- Home

- Circular Flow Diagram

- Mundell Fleming Model

Mundell Fleming Model Explained (Graphs & Examples)

The Mundell Fleming Model adds valuable depth to the Keynesian model of macroeconomics by extending its analysis to include the foreign trade sector. As with all models it is not intended to explain all possible scenarios, and it includes some unrealistic real-world assumptions in order to make a more general point.

In particular, the Mundell Fleming model assumes a world with 'perfect capital mobility' in an open economy whereby any small differential in the domestic interest rate on an asset class (i.e. assets with a given level of associated risk) will cause massive inflows/outflows of money across the world in search of the highest returns, which would thereby equalize those returns through the forces of supply and demand.

There is, of course, no such perfect capital mobility. All economies are unique and highly complex, with very different mixes of resources and different comparative advantages. Some countries are land rich, others are resource rich, some are capital rich, all have different tax structures, and all are specialized to their particular mix of attributes. On top of this, our governments have different policy agendas and different approaches to management of their economies.

Consumers in different countries have different tastes, different preferences, and different cultures - all of which leads to an enormous amount of diversity that affects their economies relative to other economies in unpredictable ways, and make risk-return calculations extremely complex. Because of these realities, there is no equalization of interest rates, because there is no equalization of risk for any given asset class.

However, the scope for differences in interest rates is reduced by international capital flow opportunities, and that means that there are still some useful policy implications to be drawn from the Mundell Fleming model.

As with all Keynesian models, we continue to simplify the analysis with the standard assumption that the economy is operating on the horizontal section of the aggregate supply curve, and therefore that prices are unaffected by increases in economic output.

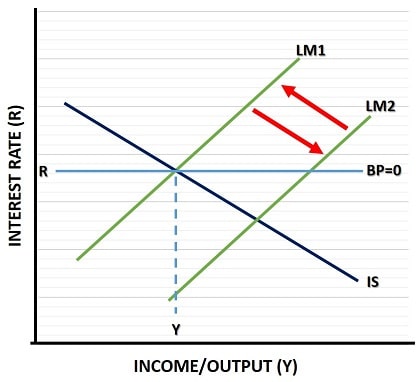

The Mundell Fleming Model Graph, with a Fixed Exchange Rate Example

Monetary Policy

As the graph illustrates, monetary policy under a fixed exchange rate regime is ineffective. The reason for that is because any attempt by the government to boost the economy via a monetary expansion will cause a fall in the domestic interest rate.

This is illustrated by the movement of the LM curve, (click the link for clarity).

With a lower interest rate, US financial assets offer lower returns than foreign financial assets, and this causes a capital outflow from the domestic economy, which in turn creates a deficit on the balance of payments (BoP).

The central bank can try to plug the gap on the BoP by running down its reserves of foreign currency, but with perfect capital mobility the outflow of foreign currency would be far larger than the total amount of the central bank's reserves, and so any attempt at plugging the gap is futile.

The horizontal BP curve shows that only an interest rate of R gives stability on the BoP, higher rates would give a surplus and a capital inflow, lower rates give a deficit and a capital outflow.

In this example, as capital flows out, the inevitable deficit on the BoP forces the central bank to reduce the money supply back to its original level if it wishes to maintain the fixed exchange rate regime. If it does not do this, it will run out of foreign reserves of money and thereby lose control of the rate at which foreign currency is exchanged for domestic currency.

With the money supply reduced back to its original level, the interest rate also returns to its original level, meaning that domestic capital assets no longer have lower returns than foreign capital assets. This will restore equilibrium to the BoP and foreign exchange market, but the independent monetary policy has been completely nullified.

In economic jargon, we say that there is no monetary autonomy under this system.

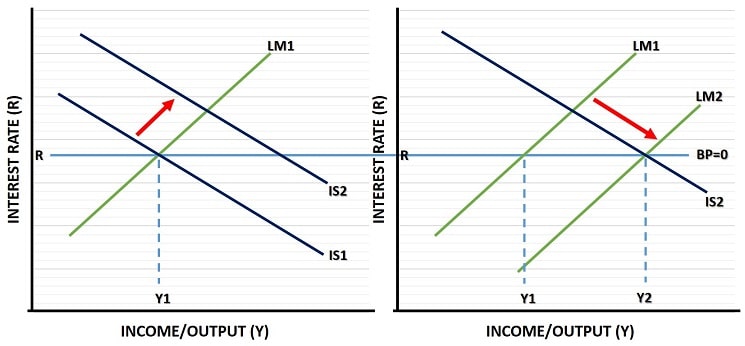

Fiscal Policy

While monetary policy is ineffective under fixed exchange rates, discretionary fiscal policy is very powerful. If the government increases its spending in order to boost the consumption function, the result can be illustrated as a rightward shift of the IS curve (again, click the link for clarity).

Unlike monetary policy, the fiscal policy expansion causes the interest rate to increase which,with perfect capital mobility, attracts a massive inflow of foreign money because domestic capital assets now offer a higher yield. This would cause a surplus on the BoP and put pressure on the domestic currency to revalue to a higher exchange rate.

To maintain the fixed exchange rate, the central bank is forced to expand the money supply in order to prevent the interest rate from rising, so that domestic financial assets maintain the same yield. This implies a rightward shift of the LM curve, and domestic output increases from Y1 to Y2 as illustrated in the graph above. The increase in income/output here is in accordance with the full effect of the Keynesian Multiplier.

In the next section we stick with the Mundell Fleming model, and its assumed perfect capital mobility, to consider the same policies under a floating, or flexible exchange rate system.

