- Home

- Production Possibilities Curve

- Costs of Production

Costs of

Production Explained (Short-Run & Long-Run)

The costs of production in economics are quite different to those in accounting, where the ownership of certain inputs like land or capital affect the costs reported on a company’s balance sheet. In economics, we focus on the full costs, regardless of input ownership.

This is an important differentiating factor between economics and accountancy i.e., in economics, land and capital have an opportunity cost associated with their use in one endeavor in terms of the lost income that could have been earned by utilizing them in an alternative endeavor.

Economic Cost = Opportunity Cost

While this might seem like a burdensome complication, it is actually a significant simplification, because we can simply assign the same cost of capital and land to all firms regardless of whether or not such inputs are owned, borrowed, or leased.

The cost of capital is simply the prevailing interest rate applied to borrowing money, which for further simplicity we hold constant for all producers. The cost of land is simply the rental value of that land, and labor costs are given by the wage rate. Entrepreneurial costs are somewhat more complicated, being related to, but not equal to, profits (again there is a difference between economics and accountancy in terms of how profit is calculated).

In practice, we make yet another simplification by restricting our economic models to only two of the four factors of production i.e., labor and capital. These are the dominant input costs in most industries, and by restricting our models to these two inputs we can use simple two-dimensional graphs to illustrate all the important economic concepts.

Efficient Short-Run

& Long-Run Production Cost Models

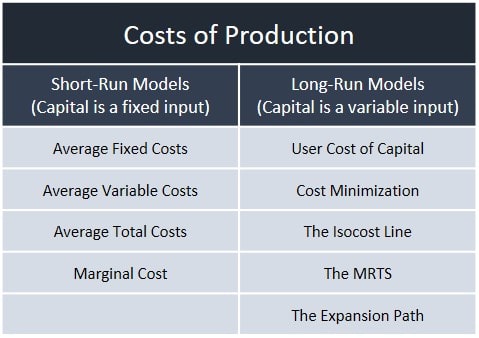

In the table above I have separated production costs into those associated with short-run economic models, and those associated with the long-run. The long-run side is related to productive efficiency in how firms arrive at their input preferences.

The important point to keep in mind with these models is that only labor is considered to be a variable input in the short-run. A firm can relatively easily increase or decrease its workforce in a short period of time, but capital equipment is usually far less flexible, and is considered a fixed input. In the long-run, all inputs are variable because firms can build new plants and expand existing plants when given sufficient time to do so.

I will not explain these models in this article, but you can find links to all of them at the bottom of the page.

What are the

5 Types of Production Costs?

- Fixed Costs - These are costs that do not vary with the level of production. Examples include rent, loan repayments, and insurance premiums.

- Variable Costs - Expenses that change as production increases or decreases. Examples include raw materials, direct labor, and energy costs.

- Total Costs - This is the sum of both fixed and variable costs. It represents the overall cost incurred by a company in the production of goods or services.

- Marginal Costs - Marginal cost refers to the additional cost incurred by producing one more unit of a good or service.

- Average Costs - The total cost divided by the quantity of goods or services produced gives us the average cost. This number is commonly subdivided into average fixed cost (AFC), average variable cost (AVC), and average total cost (ATC).

A special type of fixed cost is a sunk cost, this is a cost that must be paid even if a firm shuts down. Normal fixed costs, such as rental costs, insurance costs, maintenance costs etc., are unrelated to output levels, but fall to zero if a firm goes out of business. Sunk costs are different, they continue even after closure.

For example, if a business owner has already invested $1m of personal wealth in capital equipment for the firm, and that capital has no resale value, it is a cost that cannot be recouped even if the firm shuts down. On the other hand, if that $1m was borrowed from the bank on an unsecured loan, the bank will still want to be repaid even if the firm closes but in this scenario it may be that some, or all, of the cost can be written off by filing for bankruptcy.

More Costs

of Production Concepts

Production costs are closely related to ‘returns to scale’ and the ‘long run average cost curve’. These concepts help explain how changes in the scale of production impact the average costs of production over the long-term.

Returns to

Scale

Returns to scale refer to the effect on output when all inputs are increased by the same proportion. There are three possible scenarios:

- Increasing Returns to Scale - If doubling inputs results in more than a doubling of output, there are increasing returns to scale. This implies lower average costs per unit of output.

- Constant Returns to Scale - If doubling inputs results in a doubling of output, there are constant returns to scale. Average costs per unit of output remain constant.

- Decreasing Returns to Scale - If doubling inputs results in less than a doubling of output, there are decreasing returns to scale. This implies higher average costs per unit of output.

Long Run

Average Cost Curve

The long run average cost (LRAC) curve represents the lowest possible average costs of production for different levels of output when the firm can vary all inputs, including capital. It is derived from the combination of different short-run average cost curves.

The LRAC curve reflects economies and diseconomies of scale. As with returns to scale, there are three possible scenarios:

- Decreasing Cost Industries - this occurs when long-run average costs of production decrease as output levels increase.

- Increasing Cost Industries - this occurs when long-run average costs of production increase as output levels increase.

- Constant Cost Industries - this occurs when long-run average costs of production hold steady as output levels increase or decrease.

Related Pages:

- Minimum Efficient Scale

- User Cost of Capital

- Cost Minimization

- The Isocost Line

- The Expansion Path

- The Marginal Rate of Technical Substitution MRTS

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.