- Home

- Economies of Scale

- Long Run Average Cost Curve

Short Run & Long Run Average Cost Curve (SRAC & LRAC)

The long run average cost curve for a firm describes how its costs change when all of the factors of production which it employs to make its products are allowed time to vary. This is the key distinction between the long run and the short run i.e., in the short run only labor is allowed to vary because only workers can be recruited or released quickly.

Whatever capital and land is used in the production process is relatively fixed, at least until sufficient time has passed that investment in new plant and equipment can be arranged. Entrepreneurship, which refers to the business creator/owner, is typically regarded as completely fixed regardless of timeframe because a firm cannot operate without it.

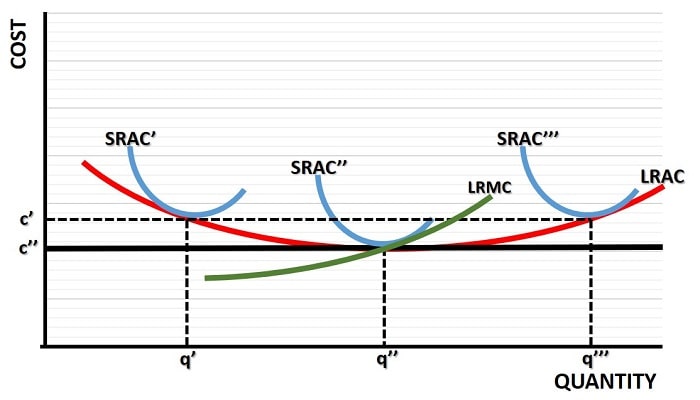

Both the short run and long run average cost curve is U shaped (see graph below), illustrating that lower average costs can be achieved by increasing production, but only up to a point. Beyond that point average costs will increase.

Average Cost Curves Graph

In the graph below I have illustrated three short run average cost curves in blue, and one long run average cost curve in red. For simplicity, you can imagine that each of the short run curves represents a factory. Each factory has its own unique costs of production, but let's imagine that they are all identical with identical costs. I will explain the reason for the shapes of these curves below, but for now lets just be aware that each short run curve lies above the long run curve at all output levels except at its lowest point, where it tangentially touches the long run curve.

Now, you may be wondering why, given that each factory is identical with identical costs, the middle short run curve is lower than the other two. The reason is because production at that point represents the combined production of the first two factories. Similarly, the rightmost short run average cost curve represents the combined production of all three factories.

Next I'll explain the shapes of these curves.

The SRAC Curve

The reason for the U shaped short run average cost (SRAC) curve is that the fixed costs it incurs are independent of output i.e., even if the firm produces nothing, it will still need to pay the rent it owes and the interest on the capital it has invested in. Labor, on the other hand, is a variable cost that relates to the amount of output produced. So, since fixed cost dominates at low levels of production but does not increase with additional units of output, the average fixed cost falls sharply as output expands.

However, at some point, adding additional workers to the production process will be counterproductive unless new plant and equipment is made available for them to work with. Since this cannot be done in the short run, the average variable cost will start to rise at higher levels of output and will start to dominate the falling average fixed cost. This gives us the U shaped SRAC curve.

The LRAC Curve

The long run average cost (LRAC) curve is U shaped for a different reason. Since all factors of production are variable in the long run, there is time for a business to increase its investment in new plant and equipment. That means that while the SRAC curve quickly runs into rising costs as the firm increases the output of any given factory, the long term ability to increase the number of factories means that rising average costs need not occur on account of too many workers crowding too few of the other inputs in the production process.

This, of course, raises the question of why the LRAC curve is U shaped at all? The answer is because there are different returns to scale at the level of the entire industry. In other words, a firm operating in an under-served industry may find that there are overall average cost savings to be had across all of its factories as output expands. However, as the industry reaches an optimal level of production, further expansion causes average costs to increase.

The Long Run Marginal Cost Curve

The long run marginal cost (LRMC) curve relates to the LRAC curve in exactly the same way that short run marginal cost relates to a short run average cost curve. Marginal cost means the cost of producing the last unit of output, so whenever average cost is falling it follows that marginal cost must be lower than average cost, and vice versa when average cost is rising. The LRMC curve passes through the LRAC curve at its minimum point. This will be useful to know when considering a firm's Minimum Efficient Scale.

Returns to Scale & Industry Production Costs

As explained above, the long run returns to scale are illustrated by the U shaped LRAC curve, and the different slopes of that curve illustrate the concept of increasing, constant, and decreasing returns to scale. I have not, however, fleshed out why exactly the returns to scale differ with output levels. All I have said is that under-served industries can experience increasing returns to scale up to a point beyond which decreasing returns set in.

For a full explanation of this concept, you can refer to my article at: Economies of Scale.

For details about the transition phase between the short run and long run for firms given different returns to scale, have a read of my articles at:

Technology & The Learning Curve in Economics

Long run cost savings can accrue to firms that expand production for all the reasons explained here, and particularly in my article about economies of scale, but there is another distinct type of efficiency that is somewhat independent of all those causes i.e., the Learning Curve.

The learning curve in economics occurs when new technology is introduced to the production process. Any new technology will take time for workers to master, and during the learning period output will increase meaning that the average cost of production will fall. These are not the usual average cost savings illustrated by a movement along the LRAS curve, these savings imply a downward shift of the entire curve.

The downward shift of the LRAS curve occurs because, once learned, the newly acquired skills of the workforce will not be forgotten even if production were to be cut back to its original level (e.g., by reducing the size of the workforce).

There is also a sort of relationship between the production level and the learning curve. Higher rates of production will mean more practice for workers and faster learning. The skills gained from performing a task repeatedly should not be underestimated, as any top level sportsman could attest to. The 10,000 hour rule should not be taken literally, but it does have some truth in it. Any reasonably complex task will take many hours of practice to master, and firms can expect their employees to gain productivity for several years during the learning process.

Long Run Average Cost Final Thoughts

The actual shape of the LRAC curve depicted here is 'unconstrained' i.e., it ignores real world market structures where entire industries are frequently served by a small number of firms (meaning a small number of SRAC curves). In such cases, the long run average costs that apply might not be a smooth U shape traced out by connecting all the minimum cost points of hundreds or thousands of SRAC curves.

The general principles are unaffected, but the implication would be a non-uniform U shaped long run average cost curve that appears bumpy as it traces along one SRAC curve before transitioning to the next. Naturally, this would affect the long run marginal cost curve in the same way, and also make it bumpy.

Sources:

Related Pages:

- Minimum Efficient Scale

- Costs of Production

- The Law of Diminishing Returns

- The Production Possibilities Curve

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.