- Home

- Production Possibilities Curve

- Average Total Cost

Average Total Cost Explained (Graph, Formula & Examples)

Average Total Cost (ATC) is a key metric in a firm’s short-run cost analysis, it represents the average cost of producing each unit of output. It is calculated by dividing the total cost of production by the total number of units produced.

The total cost of production includes both fixed costs and variable costs, which together constitute the overall expense framework for a business.

- Fixed costs are those expenses that do not change with the level of production, such as rent, salaries, and insurance. These costs remain constant regardless of whether a business produces one unit or thousands of units.

- Variable costs, on the other hand, fluctuate with changes in production volume. Examples of variable costs include raw materials, labor, and utilities. As production increases, variable costs rise proportionally, and as production decreases, variable costs fall.

Analysis of both fixed costs and variable costs helps businesses to identify areas where they can improve efficiency, reduce expenses, and optimize production processes. This, in turn, helps to enhance profitability and competitiveness in the market.

Average

Total Cost Formula

Calculating the Average Total Cost (ATC) involves a straightforward formula:

ATC = Total Cost / Total Output

For example, if a business has total fixed costs of $10,000 and total variable costs of $5,000, the total cost of production would be $15,000. If the business produces 1,000 units, the ATC would be $15,000 / 1,000 units = $15 per unit.

Average

Total Cost Graph

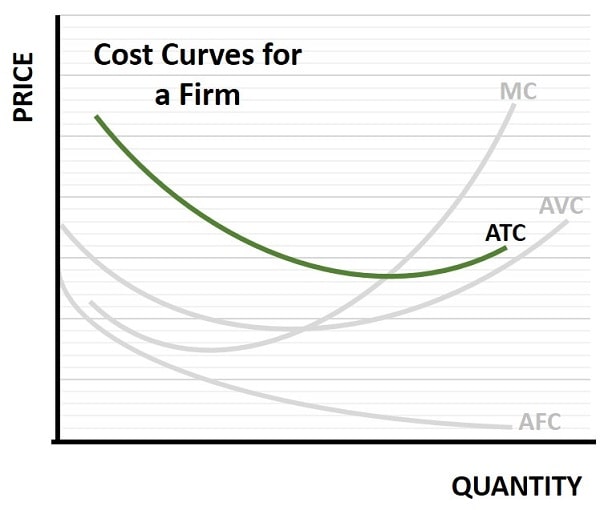

In the average total cost graph above I have illustrated the four main cost curves that apply to a firm in the short-run. The ATC curve is the vertical summation of the AVC curve and the AFC curve. In words:

Average Total Cost = Average Variable cost + Average Fixed Cost

For full information about the other cost curves in the graph above, have a look at:

The

Relationship Between Average Total Cost and Production Levels

At lower levels of production, the ATC tends to be high due to the significant impact of fixed costs. Since fixed costs remain constant regardless of output, producing fewer units results in a higher average cost per unit. As production increases, fixed costs are spread over a larger number of units, reducing the ATC. This phenomenon is known as economies of scale, where higher production levels lead to lower average costs.

However, beyond a certain point, increasing production may lead to diseconomies of scale, where the ATC starts to rise again. This can occur due to factors such as increased complexity in managing production processes, higher labor costs, and inefficiencies in resource allocation.

Average

Total Cost vs Marginal Cost

Average Total Cost (ATC) and Marginal Cost (MC) are two distinct but closely related concepts in cost analysis. While ATC represents the average cost of producing each unit of output, MC refers only to the cost incurred by producing one additional unit of output.

When MC is lower than ATC, producing additional units reduces the ATC, leading to economies of scale. Conversely, when MC is higher than ATC, producing additional units increases the ATC, leading to diseconomies of scale.

Examples of Factors

Influencing Average Total Cost

A key factor influencing ATC is the cost of inputs, such as raw materials, labor, and utilities. Fluctuations in the prices of these inputs can significantly impact the total cost of production and, consequently, the ATC. For example, an increase in raw material prices can raise variable costs, leading to a higher ATC. Similarly, changes in labor costs or utility rates can affect the overall expense framework and influence the average cost of production.

Technological advancements and improvements in production processes can also impact ATC. By adopting more efficient production methods or investing in advanced technology, businesses can reduce variable costs and enhance overall productivity. This can lead to a lower ATC and improved competitiveness in the market.

Finally, factors such as government regulations, tariffs, and subsidies can affect the cost structure of production and influence the ATC.

FAQs

How does Average Total Cost behave in the long run compared

to the short run?

How does Average Total Cost behave in the long run compared to the short run?

In the long run, all costs are variable, so the concept of fixed costs disappears. The long-run average cost (LRAC) curve typically forms a flatter U-shape, reflecting optimal scale efficiencies. Unlike the short-run ATC, firms can adjust all inputs in the long run, enabling more cost-efficient production.

What role does Average Total Cost play in break-even

analysis?

What role does Average Total Cost play in break-even analysis?

ATC is crucial in break-even analysis because it helps determine the price point at which total revenue equals total cost. A firm breaks even when the market price equals ATC. Understanding ATC allows businesses to calculate the minimum output level required to cover all costs.

How does Average Total Cost relate to pricing strategies in

competitive markets?

How does Average Total Cost relate to pricing strategies in competitive markets?

In perfectly competitive markets, firms are price takers and tend to price at or near ATC in the long run to remain profitable. If a firm’s ATC exceeds the market price, it incurs losses and may exit the market over time.

Can Average Total Cost be used to assess operational

scalability?

Can Average Total Cost be used to assess operational scalability?

Yes. Declining ATC as output increases signals scalable operations. If ATC continues to drop with higher output, the firm benefits from economies of scale. A rising ATC, on the other hand, may indicate scalability limits or inefficiencies at larger production volumes.

How do different market structures influence the importance

of ATC?

How do different market structures influence the importance of ATC?

In monopolistic and oligopolistic markets, ATC affects pricing flexibility and profit margins but doesn't solely determine price. In contrast, in perfect competition, ATC closely aligns with the equilibrium price. Monopolies may operate above minimum ATC due to lack of competitive pressure.

Conclusion

and Key Takeaways

In conclusion, understanding average total cost is essential for businesses and policymakers to optimize production processes, make informed pricing decisions, and enhance overall profitability. By analyzing the components of ATC, including fixed and variable costs, businesses can gain valuable insights into their cost structure and identify areas for improvement.

Additionally, understanding the relationship between ATC and production levels, as well as the interplay between ATC and Marginal Cost (MC), is crucial for determining the most cost-effective level of output.

Real-world applications of ATC include pricing decisions, production planning, and economic policy, highlighting the importance of this concept in both business operations and policymaking.

Related Pages:

- The Long-Run Average Cost Curve (LRAC)

- Sunk Costs

- Fixed Inputs

- Variable Inputs

- Costs of Production

- The Production Possibilities Curve

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.