. The slope depends on the marginal propensity to consume (MPC), which means that the larger the proportion of any increase in income that goes towards consumption, the steeper the slope will be.

Although the functions are illustrated as straight lines, this is just for simplicity. As an economy gets richer, i.e. as the sustainable level of national income increases, it may be that the MPC will decrease if people start to save larger proportions of any extra income that they receive. In that case the straight consumption line would be more accurately drawn as a curve that gets less steep at higher income levels. However, the 'Relative Income Hypothesis' challenges the idea that the savings rate of a country will increase as its national income increases, although the issue is as yet unsettled.

Economists don't really debate this point, and even with a constant MPC it can be seen that a richer economy will save an increasing share of its total income each year, and that very poor economies will have negative savings, as explained above by the autonomous component of consumption.

It is also true that the MPC can change for any given level of national income depending on circumstances at any point in time. For example, if a housing market bubble starts to develop, it will encourage potential buyers to enter the market by spending more of their income on second homes, first time homes, bigger homes etc. That would then incur extra spending on decoration, furniture, legal fees and so on. All of this extra spending would mean that the housing bubble had encouraged people to increase their MPC in order to try and benefit from the expectations of higher house prices in the future.

If the MPC does increase, a steeper consumption function will result that intersects the AD=Y line at a higher rate, causing a spending-fueled boom in national income. However, this sort of boom is not really the focus of Keynesian economics, instead it tends to put the blame for most booms on volatile rates of business investment rather than volatility in other metrics.

Okay, now it's time to consider how the Keynesian economists advise the government to stabilize the economy in times of turbulence.

The Aggregate Consumption Function

Up to now we have assumed that consumption is the only factor that makes up national income. In reality there are several more:

|

Positive Factors

|

Negative Factors

|

The positive factors create extra spending and higher national income, the negative factors have the opposite effect.

The aggregate consumption function based assumptions specify that these other components of aggregate demand, i.e. non-consumption factors, are autonomous of national income. In other words they are more responsive to other drivers like wealth, expectations, and foreign expenditure.

Of these components, investment spending in particular is thought to be extremely influential, and is usually blamed for short-run fluctuations in national income i.e. booms and recessions due to its volatility. Investment spending is volatile because it depends on business confidence, which is in large part a psychological phenomena and almost impossible to predict with any degree of accuracy.

To counteract Investment fluctuations, the Keynesians usually prescribe active manipulation of government spending in order to even things out and maintain a stable aggregate consumption function with a stable national income.

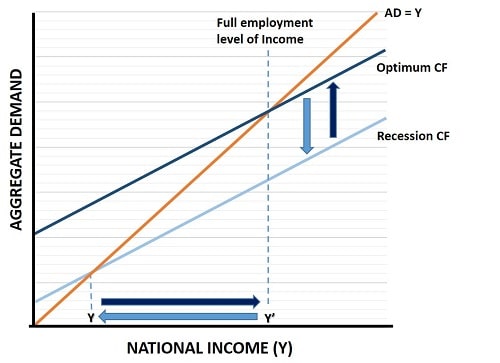

Figure 2: Shift in the Consumption Function Graph

Figure 2: Shift in the Consumption Function GraphThis consumption function graph shows an upward shift of the curve, indicating higher consumption at each level of disposable income, potentially due to changes in consumer confidence or fiscal policy.

In the diagram, suppose that initially the economy is performing well with an optimal consumption function that achieves a full employment level of national income at Y'.

Now, for some reason, business confidence takes a tumble and investment levels in the economy decline. This will cause a recession and a downward shift of the aggregate consumption function to 'Recession CF' as illustrated in the graph.

After a delay, called the 'recognition lag', national statistics will start to show that a recession is building up in the economy, and this will prompt the government to put together a stimulus spending package to boost the shrinking national income.

To get back to the full employment income level of Y' (or the 'Natural Rate of Unemployment'), the government increases government spending to fill the gap left by the reduced level of investment spending. After another delay, the stimulus will start to take effect. If the government has correctly predicted the necessary size of the stimulus, it will raise the CF back to its original optimal level and restore output levels and full employment in the economy.

You may have noticed that the movement of the consumption function in the diagrams above cause relatively larger impacts on national income. This is due to the effects of the Keynesian multiplier, which I explain in my article:

As a quick heads up, the multiplier is negligible in reality, and with ever increasing levels of debt it may even be less than unity, but check out the link for more details.

Criticisms of Government Induced Income Boosts

Although the model is specifically designed as part of Keynes' general ideas about how boosting consumption or other spending metrics can counteract short-run disruptions to the economy (typically caused by declines in business confidence that lead investment levels to fall), it is a fair criticism to note that there is no mention of any implications for the economic growth rate in the long-run when such stimulus policies are followed.

