- Home

- Production Possibilities Curve

- Average Variable Cost

Average Variable Cost (AVC): Graph & Formula

Average variable cost in economics relates to the cost structure of a firm in the short-term, and focuses on those costs that vary with the level of production. I specify the short-term here because the economic models that use this concept recognize that some inputs into the production process are relatively fixed in the short-term, while others are more flexible and can be adjusted.

The usual assumption is that labor is flexible in the short-run, but capital is not. In the long-run, of course, both are flexible.

Average variable cost is pivotal in determining the efficiency of production and in formulating pricing strategies that ensure profitability. These costs are dynamic and fluctuate based on the level of output, making them essential for short-term financial planning and operational adjustments.

In essence, AVC is a vital metric for sustaining business viability and competitive advantage.

In many models, variable costs are not restricted to labor costs, they also include raw materials, and utilities used in the production process. Fixed costs, on the other hand, include expenses like rent, permanent salaries, and insurance.

A separate but related concept is marginal cost, which refers to the cost of producing one additional unit of output. Marginal cost is closely related to average variable cost because it influences how AVC changes as production increases. When marginal cost is below AVC, producing additional units will lower the AVC. Conversely, when marginal cost is above AVC, producing more will increase the AVC.

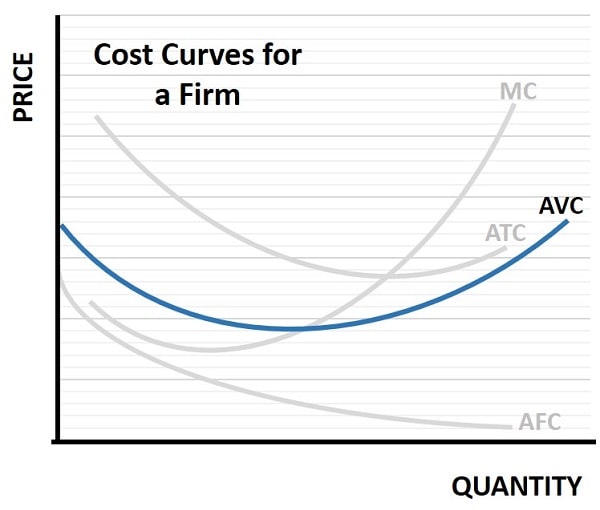

Finally, it’s important to differentiate AVC from average total cost (ATC). While AVC includes only variable costs, ATC encompasses both fixed and variable costs. Therefore, ATC provides a broader perspective on overall production costs. This is best understood with the help of a graph to illustrate how all these costs relate to each other, and a graph is provided below for this purpose.

Average

Variable Cost Graph

In the average variable cost graph above I have illustrated the four standard cost curves for a firm in the short-run. As can be seen, the AVC curve has a U-shaped appearance, this is because a firm can experience economies of scale by increasing production from a low level to a moderate level.

At some point however, with a fixed amount of capital to work with, the firm will start to experience increasing average variable costs because its capital stock is approaching full capacity, and simply adding more labor and other variable inputs will deliver diminishing returns to scale.

The average variable cost curve is downward sloping when the marginal cost curve is below it, flat at the point where the marginal cost curve intercepts it, and upward sloping when marginal cost is higher variable cost. For full details on these other costs, see my articles:

How to

Calculate Average Variable Cost

Calculating AVC is a straightforward process that involves dividing the total variable costs by the quantity of output produced. The formula for AVC is:

AVC = Total Variable Costs / Quantity of Output

This calculation helps businesses determine the cost per unit of production attributable to variable costs. It’s an important metric for assessing cost efficiency and making informed production decisions.

To illustrate, let’s consider a hypothetical example. Suppose a company produces 1,000 units of a product, and the total variable costs amount to $10,000. Using the formula, the AVC would be $10,000 / 1,000 units, resulting in an AVC of $10 per unit. By calculating AVC, the company can evaluate whether its production process is cost-effective and identify areas for potential cost reduction.

It’s important to note that AVC can fluctuate based on changes in variable costs and production levels. For instance, if the company increases production to 1,500 units but the total variable costs rise to $15,000, the new AVC would be $15,000 / 1,500 units, resulting in an AVC of $10 per unit. This consistency in AVC indicates that the variable costs are proportional to the level of output, which can help businesses maintain cost control and predict future expenses accurately.

Average

Variable Cost Vs Total Variable Cost

The relationship between AVC and total variable cost (TVC) is fundamental to understanding cost behavior in production. While AVC provides the cost per unit of output, TVC represents the aggregate of all variable costs incurred during production. The two metrics are interconnected, as AVC is derived from TVC by dividing it by the quantity of output.

For instance, if a company’s TVC for producing 1,000 units is $10,000, the AVC would be $10, as previously calculated. If the production increases to 2,000 units and the TVC rises to $20,000, the AVC remains $10 per unit. This direct proportionality between TVC and AVC is crucial for businesses to understand, as it helps in forecasting costs and making strategic decisions about scaling production.

For example, if a firm is experiencing increasing AVC as it increases production, it may start long-term planning for investment in a new production facility, so as to keep costs down.

FAQs about

Average Variable Cost

How does Average Variable Cost impact shutdown decisions in

the short run?

How does Average Variable Cost impact shutdown decisions in the short run?

A firm may decide to shut down in the short run if the market price falls below its AVC. Operating below AVC means the firm can't cover its variable costs, making continued production financially unsustainable.

Can Average Variable Cost be negative in any economic

scenario?

Can Average Variable Cost be negative in any economic scenario?

No, AVC cannot be negative. Since variable costs are actual expenses incurred in production (like labor or materials), they’re always zero or positive. A negative AVC would imply the firm earns money by producing, even before selling, which is economically implausible.

How do technological improvements affect Average Variable

Cost?

How do technological improvements affect Average Variable Cost?

Technological improvements can lower AVC by increasing efficiency. For example, automation or better workflow management can reduce labor hours per unit, directly reducing variable costs.

What role does AVC play in perfect competition market

structures?

What role does AVC play in perfect competition market structures?

In perfect competition, firms are price takers. If the market price falls below AVC, the firm should shut down in the short run. Thus, AVC acts as a benchmark for survival in competitive markets.

How can seasonality affect Average Variable Cost?

How can seasonality affect Average Variable Cost?

Seasonal changes in raw material prices, labor demand, or energy usage can cause AVC to fluctuate. For instance, higher energy costs in winter or harvest-season labor spikes can temporarily raise AVC.

How does outsourcing affect a firm's Average Variable Cost?

How does outsourcing affect a firm's Average Variable Cost?

Outsourcing can lower AVC by converting fixed labor or infrastructure costs into variable costs tied to usage. This flexibility can reduce per-unit costs, especially at lower production volumes.

Conclusion

In conclusion, AVC provides valuable insights into how costs fluctuate with production levels, enabling informed decision-making and effective cost management. By differentiating AVC from fixed costs and other cost metrics, businesses and economists can develop competitive pricing strategies, optimize production processes, and achieve financial stability.

Related Pages:

- Costs of Production

- Long-Run Average Cost Curve

- Variable Inputs

- Sunk Costs

- Production Possibilities Curve

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.