- Home

- Circular Flow Diagram

- Mundell Fleming Trilemma

The Mundell Fleming Trilemma & The Impossible Trinity

The Mundell Fleming Trilemma, also known as the 'impossible trinity' presents a problem that Keynesian economic policy-makers have to grapple with at all times.

It can be summarized simply as a constraint that limits the policy-maker to a choice of two out of three desired policy goals:

- International Capital Mobility

- A Stable Exchange Rate

- Independent Monetary Policy

I have discussed some of the issues relating to these choices already, and if you are unaware of the basic tradeoff between monetary independence and exchange rate control in a world with free capital mobility, then I'd advise you to start here:

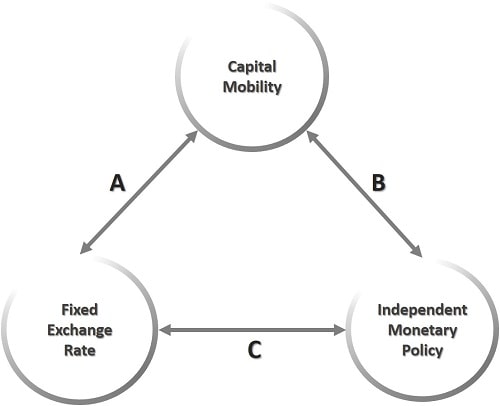

To illustrate the impossible trinity problem, consider the diagram below, where a country's government can choose any of the three policy bundles A, B or C:

- Bundle A allows the free flow of international capital into and out of the country whilst also maintaining a fixed exchange rate. However, in order to maintain exchange rate stability the country must allow its money-supply to adjust to whatever level is required in order to equalize the domestic interest rate with the world interest rate. If the country fails to do this then international cross border capital flows will cause Balance of Payments problems such that the exchange rate must rise or fall.

- Bundle B maintains capital mobility and allows the domestic economy to retain an independent monetary policy. This does allow the central bank authorities to adjust their macroeconomic management of the economy so that an attempt to smooth out the business cycle can be made, but it is not possible to maintain a fixed exchange rate with this policy mix, so a floating exchange rate must be accepted.

- Bundle C also allows central bank policy-makers to adjust their macroeconomic management tools as they see fit, and it also allows them to maintain a stable fixed exchange rate regime for their currency on the foreign exchange market. However, the price for this is that there can be no capital mobility allowed since that would undermine the fixed exchange rate.

|NOTE| All of these bundles represent the extreme cases where the government is wholly committed to two of these 'desired outcomes' and completely abandons the other. In reality this is rarely typical of any government's macroeconomic policy, and compromises are usually made that give some control of all variables without having complete control over any of them.

Furthermore, if a country abandons capital mobility, it does not necessarily imply that it is immediately opting for a fixed exchange rate. It may instead be trying to manage a crisis situation. For example, in recent years (up to mid 2024 at the time of writing) Argentina has operated a flexible exchange rate with capital controls as it attempts to contain its double-digit inflation problem. Maintaining a fixed exchange rate is not possible when inflation is so high, regardless of capital controls.

Incoming President, Javier Milei, is committed to achieving capital mobility and a fixed exchange rate (pegged to the US Dollar), but must first get inflation under control by eliminating Argentina's excessive government spending. This is because fiscal policy, rather than monetary policy, exerts a powerful influence on the business-cycle under Milei's desired policies (Bundle A).

Bundle A had been the preferred choice for much of the developed world up until the end of the Bretton Woods system in the 1970s. Since that time, many of the member countries of the European Union have also dabbled with this option e.g. when they joined the ill-fated 'Exchange Rate Mechanism' as a prelude to full monetary union.

Most of the emerging market countries in the developing world have long championed Bundle C, but in recent times they have moved more towards an opening up of their capital markets while relinquishing some monetary policy autonomy. In other words, they have moved significantly closer to Bundle B.

Bundle B is the current favored option among most of the developed world economies, but with the serious threat of rising inflation following on from decades of macroeconomic mismanagement, the future preferred policy bundle may well change. The sensible option going forward would seem to be one that lowers western exchange rates so that domestic firms can compete more effectively on world markets, but government reactions to crisis situations are difficult to predict.

Ray Dalio (one of the world's leading Macro investors) suspects that capital controls, i.e. restricted capital mobility, may soon be put in place to control any potential problems with mass selling of over-priced western government bonds once investors start to realize how hopelessly over-leveraged our governments really are. Coupled with an independent monetary policy this would imply moving from a predominantly Bundle B position towards Bundle C, and thereby make any exchange rate depreciation more difficult. Whilst this would help to limit rising inflationary pressure (since import prices would be kept down) in the current loose monetary policy environment, it would do little to help restore competitiveness for domestic businesses.

Since this would imply ongoing trade deficits i.e. negative net exports in the goods market, an ongoing capital account surplus in the form of yet more borrowing would be required, but at some point no one is going to want to lend to the west. An inevitable global financial crisis would be the result, and the carnage that follows would be severe indeed. I suspect that capitalism will be blamed for the mess that decades of incompetent/negligent western governments have created, and if so then we could lurch towards socialism instead. In that case we really are looking at the demise of western economic prosperity, because more government (socialism) is never the correct response to bad government.

Are the 3 Objectives Really Desirable?

Before continuing we need to give some thought to whether or not the three desired objectives are really something that the citizens of a country would want. They may seem like good outcomes to pursue, and it is very much in the spirit of Keynesian economics to pursue this type of macroeconomic management, so let's take a little time to consider the implications.

International Capital Mobility

International capital mobility leads to increased global economic growth because it enables money to be invested in the most promising ventures, in the most efficient locations.

