- Home

- Consumer Behavior

- Income Effect Example

Income Effect Example (Graph & Real-World Case Study)

A clear income effect example helps illustrate one of the most fundamental ideas in economics: how changes in the price of a good affect a consumer’s purchasing power and spending decisions in real-world markets.

In applied economics, particularly in the United States and the United Kingdom, the income effect is used to understand household consumption, demand forecasting, and the impact of price changes on everyday consumer behavior.

When a product becomes cheaper, a person’s effective income rises, allowing them to buy more than before, not only of the cheaper item but potentially of other goods as well. Understanding this effect is much easier when you see it in action with a graph and a concrete case study.

The income effect often works alongside the substitution effect, which describes the tendency for consumers to buy more of the cheaper good and less of other goods when relative prices change. Together, these two forces explain why price changes can have complex effects on consumption patterns.

A Simple Income Effect Example: Coffee and Muffins

Consider a simple income effect example. Alice spends $50 a week on coffee and muffins. If the price of coffee drops, she no longer needs to spend as much to buy her usual amount.

With the extra money saved, she can either buy additional coffee, increase her muffin purchases, or allocate her savings to other goods entirely. The increase in consumption due purely to the rise in effective income is called the “income effect”.

If we look more closely, we see that Alice will also experience the substitution effect. Because coffee is now cheaper relative to muffins, she is likely to buy more coffee even if her total consumption of muffins does not change proportionally.

While the substitution effect shifts her consumption between goods, the income effect increases her overall purchasing power and can raise consumption across multiple normal goods.

In practice, income effect examples like this are widely used by economists, analysts, and policymakers to interpret changes in consumer demand. By visualizing how price changes alter household purchasing power, the income effect graph provides a simple but powerful tool for analyzing real-world markets rather than abstract textbook cases.

The Income Effect Graph

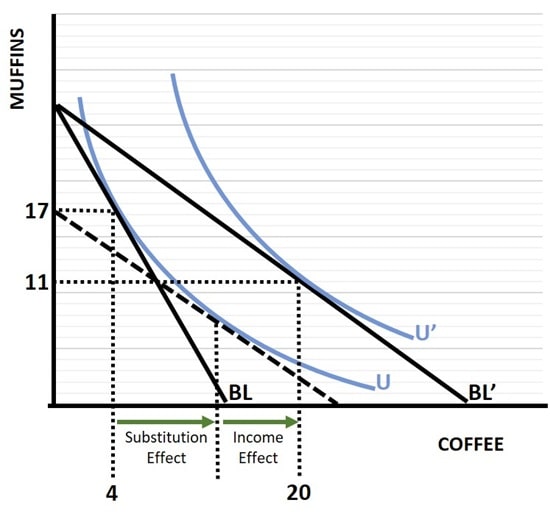

Visualizing an income effect example can clarify the interaction between income and substitution effects.

If you are unfamiliar with the budget line or the indifference curve, then a little background reading will be helpful. Have a look at my articles about:

An income effect graph typically begins with a budget line, which represents all combinations of two goods that Alice can afford given her income. The graph is limited to two goods since illustrating multiple goods in not feasible.

Alice’s preferences are then included in the graph by adding an indifference curve, showing combinations of the two goods that provide her with an equal level of satisfaction. The graph below illustrates both the income effect and the substitution effect of a fall in the price of coffee relative to muffins.

When the price of coffee falls, the budget line pivots outward. Alice can now reach a higher indifference curve, representing increased utility. The movement from the original combination of goods to the new preferred combination reflects the total effect of the price change.

In the graph, we start with budget line BL and indifference curve U. The budget line shows all combinations of coffee and muffins that Alice can afford given her income. Points on the line will exhaust that income, points below it will mean that some income is left unspent. Clearly, points above the line are not affordable.

For simplicity, we assume that Alice will always wish to maximize utility by spending all of her income, so only points on the line are relevant.

The indifference curve plots all combinations of coffee and muffins that are equally desirable i.e., that offer the same 'utility', even though some of those combinations are more expensive than others.

The most utility that Alice can afford is illustrated by the highest indifference curve that touches her budget line, and this occurs with 4 coffees and 17 muffins.

Now, after a reduction in the price of coffee the budget line pivots outwards to BL' as illustrated. The new preferred combination of goods is 20 and 11 respectively. Consumption of the coffee has increased dramatically, but consumption of muffins has fallen even though the new purchasing power of Alice’s income has increased, meaning that more of both goods could have been chosen.

In this example, even though consumption of muffins fell, there was still both an income effect and a substitution effect at play.

We can illustrate the two effects by adding a new budget line that is parallel to BL' and that touches the original indifference curve U. This shows us what the preferred consumption of coffee and muffins would be if the original amount of utility is held constant, but with the new lower price of coffee implemented.

This eliminates the income effect, because the movement down the original indifference curve represents a pure substitution of one good for the other. For coffee this is illustrated by the first green arrow. As can be seen, consumption of coffee increases, but by less than the full 4 to 20. The income effect accounts for the remainder, as illustrated by the second green arrow.

Note how the substitution effect led to an increase in consumption of coffee at the cost of decreased consumption of muffins, this is reasonable since coffee became cheaper. However, the income effect led to a further increase in coffee consumption AND an increase in consumption of muffins.

