- Home

- Production Possibilities Curve

- Marginal Cost

Marginal Cost Explained (Graph, Formula & Examples)

Marginal cost refers to the additional expense incurred when producing one more unit of a good or service, and it is widely used in microeconomics with regard to the ‘theory of the firm’. The concept allows businesses to understand how production costs change as they scale up or down, which is crucial for efficient resource allocation and decision-making.

To understand marginal cost more deeply, consider the components that contribute to it. These include both:

- Variable costs, such as raw materials and labor, which fluctuate with production levels.

- Fixed costs, such as rent and salaries, which remain constant regardless of the level of output.

Marginal cost is not static like fixed costs, but neither is it a variable cost. It is not actually a cost at all, rather it is a separate way of measuring how variable costs change as output is increased one unit at a time. It can change based on various factors like production efficiency, technological advancements, and market conditions.

For instance, as a company becomes more efficient in its production processes, the marginal cost may decrease, allowing the business to produce more at a lower cost. Conversely, if the cost of raw materials increases, the marginal cost may rise, affecting the overall profitability.

We should note that the standard treatment of marginal cost in economics applies to the short-run. This is a time period in which some costs of production are fixed (capital) and some are variable (labor). In the long-run all costs are variable; there is a related concept called the long-run marginal cost curve, but that applies to a different, but related, concept:

Click the link for details on that, but for the remainder of this article keep in mind that we are studying the short-run.

Marginal

Cost Graph

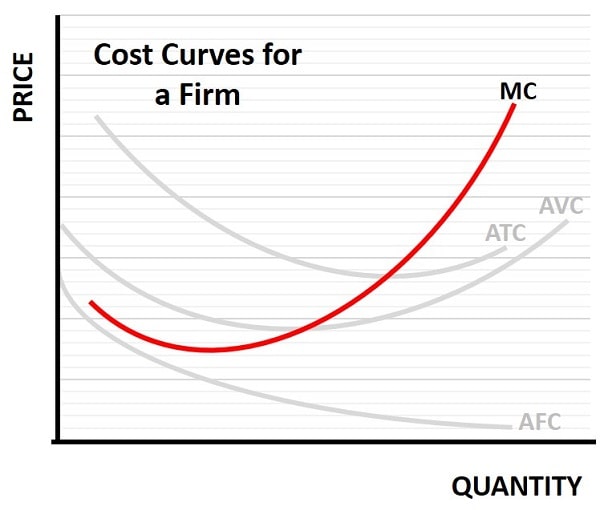

As can be seen in the graph above, the marginal cost curve is negatively sloped at low levels of production, flattens out as production increases, and then becomes positively sloped at higher production levels. The reason for this is because there are large economies of scale to be enjoyed by increasing output when it is running at a low level. These economies then gradually disappear, until diseconomies of scale start to present themselves.

The relationship holds to the law of diminishing returns i.e., that with a given amount of capital, continually adding more and more labor to the production line will yield a smaller and smaller increase in output, meaning that the cost of producing it will rise and rise.

Notice in the graph above that the marginal cost curve intercepts the average variable cost curve and the average total cost curve at their minimum points. It should be intuitively obvious why this is the case i.e., when marginal cost is lower than average cost, adding a unit of output must make the average costs of production fall. Similarly, if marginal cost is higher than average costs, adding a unit of output will pull up the average costs.

Finally, take note that since a firm will always produce when marginal cost is greater than average variable cost, in a competitive market the marginal cost curve that sits above average variable cost is the firm's supply curve. In other, non-competitive markets, this is not the case because firms in those markets have some market power to adjust supply and prices to levels in excess of marginal cost.

For more details on these related cost curves, see my articles at:

The Formula

for Calculating Marginal Cost

The formula for calculating marginal cost is straightforward but requires precise data to ensure accuracy. Marginal cost (MC) is calculated by dividing the change in total cost (ΔTC) by the change in quantity (ΔQ). Mathematically, it is expressed as:

MC = ΔTC / ΔQ

This formula highlights the incremental cost associated with producing one more unit of output. We can also use MC = ΔVC / ΔQ as the formula because the incremental cost will be identical regardless of whether we use the change in total cost or variable cost.

To illustrate, imagine a factory that produces widgets. If the total cost to produce 100 widgets is $1,000 and the total cost to produce 101 widgets is $1,010, the marginal cost of producing the 101st widget is calculated as follows: ΔTC = $1,010 - $1,000 = $10, and ΔQ = 101 - 100 = 1. Therefore, MC = $10 / 1 = $10. This means that the additional cost of producing one more widget is $10. This simple calculation can provide valuable insights into the cost structure of production.

Importance

of Marginal Cost in Economic Decision-Making

Marginal cost plays a critical role in economic decision-making, influencing various aspects of business operations and policy formulation. For businesses, understanding marginal cost helps in determining the most cost-effective level of production. By analyzing the additional cost of producing one more unit, companies can decide whether increasing or decreasing production will lead to higher profitability.

In addition to guiding production decisions, marginal cost is also instrumental in pricing strategies. Businesses often use marginal cost to set prices that cover production costs while maximizing profit margins. By ensuring that the price of a product exceeds its marginal cost, companies can achieve profitability and sustain their operations.