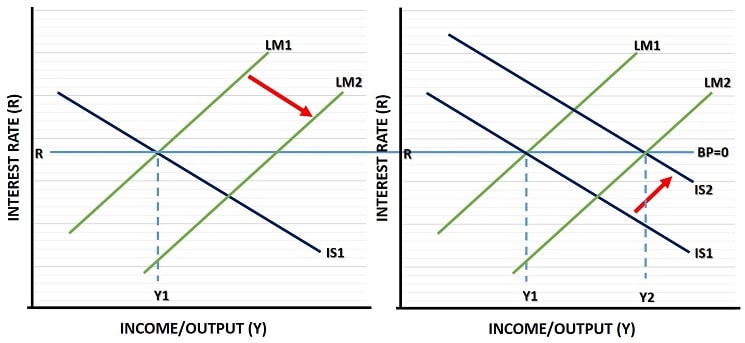

The Model with a Floating Exchange Rate Example

Monetary Policy

In the Mundell Fleming model with a floating exchange rate, the central bank plays no role in maintaining any particular value for the domestic currency, it simply allows supply and demand to do its thing and settle at the equilibrium rate - the rate at which the BoP is in balance. Keep in mind that, under perfect capital mobility, even a small interest rate differential with the rest of the world would induce massive capital inflows/outflows.

Under this system, when an expansionary monetary policy is enacted, the rightward shift of the LM curve puts downward pressure on the interest rate just as before, but this time the central bank does nothing when money starts to flow out of the economy in search of higher yields in foreign markets.

As a result, the exchange rate depreciates to a lower value, and this makes imports more expensive and exports more competitive. Both of these effects improve the trade balance and lead to an increase in consumption of domestic goods and services, which means that the IS curve shifts to the right putting upward pressure on the interest rate.

At the point that the new IS curve intersects the new LM curve, the interest rate will return to its original level stabilizing the inflow and outflow of capital such that the BoP is in equilibrium. At the new equilibrium point, national income/output rises from Y1 to Y2, as shown in the diagram.

Monetary policy is therefore a very powerful tool in a floating exchange rate system with high capital mobility - which is precisely the opposite of what happens with fixed exchange rates.

As a quick qualifying point, you should note that at Y2 the domestic economy will maintain a lower exchange rate despite the return to the original interest rate. This is because the economy achieves a new equilibrium with a reduced capital surplus, but with an equal offsetting reduction in its trade deficit given the lower exchange rate.

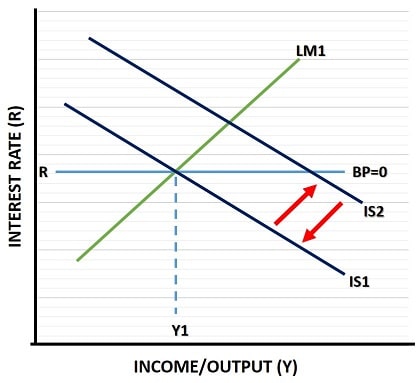

Fiscal Policy

Now consider a fiscal policy expansion. If the government increases its spending in the economy to try and boost income/output, it will simply lead to an exchange rate appreciation that offsets that increased spending.

This adjustment process to the government spending increase would at first boost national income, as illustrated by the IS curve shift to the right. However, this would cause the interest rate to rise and capital to flood in. The exchange rate would then rise and make imports cheaper. Spending would be diverted from domestic goods in favor of imported goods, causing a contraction of national income i.e., the IS curve would be forced back to its original position.

Now, while the national income and output reverts back to its original level, the composition of that output has changed. Government spending is higher, but net international trade income is lower due to the increased spending on imports.

So, as with monetary policy, the exact opposite of what happens under fixed exchange rates with capital mobility happens with floating rates - fiscal policy is ineffective for raising national income.

In the Real World

Whilst perfect capital mobility is not possible, for the reasons given at the top of the page, significantly high capital mobility does exist. However, there is still some room for monetary and fiscal policy in either exchange rate system, and this is often accompanied by coordinated policies throughout the international economy to maximize impact.

Governments do not operate in isolation in the modern world, and experts in international macroeconomics understand that even a small open economy can significantly affect other countries when it enacts domestic economic policies. For this reason there is often a coordinated approach to fiscal and monetary policy across national boundaries.

Another challenge to the Mundell Fleming model can be made with respect to the level of competence that economic agents exercise.

For anyone who believes that these agents will immediately react to interest rate differentials, consider how the most important economic agents across the western world marched straight into the housing market boom from 2005 to 2008 in complete ignorance of the financial meltdown that was to follow.

Clearly interest rates from 2005-08 were far too low, so where were the capital outflows to offset the implicit higher risks associated with such a self-inflicted economic suicide? In fact, how is it possible that any macroeconomic bubble can grow - surely capital flows should immediately deflate such things?

The truth is that international money chases short-term opportunities, and it suffers from the principal-agent problem whereby those economic agents will get paid their commissions even when the principal (regular people whose savings and pension plans they control) suffer the losses of bad investment choices.

With all that said, the Mundell Fleming model does provide some useful predictions about the effects of macroeconomic policy changes, and real-world interest rate differentials do operate within reasonably narrow bounds.

Sources:

- M. Obstfeld - Beyond the Mundell Fleming Model, Lecture Notes (PDF)

- Open Economy Macroeconomics (PDF)

Related Pages:

- National Income Accounting

- The IS-LM Model

- Floating vs Fixed Exchange Rates

- The Balance of Payments

- Aggregate Supply

- The Mundell-Fleming Trilemma

- Comparative Advantage in International Trade

- The Circular Flow Model

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.