- Home

- Foreign Trade

Comparative

Advantage in Economics, Explained (with Graph & Example)

At first glance, the concept of comparative advantage in international trade models is not obvious, and that is because it is natural to assume that countries will produce all goods in which they have an absolute advantage i.e. lower costs of production than competitor countries.

I will discuss the virtues of comparative advantage vs absolute advantage shortly, but for now it is sufficient to know that countries tend to specialize in the production of those goods at which they are best, not just better. The reasons for that will soon become apparent.

The key to understanding comparative advantage relates to opportunity cost i.e., the cost of producing one more unit of good A in terms of how much of good B must be given up to get it. In this regard, I will show the gains from trade by using an amended version of the Production Possibilities Curve to illustrate how countries can enjoy a higher level of utility by trading with each other.

The ‘Law of Comparative Advantage’ was developed by the famous British economist David Ricardo over 200 years ago, and it is as relevant today as it was then. For information specific to the Ricardian Model, click the link.

Comparative

Advantage vs Absolute Advantage

It is comparative advantage, not absolute advantage, that creates the potential for mutually beneficial trade between different countries. This point will be demonstrated below under the heading of ‘gains from trade’, but for now let’s consider an imaginary two-country world (the UK and the USA) with only two goods being produced (biscuits and cheese).

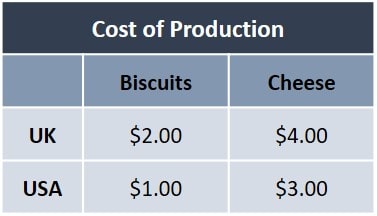

The table below shows opportunity costs of producing biscuits and cheese in the UK and the USA. As can be seen, the cost of producing both biscuits and cheese is cheaper in the USA than in the UK i.e., the USA has an absolute advantage in producing both products.

However, while the UK produces cheese at a higher cost than in the USA, it is only a third more expensive to do so, while it costs twice as much to produce biscuits. Does this mean that the UK should just give up on its economy and produce nothing? Obviously, that would not make sense, so the UK chooses to produce cheese since it is relatively more efficient at that than it is at producing biscuits. In other words, the UK still has a comparative advantage in cheese production (compared to biscuits).

The USA, by the same logic, is comparatively more efficient at producing biscuits.

Total output, and utility (satisfaction), in this two-country world economy will be optimized if each country concentrates its production on that good in which it has a comparative advantage, and then trades with the other country to obtain a utility maximizing combination of both goods.

Comparative

Advantage Example

Notice how, in the table above, all production costs are quoted in terms of dollars. However, the UK does not use dollars, it uses the pound. Let’s suppose that the exchange rate of dollars to pounds is set at 2:1 i.e., £1 = $2. We’ll also assume that each country can produce at a constant return to scale and that production costs are constant.

Now, imagine that the UK can produce 100 packets of biscuits or 50 blocks of cheese domestically. The cost, therefore, of producing 50 blocks of cheese is the 100 packets of biscuits that could have been produced. However, by selling the cheese in the USA at $3 per block, the UK can earn $150. The UK can then use those dollars to purchase 150 packets of biscuits. Recall that the UK was only able to produce a maximum of 100 packets of biscuits so, by exploiting its comparative advantage and trading with the USA, it can increase its consumption of biscuits by 50 packets.

The exact same logic applies to the USA; by exploiting its comparative advantage and producing biscuits, it can sell them to the UK and use the pounds it earns to buy cheese. In so doing, the USA will be able to consume extra amounts of cheese than if it were to produce it in the domestic economy.

How to

calculate Terms of Trade

The ‘terms of trade’ is an expression the economists use to express the potential benefits of trading with another country. In other words, it is the relative value of the imports that can be gained relative to the value of exports that it must give up. This, of course, depends on the currency exchange rate between the two countries. In the example above, an exchange rate of £1 = $2 allowed both countries to gain from trading with each other, but there is a range of other exchange rates that also could have been mutually advantageous.

For the UK, any exchange rate over $1.50 per £1.00 is advantageous, but the higher the exchange rate the better the terms of trade. For the USA, any exchange rate under $3 per £1 is advantageous, but lower the exchange rate the better the terms of trade.

The actual terms of trade will depend on the relative demand and relative supply, for and of, each country’s imports and exports.

