- Home

- Foreign Trade

- Balance of Payments

Balance of Payments Accounting in Economics, Explained

Balance of payments accounting concerns the movement of goods, services and financial assets between one country and the rest of the world.

By definition the account must always be in balance, meaning that each country must maintain parity between the economic value of what enters their national economies, and what leaves.

The means by which this is achieved will be discussed on this page, but first we need a little more information about how the Balance of Payments accounting system is set up.

There are two main divisions within the accounting process i.e.:

- The Current Account - that deals with goods/services

- The Capital Account - that deals with financial assets

It is not necessary, and rarely happens, that these two parts of the overall Balance of Payments are each individually in balance. Almost all countries experience a deficit on one account that is counter-balanced by a surplus on the other, and these deficits/surpluses can persist for many years without necessarily being any cause for concern.

The Current Account of the Balance of Payments

Imports and exports of goods and services are accounted for on the Current Account of the BoP, but accounting for transactions here is usually not quite as straightforward as it seems. For example, if a person in the UK purchases a new computer from a local retailer, but that computer was manufactured in China, and the raw materials that were used in its construction were provided from several other countries, how do we account for this?

The answer is that we must account for 'value added' rather than the full selling price of the computer. So how would this work in the example above? If a UK retailer bought the computer from the Chinese manufacturer for maybe £500, and then sold it to the consumer for £600, then £100 of the sale relates to the value added by the UK retailer (e.g. by providing a convenient location for shopping, guarantees on the product etc).

The £500 on the other hand is an import cost, because it was value added by different countries at different stages of the production process, so this amount is added as a negative entry on the Current Account of the BoP. Had the transaction been an export, i.e. a UK manufacturer selling to a foreign retailer, this would have been recorded as a positive entry because it would represent an inflow of money into the UK.

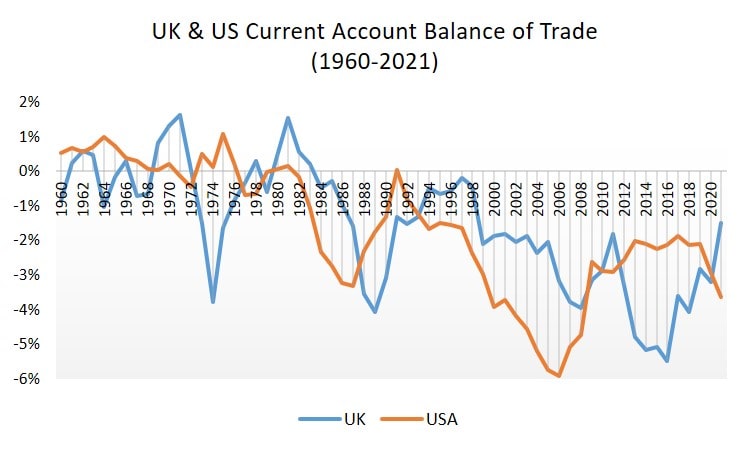

As the diagram above illustrates, the Current Account Trade Balance has been deteriorating in the UK and the USA for decades, with many causal factors at play but government policy the chief architect. This trend is not limited to the UK and USA, many other western countries have followed a similar path.

Trade to GDP Ratios

If you have ever looked up the trade to GDP ratio for various countries then you may have noticed that some countries record ratios in excess of 100%. Luxembourg is listed on Wikipedia with exports of goods and services amounting to more than 200% of its GDP! Clearly this is not possible in the usual sense, and the reason why these numbers are inflated is because of the way that they are recorded.

For example, imagine that Luxembourg has a large manufacturing facility that assembles automobile parts into a final product that is sold to retail sellers throughout Europe. Before this can happen, the component parts must be imported into Luxembourg.

Suppose that the cost of the component parts is €20,000 per car, and that the assembled car is sold to a foreign retailer for €24,000. As with the previous example, only €4,000 of value added has been undertaken by the manufacturing facility in Luxembourg, but the entire €20,000 of imported component parts is recorded on the imports side of the current account, and the entire €24,000 is recorded as an export. This is why Luxembourg's export sector looks so large, but it is a misrepresentation of the true contribution of trade to their national income.

This is not to downplay the importance of trade, it is merely to explain an otherwise confusing statistic. If the entire production process of automobiles had been handled within Luxembourg (right down to the mining of all the necessary raw materials) and only then exported, a single entry of €24,000 would have been recorded on the exports section of the Current Account, and it would have been an accurate measure of the value added in Luxembourg.

However, this is not typical of the way that most production processes are completed in the real world, where many different stages of the process are handled by many different countries.

The Capital Account of the Balance of Payments

The capital account of the BoP deals with the international flow of money to purchase financial assets and other investments e.g. land acquisition.

The easiest way to think of this is to imagine the US current account deficit in the Balance of Payments Accounting system. Then imagine what foreign businesses can do with their earnings from selling goods and services in the US economy. The currency that they earn from selling goods in the USA can be disposed of in various ways:

- They could exchange the US Dollars into their own preferred currency.

- They can invest the dollars into a production facility (inward investment).

- They can purchase financial assets in the USA e.g. stocks, shares, property.

- They can lend the money back to the USA by purchasing bonds.

In the first case the exchange of dollars would translate as an increased demand for foreign currency, which would tend to cause an exchange rate adjustment that makes US Dollars cheaper. This in turn would make US goods more competitive and eventually reduce the current account trade deficit.

In the second case, if the importing firm builds a production facility in the USA, the goods that the facility goes on to produce would be classed as US goods, and assuming that they replace the imported goods there will again be a move to reduce the current account deficit.

It is the third and fourth options that can lead to long-term surpluses on the capital account of the BoP, because they do not work to reduce the current account deficit.

Whether the foreign company increases its acquisition of US assets, or if it effectively lends the dollars back to the US by purchasing US government bonds or US commercial bonds, the exchange rate of US Dollars will be maintained such that foreign imports maintain their competitive edge and the current account deficit can persist.

The desirability of a persistent trade deficit in goods and services is controversial. If the free market is allowed to adjust then it should disappear in time, but if an irresponsible government decides to run a persistent budget deficit (i.e. constantly spending more than it raises from taxes) and financing it by issuing bonds that are bought by foreigners, then ultimately this translates as persistent living beyond the country's means - and eventually there will be a price to pay!

Technically speaking there will always be some discrepancy in the BoP because of errors in calculation. This discrepancy is accounted for in the BoP and is referred to as the 'balancing item'.

Balance of Payments Accounting Summary

Balance of Payments accounting is not concerned with the desirability of trade deficits/surpluses, it merely records the numbers on both sides of the account so that official statistics can measure the amount of economic activity across national boundaries, and keep track of changes over time.

Any persistent imbalance is impossible, because the exchange rate will be forced to adjust one way or another such that competitiveness is gained or lost, and balance is restored. For more information on that, see the link below about fixed/floating exchange rates.

Sources:

Related Pages:

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.