As you will see from my explanation of Endogenous Growth Theory, the key determinant of long-run growth is the rate of saving because, as explained in my article about the saving function, savings fuel private sector investment. This may be a problem if government actions to boost the economy in the short-run come at the expense of permanently lower rates of saving in the long-run (and a higher consumption rate by extension). Excessive government spending can effectively squeeze out investment by borrowing from savers - a process known as 'Crowding Out'.

The false counter to this criticism is that saving in the short-run will be reduced if the economy is allowed to decline, as predicted by the Paradox of Thrift, and that once business confidence is restored the stimulus package can be stopped so that saving and investment can return to normal levels.

However, since the 1980s, the experiences of most of the developed world countries have been of persistent budget deficits that have culminated in truly enormous levels of debt, fueled by the excessive push to consume and all whilst saving rates have been left to dwindle.

Monetary policy expansion to prop up yet more borrowing & consumption had for many years brought near zero rates of interest that have discouraged saving, and all at the same time that irresponsible levels of government deficit spending have crowded-out private investment.

Japan is the most obvious example of this sort of economic madness.

Since the mid-1990s successive Japanese governments have borrowed huge chunks of their country's savings in order to spend on government projects of one sort or another. Savings can only be borrowed once, meaning that as the government increased its debt-fueled spending, the private sector has been denied access to funds that could have been used for investment purposes. The end result of this is that Japan now suffers the highest government debt to GDP ratio in the world, and has had near zero economic growth for decades.

Another common criticism relates to the fact that Keynesian stimulus policy is not always appropriate for every recession. This was amply demonstrated by the 1970s period of stagflation when a recession was caused via a supply-side contraction in the economy (rather than a demand-side contraction that Keynes' theory was designed to correct).

Boosting aggregate demand when aggregate supply is contracting is highly inflationary, and western economies paid a hefty price for following Keynesian policies at that time.

Then there is the fact that the Keynesian consumption function 'fundamental psychological law' (quoted at the top of the page) is actually a ridiculously over-simplified estimation of how consumer spending varies with changes in disposable income. For a more realistic model of consumption expenditures, see:

A final criticism comes from the Austrian school of economics which points out the fact that, when boosting aggregate demand, the stimulus effects are not distributed equally across all sectors of the economy.

Whilst the model assumes that short-run prices are unaffected by stimulus packages (because Keynesian economists assume that the economy is operating on the flat section of the aggregate supply curve), in the long-run prices will rise, and some prices will rise faster than others. This will distort the vitally important functioning of the free-market price-mechanism, which in turn will lead to malinvestment in a sub-optimal mix of industries as businesses chase profits in those industries with artificially high prices.

FAQs

How does cultural attitude towards saving affect the marginal propensity to consume (MPC) in different countries?

How does cultural attitude towards saving affect the marginal propensity to consume (MPC) in different countries?

Cultural factors influence household spending habits and the MPC. Societies that prioritize long-term saving or have social safety nets may exhibit lower MPCs, while cultures with strong consumption-oriented lifestyles may show higher MPCs, leading to different effects on national income growth under the Keynesian model.

What role does consumer confidence play in shaping the consumption function beyond disposable income?

What role does consumer confidence play in shaping the consumption function beyond disposable income?

Consumer confidence can shift the consumption function upward or downward independently of income changes. Higher confidence encourages spending on durable goods and investments, effectively increasing the MPC temporarily, while low confidence can suppress consumption even if income rises.

How do housing market trends influence the marginal propensity to consume?

How do housing market trends influence the marginal propensity to consume?

Housing market booms can increase consumption as households purchase homes and spend on furnishings, renovations, and services. This temporarily raises the MPC and can create short-term expansions in national income, highlighting the Keynesian link between wealth expectations and consumption.

Why might the Keynesian consumption function become less accurate at high levels of national income?

Why might the Keynesian consumption function become less accurate at high levels of national income?

At high income levels, households tend to save a larger proportion of additional income, causing the MPC to decline. This makes the linear consumption function less precise, as the relationship between income and consumption becomes nonlinear, reflecting diminishing marginal utility of income.

How do government transfers and social welfare programs interact with the Keynesian consumption function?

How do government transfers and social welfare programs interact with the Keynesian consumption function?

Transfers and welfare programs can act as autonomous consumption factors, increasing household spending even when national income is stagnant. These policies can stabilize the consumption function by reducing fluctuations in disposable income for lower-income households.

How does the Keynesian consumption function relate to modern behavioral economics insights?

How does the Keynesian consumption function relate to modern behavioral economics insights?

Behavioral economics suggests that consumption decisions are influenced by psychological biases, heuristics, and framing effects, which can lead to deviations from the linear predictions of the Keynesian function. For example, mental accounting can cause households to treat windfalls differently from regular income.

Sources:

Related Pages:

- The Keynesian Theory of Consumption

- The Consumption Function Formula

- Marginal Propensity to Save

- Cyclical Unemployment

- Balanced Budget Multiplier

- The Net Exports Effect

- The AD-AS Model

- IS-LM Model

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.