The Gains

from Trade; Comparative Advantage Graph

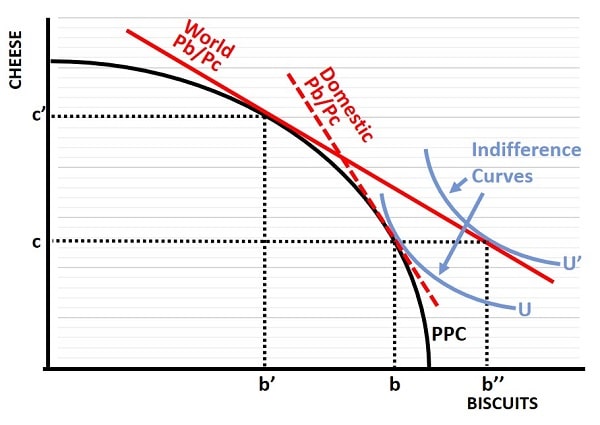

The gains from trade when countries specialize their production into those products in which they enjoy a comparative advantage are illustrated in the graph below, and this graph brings new understanding to how comparative advantage plays out in the real world.

To understand what is going on in the graph, you will need an understanding of the production possibilities curve (PPC) and indifference curves, so click the links for information if you need a quick refresher on those topics.

We continue to assume a simple two-country world that only produces and consumes two goods, biscuits and cheese. We also assume, for simplicity, that there are no restrictions on trade and no international transport costs. If we imagine that (before trading) a domestic economy is producing efficiently, it will optimize utility (satisfaction) where the indifference curve (U) just touches the PPC. This occurs in the graph with production & consumption of biscuits & cheese at b and c respectively.

At this point, the opportunity cost of increasing one good is given by the necessary reduction in consumption of the other good. The relative price of biscuits in terms of cheese is therefore Pb/Pc. This is illustrated by the dashed red line, and it is equal to the slope of the PPC because it is tangential to the PPC at point b, c.

However, with international trade, the relevant price will change because the terms of trade mean that domestic prices are dominated by world prices. As illustrated in the graph above, the red line showing the World Pb/Pc is less steep than the Domestic Pb/Pc, indicating that biscuits are relatively cheaper than cheese on the world market compared to the domestic market.

The relatively lower world price of biscuits implies that cheese (in terms of biscuits) is relatively more expensive on the world market, and the domestic economy enjoys a comparative advantage in cheese production. Because of this. it increases cheese production from c to c’. On the other hand, foreign producers enjoy a comparative advantage in biscuit production, meaning that domestic production of biscuits falls from b to b’.

Notice how, at the new production levels of b’ and c’, there is no further comparative advantage in production of either good. This is because of the law of diminishing returns, in other words, a comparative advantage in production of one good does not lead to a complete cessation in production of that good. It only leads to a reduction of production until returns are high enough to compete in world markets.

The gains from trade are illustrated in the way that comparative advantage affects consumption. Before international trade began, domestic production and consumption were equal at b, c respectively. After trading, consumption of cheese remains at c, but biscuit consumption increases to b’’. Clearly, since biscuit consumption has increased without any loss of cheese consumption, utility is higher. This is evidenced by the higher indifference curve U’, and this demonstrates the gains from trade.

A comparative advantage in cheese production has allowed the domestic economy to export some of its cheese overseas, c’ – c in this example. The income earned from those exports then allows the importation of extra biscuits b’’ – b as illustrated. The domestic economy is unambiguously better off after the gains from trade, but not everyone is better off. Domestic producers of biscuits are worse off, having been out-competed to some extent. Domestic cheese producers, on the other hand, have benefited particularly well.

Final

Thoughts about the Effects of Comparative Advantage

Comparative advantage refers to the ability of a country, individual, or entity to produce goods or services at a lower opportunity cost than others. When countries specialize in the production of goods and services in which they have a comparative advantage, several positive effects can be observed, such as:

- Increased Efficiency & Economic Growth - Comparative advantage promotes specialization, allowing countries to focus on producing goods and services where they are most efficient.

- Wider Variety of Goods and Services - Comparative advantage encourages trade between nations, enabling them to access a broader range of goods and services.

- Global Interdependence - Comparative advantage fosters interdependence among nations. This interdependence can promote peace and cooperation.

- Lower Prices - Increased specialization and trade often result in lower production costs, leading to lower prices for goods and services.

- Innovation & Technological Progress - Increased global competition can drive innovation and technological progress.

While

comparative advantage can have numerous positive effects, it's important to

note that there can be distributional impacts within countries. Some industries

or regions may face challenges or job displacement as a result of

specialization and trade.

This is because, while those industries which enjoy a comparative advantage will grow and increase jobs, other industries will decline somewhat due to foreign imports penetrating domestic markets. Some degree of job losses would then follow in the short-run, but it is likely that the benefits outweigh the costs, and trade via comparative advantage principles is a net positive in the vast majority of cases.

Related Pages:

- Trade Barriers

- Capital Mobility

- The Balance of Payments

- The J Curve

- The Economics of Decline

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.