- Home

- Consumer Behavior

- Normal Goods

Normal Goods in Economics, Explained (with Graph & Examples)

Normal goods are products or services for which demand increases as consumers' incomes rise. In simpler terms, as people earn more money, they tend to spend more on these goods. This positive relationship between income and demand is the key distinguishing factor that distinguishes this type of economic goods.

Normal goods can be sub-divided into:

- Luxury Goods: These are goods that experience a large increase in demand as income rises. However, their consumption is not essential for survival. Luxury goods needn’t be extravagant, but they tend to be of a higher price & quality than is usually consumed.

- Basic Necessities: These are goods that consumers require regardless of their income level. As consumers' incomes increase, they may choose higher-quality versions of these goods. Examples of necessities include basic food items, utilities, and healthcare services.

In this article, I will explain the concept of normal goods and their significance in the context of consumer demand, and how they relate to Engel curves.

Income

Elasticity of Demand

The concept of income elasticity measures how sensitive the demand for a good is to changes in income levels. Since we know that normal goods experience extra demand as income rises, we know that they have a positive income elasticity of demand. This is particularly true of luxury goods, which have a much higher income elasticity than basic necessities.

The point here is that economists use estimates of income elasticities to predict which goods will experience the most additional demand during periods of rapid economic growth and, conversely, which goods will suffer the greatest loss of demand should the economy go into recession.

Normal goods are frequently considered alongside inferior goods. Inferior goods exhibit negative income elasticity of demand, because consumers prefer to substitute better alternatives in their stead whenever their incomes rise. Typically, they are of lower quality or less desirable compared to alternatives so, as consumers become wealthier, they switch to superior options.

The Engel

Curve

The Engel curve is a useful tool for understanding the relationship between a consumer’s income and his/her expenditure on a specific good. It was developed by the German statistician Ernst Engel in the 19th century. Engel observed that as a consumer’s income increases, the preferred spending on different goods and services also changes.

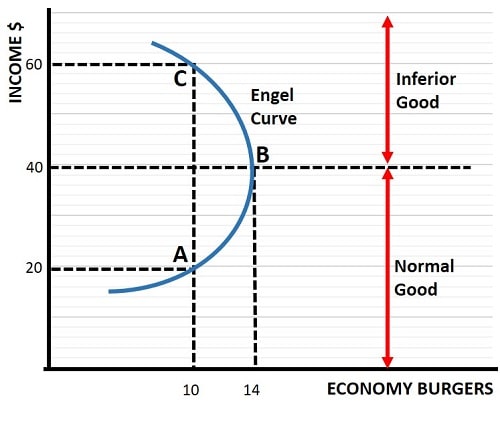

For normal goods, the Engel curve exhibits an upward-sloping pattern. As income rises, the demand for the normal good increases, resulting in a movement along the curve upwards and to the right e.g., from point A to point B in the graph above.

Conversely, for inferior goods, the Engel curve displays a backward-sloping pattern. As income rises further, the demand for that same good (economy burgers) declines, indicating that it has become an inferior good beyond a given income level ($40 in the graph). We might assume here that an income above $40 allows the consumer to substitute a better alternative i.e., premium burgers or some other preferred item.

For more details, see my article about The Engel Curve.

The

Income Effect & Substitution Effect

While the income elasticity of demand explains how consumption changes after a given increase in income, it fails to distinguish between the income effect alone, and the desire to substitute superior alternatives.

The substitution effect accounts for this by focusing on the change in the relative prices of goods. When the relative price of a good increases, consumers may choose to substitute other goods in place of it i.e., alternative goods that have become relatively cheaper. The substitution effect is closely related to consumer preferences and the desire to maximize utility while staying within budget constraints.

The substitution effect complements the income effect in influencing changes in the quantity demanded of normal goods.

Growth

and Policymaking

The main uses of economic analysis around the consumption patterns of normal goods are:

- Understanding of Consumer Spending: Analysis of income elasticity for different goods allows economists and businesses to predict consumer spending patterns as the economy grows or contracts. This allows time for preparations ahead of a boom or recession.

- Indicating Economic Growth: The demand for normal goods is directly tied to economic growth. Increasing consumption of normal goods signals a growing economy and vice versa. When economies experience sustained growth in consumption, it can increase business confidence and spur higher levels of investment.

- Understanding of Income Distribution: The consumption patterns of normal goods can shed light on income distribution in society. Analyzing these patterns can help policymakers address income inequality and formulate targeted social programs.

- Formulation of Policy Interventions: Governments can use analysis of normal good consumption patterns to design targeted economic policies. For instance, during an economic downturn, targeted stimulus policies can boost economic activity for specific industries and income groups.

Real-World

Examples

Let's examine five real-world examples to better understand normal goods and their impact on consumer behavior and the economy.

- Automobile Industry – As consumer incomes increase, demand for automobiles rises. At lower income levels consumers might purchase a used car but, as their incomes grow, they may upgrade to brand new cars. Used cars would then be uncovered as inferior at certain income levels.

- Housing Market – As individuals and families experience an increase in income, they may transition from renting apartments to purchasing homes. With higher income, they may also seek larger or more luxurious properties, indicating a shift from inferior to normal goods within the housing market at certain income levels.

- Travel and Tourism – As consumer incomes increase, demand for travel and tourism services often rise disproportionately. People tend to allocate larger portions of their budgets to vacations at higher income levels, indicating that it is a luxury normal good.

- Electronics and Technology – With rising incomes, consumers are more inclined to purchase higher-quality electronics and technology products. As income increases, individuals may upgrade to premium smartphones, larger televisions, and sophisticated gadgets.

- Higher Education – Higher education, particularly in private institutions, can be considered a normal good. The higher the anticipated income that might be earned from employment after graduating, the more likely they are to pay the higher tuition fees associated with prestigious universities and specialized programs.

Conclusion

In conclusion, normal goods are an integral aspect of consumer behavior and economic analysis. As income levels rise, consumers tend to increase their spending on normal goods, which influences various economic indicators.

Understanding the distinction between normal goods and other types of economic goods enables policymakers and businesses to make informed decisions and anticipate market trends.

The Engel curve further illustrates the relationship between normal goods and inferior goods, providing valuable insights into consumer preferences and expenditure patterns.

Sources:

Related Pages:

- Complementary Goods & Substitute Goods

- Merit Goods & Demerit Goods

- Giffen Goods

- Veblen Goods

- Consumer Behavior

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.