- Home

- Foreign Trade

- Net Exports Effect

Net Exports Effect Explained (with Graph & Example)

The Net Exports Effect in economics relates to the influence that foreign trade has upon the level of aggregate demand in the domestic economy. It is therefore a key component of the Keynesian consumption function.

An increase in exports relative to imports (X-M) implies a net boost to domestic production, and thus a welcome reduction in unemployment during times of recession. To see this, recall that:

AD = C + I + G + (X-M)

If this is unfamiliar, check out my article about: Aggregate Demand.

Unfortunately, due to the close interconnectedness of the global economic system, a recession in one country often occurs at the same time as recessions in other countries (especially close trading partners), with the implication that any improvement in net exports for one country often comes with a deterioration in exports for other countries at just the wrong time in the economic cycle.

Before getting into that, I'll start with an example of the net exports effect via a shifting consumption function.

Net Exports Effect Example

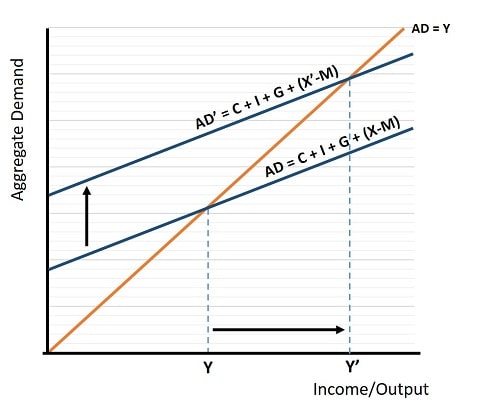

In the graph below, we start with the lower consumption function that depicts aggregate demand before an increase in exports. The relevant level of GDP (national income/output) is equal to Y.

Now, for whatever reason, domestic firms start to sell more output to foreign customers i.e., the country's exports increase relative to its imports. In other words, it's net exports increase.

The effect of the increased net exports is to shift the consumption function higher because the aggregate demand for domestic goods is higher. In the graph above, the new level of aggregate demand for domestic products is in equilibrium with the output of goods at the higher income level of Y'.

This example illustrates the net exports effect on aggregate demand. For more details on the workings of this model, see my article about the Consumption Function.

Net Export Manipulation & Beggar Thy Neighbor Policies

In years past, the temptation to boost an economy out of a recession by causing the domestic currency to weaken (either by an outright devaluation or a steady depreciation) in order to make exports more competitive, would often lead to a sort international trade war with competing countries each trying to undercut one another so as to boost their own economy at the expense of the other.

These types of policies came to be called beggar-thy-neighbor policies, because any boost to one country's net exports would necessarily cause a deterioration in another country's net exports.

Only after repeated, and costly, examples of this sort of nonsense did the developed world move more in the direction of cooperation in international trade, with various types of trade agreements.

For completeness, I should point out that it was more usually the case that these net-export manipulation policies would be used to slow down an economy during times of inflation rather than boost them during times of recession.

In so doing a country would look to improve its terms of trade by revaluing (or appreciating) its currency so that it could increase living standards by affording extra imports. This would be the reverse of the case described above, because net exports would decline after a currency appreciation, meaning that it would cause domestic GDP to fall. In times of inflation, cooling the economy down is often a necessary evil to control inflation.

With consumers switching some of their spending towards the now cheaper imported goods (after an exchange rate appreciation), the demand for domestically produced alternatives would fall and thereby ease inflationary pressures. Conversely, the increase in aggregate demand for foreign goods would add to the inflationary pressures in foreign economies, and thereby cause another problem i.e., imported inflation (click the link for details).

The long period of low stable inflation from the early 1990s to the early 2020s, as well as the increased global economic cooperation during that period, has greatly reduced the use of export manipulation policies.

Net Exports Formula

The net exports formula is simply value of exports once imports have been deducted:

Net Exports = Total value of exports - Total value of imports

The sum can, of course, be a negative in which case a country is said to have a deficit on its 'balance of trade', this is synonymous with a current account deficit, or simply a trade deficit. Any current account deficit will need to be offset by a surplus elsewhere in the overall national accounts, and this topic is discussed more fully in my article about the: Balance of Payments

Net exports are negative when consumers spend more on foreign goods & services than foreigners spend on domestically produced goods & services. There is no immediate cause for concern when this happens, but if a persistent trade deficit arises such as we have had in the US, the UK, and many other western countries for many decades, then it does become a problem. It can only be sustained by a persistent inflow of capital from foreign shores, and whilst this can be a good thing if that capital is used for investment in new or existing businesses, it is often the case that the inflow is used to buy government bonds i.e. to lend money to the government.

This has facilitated the truly enormous growth of our national debt, and at some point it will become a national catastrophe because our creditors will eventually want their money back. Our inability to pay them will come either with an outright default, or with spiraling inflation and a currency crisis. Either option will cause an economic collapse of staggering proportions. In a nutshell, the west has been living beyond its means for far too long.

How are net exports calculated?

The methods for calculating net exports is the same as for national income i.e. the income, output, and expenditure approaches as discussed in my article about: National Income Accounting

Net Export Effect on GDP

As mentioned at the top of the page, net exports is one of the components of aggregate demand that, along with aggregate supply, determines national income i.e. GDP.

An increase in net exports can be illustrated as an upward shift of the Keynesian consumption function. This will lead to a higher level of GDP, and the extent to which GDP increases is determined by the size of the Keynesian multiplier effect (click the links for details). This, of course, assumes that there is spare capacity in the economy to allow that growth.

In the developing world, economists have tried many different approaches to spurring poor countries into growth, and by far the most successful of these approaches has been the export led approach. The main alternative i.e., the import substitution model, has always failed.

All of the 'Asian tigers' succeeded in achieving rapid economic growth by following an export led strategy. The main advantage here is that it opens up the domestic economy and allows an inflow of international capital to invest in manufacturing plants that can then utilize the cheap labor in these poor countries. The opening up of the economy exposes it to international competition, and the efficiency which that necessitates spurs rapid growth in GDP.

All of the Asian tigers developed huge GDP boosts via the net exports effect, with huge trade surpluses that have allowed an accumulation of foreign assets to be built up. According to the UN, over a billion people have been lifted out of poverty since 1990, and this largely due to the export-led growth in China and elsewhere in the developing world.

Related Pages:

- Keynesian Consumption Function

- Floating vs Fixed Exchange Rates

- Mundell-Fleming Model

- Balance of Payments

- Comparative Advantage

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.