- Home

- Production Possibilities Curve

- Opportunity Cost

Opportunity Cost in Economics, Explained (with Graph & Formula)

Opportunity cost in economics is a concept that helps us to understand how individuals make choices between one thing and another. In life we must all constantly make choices about how to spend our money and our time, and choosing one thing necessarily implies giving up something else. In other words, the true individual cost of having one thing is the other thing that is given up.

Some people shrug their shoulders and don't understand why such a concept is needed at all. After all, money is a much more standard unit of account by which we measure the accounting cost of things, so why should we be concerned about opportunity cost?

The most important reason is because the accounting cost relates to the explicit costs of things, it's a monetary cost that relates to the combined preferences of all consumers in a market, but opportunity cost also includes implicit costs of alternative choices, and it describes the specific preferences of the individual (although it can also relate to entire markets as I will show below).

A second reason why we need to think about opportunity cost is because some choices are made between things which have no price e.g., the choice between going for a walk or reading a book. If an individual only has an hour of time for either option, and these are the two most preferred ways to use that time, then the cost of going for a walk is the reading that is given up (and vice-versa if reading is chosen over the walk).

In the sections below, I will show how the concept of opportunity cost relates to some of the most common models in economics, and give some examples of how the concept is used.

How to Calculate Opportunity Cost

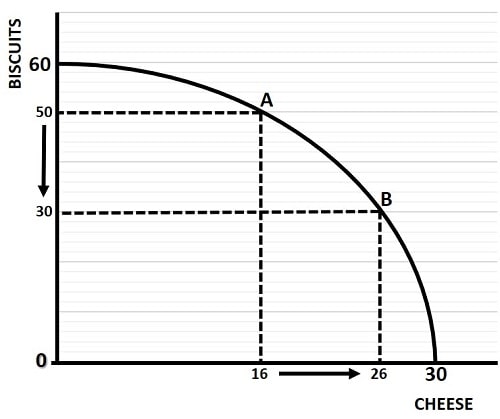

In the graph below, which is taken from my article about the production possibilities curve (PPC), we can see the whole range of production that a fictional two-good economy can produce given the factors of production that are available to it.

Assuming that this two-good economy is producing at some point on the curve, then 'productive efficiency' is maximized in the sense that producing more of one good is impossible without giving up some of the other good. At point A on the curve, with 50 servings of biscuits and 16 servings of cheese, moving to point B gains an additional 10 servings of cheese at the cost of 20 servings of biscuits. The opportunity cost of the 10 extra servings of cheese is the 20 servings of biscuits given up. That's a ratio of 1:2 in this example, which could be illustrated by drawing a straight line between point A and point B and then measuring the slope of that line.

Opportunity Cost Formula

To calculate the opportunity cost of one good in terms of another at a given point on the production possibility curve, rather than across a range as in the example above, we need to calculate the slope of the PPC at a point. That slope is equal to the tradeoff between the goods at a specific point.

Opportunity Cost = Slope of PPF

To define the opportunity cost formula in mathematical terms we would need to know the mathematical function that describes the PPF. We then apply some simple calculus to derive its slope. I won't do that here, but the concept should be clear.

Alternatively, if we know the marginal costs of the two goods, we can calculate the marginal rate of transformation. This will equal the slope of the PPF. Putting that into a formula would give:

Opportunity Cost = MRT = MCc / MCb

MCc and MCb are the marginal costs of producing cheese and biscuits. Happily, I've already written an article to explain how this works, and you can read it at: Marginal Rate of Transformation

Keep in mind, however, that these formulas only work when the economy is producing efficiently; opportunity costs always exist regardless of efficiency, but in that case we won't be able to measure it with the methods suggested here. In fact we would have to give up any attempt at measuring it at the level of the economy and instead focus on an individual firm's production alternatives, or an individual person's consumption alternatives.

In this PPC example above, you can begin to see that opportunity cost can be used to describe an entire two-good economy in terms of the cost of one good relative to another. Of course, economies produce millions of different goods, not just two alternatives, and you would be right to question how that changes the analysis. Fundamentally it doesn't change anything, but it is impossible to illustrate this on a two-dimensional graph.

Note also that the graph above tells us nothing about which point on the PPF curve would be preferred by the market, for that we need to know about consumer preferences in this two-good economy. For information on that, see my article about: The Budget Line

Finally, you should also keep in mind that we have been referring here to the opportunity cost of production, and that it therefore applies to producers. Consumers also face opportunity cost choices, and in the same way that the marginal rate of transformation is used for producers, the opportunity cost of consumption can be illustrated by the: Marginal Rate of Substitution

The Opportunity Cost of Labor

From the firm's perspective, the opportunity cost of labor is equal to the production that one of the other factors of production (typically capital) could have produced in its stead. Remember that the demand for labor is a derived demand, meaning that firms only want to employ labor for the output that it can produce.

In other words, if instead of employing more labor to expand production, the next best option for the firm was to spend an equivalent sum of money on more machinery, the lost production that the extra machinery would have produced is the opportunity cost of the extra labor. Considerations about how best to combine the different factors of production into their most efficient use is one of the responsibilities of entrepreneurs, and economists use a model called the 'production function' to analyze it.

From the worker's perspective, the opportunity cost of labor (i.e. of spending more time at work) is the leisure time that is given up. Workers have to decide whether or not the extra money that they can earn from working more hours is worth the lost leisure time. There are two primary aspects to this consideration:

- The Income Effect - any extra income from working will allow the worker to purchase more of the things he/she desires, including more leisure time.

- The Substitution Effect - whenever the wage rate is increased, there is an increased incentive to substitute extra hours of work for fewer hours of leisure.

The Opportunity Costs of Capital & Land

The opportunity costs of capital and land are usually explained in the economics textbooks more or less exclusively in terms of the production choices facing firms. There are circumstances where, for example, a homeowner might consider the opportunity cost of using a piece of land for one purpose or another, but it is fair to say that the most common and important considerations here relate to the industrial and commercial uses of capital and land.

Opportunity Cost of Capital

Firms have to make many considerations about the proper use of capital in the production of goods and services, and typically this involves decisions about the expansion or contraction of a facility. Should an existing plant be expanded, or should a new plant be built? Does the existing technology used in a plant need to be upgraded, or is it more cost-effective to maintain the existing technology?

These and many similar questions need careful long-term planning, and for that the firm will need to form an idea about the business climate in which it operates, and the future demand for its product.

Whatever choice the firm makes, the opportunity cost of capital is the next best option that it had to forgo. Of course, if the firm's calculations were wrong, it may well turn out that one of the other options in which it could have invested its capital would have been better than the one actually chosen.

Opportunity Cost of Land

With respect to land, some of the most common differences between opportunity cost and accounting cost arise. For example, if a firm has some spare land that it is not using, the accounting cost is likely to be zero (except perhaps for some ground maintenance cost). However, the opportunity cost of land includes any lost rent that the firm could have been earning if they had leased it out.

Similarly, if a firm builds a new facility on land that it already owns, an accountant might consider that land to have come at no cost. On the other hand, an economist would again know that the land could have been used for other profitable uses, and that the foregone profit from that is another example of the opportunity cost of land.

Sources:

Related Pages:

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.