Whilst this has made a huge contribution to lifting much of the world's poorest countries out of poverty, it has also undoubtedly contributed to the wholesale deindustrialization of the west, as many industries have been able to relocate their manufacturing businesses to countries where labor costs are much cheaper.

Whilst this has benefited western consumers with cheaper prices for those manufactured goods that are now imported from overseas, much of the cost has been borne by the unemployed workers in those industries that have disappeared. Economics treats people simply as factors of production, it does little to calculate the full human-cost of long-term unemployment resulting from people with non-transferable skills who permanently lose their jobs.

As imports mounted, trade deficits blew up to sky-high levels, but capital mobility has meant that governments have been willing and able to borrow back the money that is flowing to foreign export companies. This has had truly awful consequences, because the eye-watering amount of borrowing that our governments have wracked up has not only burdened our economies with permanent crippling debt repayments, the vast bulk of the borrowed money has been squandered on one bad government project after another.

Furthermore, this massive borrowing from abroad has prevented the exchange rate from adjusting to the enormous trade deficit that has blown up over recent decades.

The effect of the government borrowing from foreign (relocated) manufacturers has been to prop-up the demand for domestic currency, and this has prevented a gradual depreciation that would have restored competitiveness for at least some of our key domestic manufacturers. The implication is that the wholesale relocation of our manufacturing industries to foreign shores has actually been aided and abetted by our own governments.

While (as consumers) we have enjoyed cheap goods and lots of spending, these benefits cannot be maintained in the long-run. Our creditors will want to be paid back at some point, and they aren't going to allow us to simply borrow more money to make those repayments indefinitely. On the other hand, the costs of a lost manufacturing base, and financial insolvency, are permanent.

None of this devastation is directly attributable to international capital mobility itself, and no one who believes in free-market economics (as I do) would ever want capital controls. However, our recent experiences in the west have clearly demonstrated that capital mobility does at least provide an avenue for our self-serving political elites to pursue their own globalist interests, via insane levels of debt-fueled spending at the expense of our own domestic economies.

Stable Exchange Rate

A stable exchange rate comes with reduced risk for international trade. This is a benefit to all countries that enter contracts for orders that take time to fulfill, because it eliminates the chance that a foreign currency, i.e. the buyer's currency, will have fallen in value.

The problem here comes when the exchange rate is maintained at a stable value that is not the correct value. All fixed exchange rate systems have collapsed over time because different countries develop at different rates and have different rates of inflation.

The implication is that the exchange rate needs to be allowed to adjust to a rate that maintains competitiveness for domestic companies, otherwise a persistent trade deficit/surplus will develop.

Independent Monetary Policy

An independent monetary policy enables governments to boost their economies, or cool them down, in order to smooth out the business cycle.

The problem here is that there is a great deal of disagreement about the root cause of the business cycle, and even more disagreement about the government's ability to manage it. There are serious difficulties that arise from active demand-management policies and evidence of the government providing any sort of 'smoothing out' of the economy is in short supply.

Inappropriate government policy is often the cause, rather than the remedy, of short-term economic fluctuations. Monetary autonomy simply facilitates the construction of those inappropriate policies.

Mundell Fleming Trilemma - Conclusion

If allowing governments the ability to choose their two most desired policies from the three available options described by the Mundell Fleming trilemma is meant to achieve better economic outcomes, then the experiences of recent decades has amply demonstrated that this has failed.

Throughout the 1980s, and even more so throughout the 1990s, the developed countries and the emerging economies have willingly increased their levels of capital mobility. This has facilitated a consumer boom in the west that for a long time looked like successful economic policy, but deindustrialization has gradually led to massive deficits on the current account of the Balance of Payments, and these have further facilitated extensive rates of government borrowing on the capital account.

As western governments borrowed, they convinced themselves that it was perfectly sustainable to do so, because inflation appeared to have been kept in check. In reality, domestic inflation was masked for two reasons:

- It measured the costs of imports, which were getting much cheaper due to economies of scale in China and other developing countries as western manufacturing increasingly relocated there.

- The key domestic barometer for inflation, i.e. housing and real estate, was excluded from the official measures of inflation (even as a huge housing boom in the run up to 2007/08 plunged the west into its worst peacetime economic meltdown in living memory).

The sheer level of total incompetence demonstrated by western governments and central bank governors is impossible to express in a way that can convey just how awful their performance has been, but at least it should consign to the dustbin any notion of a worthwhile active Keynesian economic policy role for those governments in the future... except that it won't!

The lessons of failure have not been learned, the west is now paralyzed by its crippling debt, and free-market capitalism will probably be scapegoated for the failings of inept government policy-makers.

To the extent that these failed Keynesian economists are removed from their policy-making roles in future, it will most likely only be so that the far worse Modern Monetary Theory aficionados can take their place, and that puts the west in a very bleak position as far as future prosperity is concerned.

The emerging economies, on the other hand, have fared much better since the 1980s. China in particular has experienced economic growth of an enormous magnitude that has lifted over a billion people out of poverty, and it now has a middle-income economy. Unfortunately, it too has suffered a great deal of mismanagement by hopeless government officials.

China was, for a long time, a major creditor to the governments of western countries, but I suspect that much of its western currency denominated financial assets are going to be worth considerably less than anticipated once the consequences of western profligacy come to fruition. Nevertheless, the emerging markets appear to be much better positioned to prosper in the coming decades than their unfortunate counterparts in the west.

Sources:

Related Pages:

- National Income Accounting

- The Mundell Fleming Model

- The Balance of Payments

- Capital Mobility

- Floating vs Fixed Exchange Rates

- The Interest Rate and Money Supply

- The Circular Flow Model

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.