In fact, regardless of market structure (from perfect competition through to monopoly), a business will seek to produce a quantity of output such that its marginal revenue is equal to its marginal cost. In other words, profit maximization occurs where:

MR = MC

Whenever this condition is not met, a firm can increase it profit by adjusting its output. For example, if marginal revenue (the extra revenue received from selling an additional unit of output) is higher than marginal cost, the firm can increase output and make more profit. Conversely, if marginal revenue is lower than marginal cost, the firm will do better by reducing output.

Policymakers and economists also rely on marginal cost to make informed decisions about resource allocation and economic policies. For example, understanding the marginal cost of public goods and services can help governments allocate resources more efficiently, and design policies that promote economic welfare. Marginal cost analysis can also inform decisions related to taxation, subsidies, and regulation, ensuring that economic policies are both effective and equitable.

Marginal

Cost in Different Market Structures

The impact of marginal cost on pricing and profitability does vary across different market structures. In perfect competition, where many firms produce homogenous products and compete on price, marginal cost plays a critical role in pricing decisions. In this market structure, businesses set prices equal to marginal cost to attract customers and remain competitive. As a result, firms in perfect competition typically achieve normal profit, with prices covering production costs but not allowing for significant excess profit margins.

In monopolistic competition, where many firms produce differentiated products, marginal cost still influences pricing decisions, but other factors, such as branding and product differentiation, also play a role. Businesses in monopolistic competition may set prices above marginal cost to reflect the added value of their unique products. However, marginal cost remains an important consideration for determining production levels and ensuring optimal profitability.

In oligopoly and monopoly market structures, where a few firms or a single firm dominate the market, marginal cost has a different impact on pricing and profitability. In an oligopoly, firms may engage in strategic pricing, considering both marginal cost and the potential reactions of competitors. In a monopoly, the firm has significant market power and can set prices above marginal cost to maximize profit. However, even in these market structures, understanding and managing marginal cost is essential for making informed pricing and production decisions.

Real-World

Examples of Marginal Cost Analysis

Marginal cost analysis is widely used in various industries to inform pricing and production decisions:

- In the manufacturing sector, companies often use marginal cost to determine the most cost-effective production levels. By analyzing the additional cost of producing each unit, manufacturers can optimize their production processes, reduce waste, and maximize profit. This approach is particularly important in industries with high fixed costs, such as automotive and electronics manufacturing.

- In the airline industry, marginal cost analysis plays a crucial role in pricing decisions. Airlines often set ticket prices based on the marginal cost of adding passengers to a flight. For example, the marginal cost of filling an empty seat on a flight is relatively low, as most of the costs, such as fuel and crew salaries, are fixed. By understanding marginal cost, airlines can set competitive prices that maximize revenue while covering operational costs.

- The technology sector also relies on marginal cost analysis to inform production and pricing decisions. For instance, software companies often face low marginal costs, as the cost of producing additional copies of software is minimal. By analyzing marginal cost, these companies can set prices that reflect the value of their products while maximizing profit. This approach is particularly important in industries with high initial development costs and low marginal costs, such as software and digital media.

FAQs about

Marginal Cost

How does marginal cost differ from incremental cost in

large-scale operations?

How does marginal cost differ from incremental cost in large-scale operations?

While both marginal and incremental cost assess changes in cost with output, marginal cost refers to the expense of producing one additional unit, whereas incremental cost measures the total change in cost when output increases by a batch or range of units. In large-scale decisions, incremental cost is often more practical for cost-benefit analysis.

What is the relationship between marginal cost and supply

curve in microeconomics?

What is the relationship between marginal cost and supply curve in microeconomics?

In a perfectly competitive market, the firm’s marginal cost curve above AVC represents its short-run supply curve. As marginal cost rises with output, it shows how much a firm is willing to supply at different price levels, establishing a direct link between marginal cost and supply behavior.

How do environmental regulations impact marginal cost in

heavy industries?

How do environmental regulations impact marginal cost in heavy industries?

Environmental compliance, like emission controls or carbon taxes, increases variable input costs, raising marginal cost. In industries like mining or energy, this can shift the marginal cost curve upward, reducing output and prompting investment in cleaner technologies to restore cost-efficiency.

What role does marginal cost play in pricing freemium

digital products?

What role does marginal cost play in pricing freemium digital products?

Freemium models rely on low or near-zero marginal cost of digital goods. Businesses use this to provide free access at scale while monetizing through upgrades or ads. Understanding marginal cost allows firms to balance user acquisition with infrastructure costs and optimize pricing for premium features.

How does marginal cost relate to the concept of marginal

utility in consumer theory?

How does marginal cost relate to the concept of marginal utility in consumer theory?

Marginal cost represents producer-side costs, while marginal utility refers to the consumer’s benefit from one more unit. In optimal pricing, businesses aim to equate the consumer’s marginal utility (reflected in willingness to pay) with their own marginal cost to maximize market efficiency.

How can marginal cost forecasting improve inventory and

supply chain decisions?

How can marginal cost forecasting improve inventory and supply chain decisions?

Forecasting marginal cost helps businesses predict cost fluctuations based on changes in demand, input prices, or labor availability. Accurate forecasts support just-in-time inventory, price negotiation with suppliers, and more agile responses to market changes.

Conclusion

In conclusion, understanding marginal cost is necessary for making informed economic decisions in both business and policy contexts. By analyzing the additional cost of producing each unit, businesses can optimize production levels, set competitive prices, and enhance profitability. Marginal cost also plays a critical role in resource allocation and economic policy, helping governments and policymakers design effective and equitable policies.

Related Pages:

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.