The overall effect on muffins was a reduction in consumption because the substitution effect dominated the income effect, but the income effect on muffins partially offset the substitution effect.

Real‑World Case Study: Income Effect Examples from the U.S.

In the United States economy, the income effect is not just a classroom concept; it plays a central role in shaping household spending and consumer demand. When prices change, an income effect example helps explain why U.S. households often adjust overall spending patterns, not just the quantity of the good whose price has changed.

How U.S. Consumers Respond to Price and Income Changes

A landmark piece of economic research from the Federal Reserve explores how income shocks translate into changes in household consumption, particularly when income changes unexpectedly due to job loss, wage changes, or broader economic trends.

This paper reviews more than 20 years of empirical studies showing that consumer spending patterns respond systematically to shifts in real income — the very mechanism at the heart of the income effect. It highlights that households don’t only change what they buy when prices or income shifts, they change how much they buy because their effective purchasing power has changed. You can access the full research report here:

This type of research shows that U.S. consumers tend to increase their overall consumption when their income increases, especially on normal goods i.e., goods that people buy more of when money goes further, and reduce consumption when income falls.

The same income effect logic applies when prices fall – consumers feel effectively richer because their income now buys more than it used to, often leading to greater spending not only on the good whose price changed, but also on related normal goods.

Income

Effect Examples in the United Kingdom

Similar income effect examples can be observed in the United Kingdom, particularly during periods of changing food and energy prices. Analysis by the UK Office for National Statistics and the Bank of England frequently highlights how rising or falling prices affect household purchasing power and consumption decisions, reinforcing the income effect as a key driver of consumer behavior in the UK economy.

Income

Effect and Consumer Confidence

Beyond formal price changes, the income effect also intersects with consumer confidence and perceived income stability. U.S. consumer surveys and behavioral studies show that when households feel more secure about their future income (even if their nominal income doesn’t change immediately) they often increase spending.

This “psychological income effect” underscores how expectations about income and future economic conditions can shift spending behavior in ways that mirror traditional income effect responses to price changes.

Why U.S.

Examples Matter

These real‑world cases underscore that the income effect example isn’t limited to theory. In the U.S., price subsidies for food, income shocks from economic fluctuations, and shifts in consumer confidence all illustrate how changes in effective income, whether through price changes or actual income changes, influence what and how much consumers buy.

Economists and policymakers use these insights to forecast demand, set tax and subsidy policy, and design programs to improve economic well‑being.

Income

Effect Example: Related FAQs

What is the

difference between an income effect example and a substitution effect example?

What is the

difference between an income effect example and a substitution effect example?

An income effect example focuses on how a change in purchasing power alters overall consumption, while a substitution effect example isolates how consumers switch between goods when relative prices change. In practice, most real-world examples involve both effects operating together, but they can be separated analytically using indifference curves and budget constraints.

Is an income effect

example the same as a change in income?

Is an income effect

example the same as a change in income?

No. An income effect example can occur even when nominal income does not change. A fall in prices increases real income, meaning consumers can buy more with the same amount of money. This distinction is crucial in economic analysis.

Why do economists

separate income and substitution effects?

Why do economists

separate income and substitution effects?

Economists separate income and substitution effects to better understand the underlying reasons for changes in consumption. By holding utility constant, the substitution effect shows how consumers respond to relative price changes, while the income effect captures how changes in purchasing power influence overall demand.

Are income effect

examples used in public policy analysis?

Are income effect

examples used in public policy analysis?

Yes. Income effect examples are commonly used in evaluating taxes, subsidies, and welfare programs. Policymakers analyze how price changes or transfers affect household purchasing power and consumption, especially for essential goods such as food, energy, and housing.

How does the income

effect relate to inflation?

How does the income

effect relate to inflation?

Inflation reduces real purchasing power, creating a negative income effect. Even if nominal wages rise, consumers may feel poorer if prices increase faster than income, leading to reduced consumption. Income effect examples are often used to explain changes in consumer behavior during periods of high inflation.

Can income effect

examples differ across income groups?

Can income effect

examples differ across income groups?

Yes. Lower-income households typically experience stronger income effects because a larger share of their income is spent on necessities. A small price change can significantly affect their purchasing power, while higher-income households may show weaker income effects for the same price change.

Conclusion

This article has shown how an income effect example can be used to explain the way price changes affect consumer behavior in real-world markets. By combining a simple example, a standard income effect graph, and evidence from the United States and the United Kingdom, it becomes clear how changes in purchasing power influence household spending decisions.

The income effect works alongside the substitution effect to shape demand, and together they provide a practical framework used by economists, analysts, and policymakers to understand consumption, inflation, and market outcomes. With a clear income effect example and supporting evidence, the concept becomes a useful analytical tool rather than an abstract theoretical idea.

Related Pages:

- Marginal Rate of Substitution – Helps explain how consumers trade one good for another along an indifference curve in income effect diagrams.

- Price Consumption Curve – Summarizes how consumption changes as prices change, combining multiple income effect outcomes in one curve.

- Utility Function – Provides a formal way to represent preferences that underlie income effect graphs and examples.

- Compensated Demand Function – Used to isolate the substitution effect, making income effects easier to analyze separately.

- Income Elasticity of Demand – Helps explain how strongly demand responds to changes in purchasing power across different goods.

- Consumer Behavior – Places the income effect within the broader study of how consumers make choices under constraints.

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.