- Home

- Production Possibilities Curve

- Average Fixed Cost

Average

Fixed Cost (Graph, Formula, Example & More)

In microeconomic models of short-run costs for a firm, average fixed cost (AFC) is the fixed cost per unit of output produced. Fixed costs are those expenses that do not change with the level of production. Unlike variable costs, which do fluctuate with production levels, fixed costs remain constant regardless of output.

The average fixed cost, therefore, is derived by dividing total fixed costs by the total number of units produced.

To visualize this, imagine a factory that produces widgets. The factory incurs fixed costs like the rent of the building, the salaries of the managerial staff, and the depreciation of machinery. Whether the factory produces 10 widgets or 10,000, these costs remain unchanged and must still be paid.

The average fixed cost gives a per-unit perspective of these fixed expenses, helping businesses understand how much of the fixed cost is attributable to each unit of output, and this allows managers and decision-makers to assess how efficiently they are utilizing their fixed resources.

A lower AFC typically indicates better utilization of fixed assets, and usually translates into higher profitability and competitive pricing strategies.

Average

Fixed Cost Graph

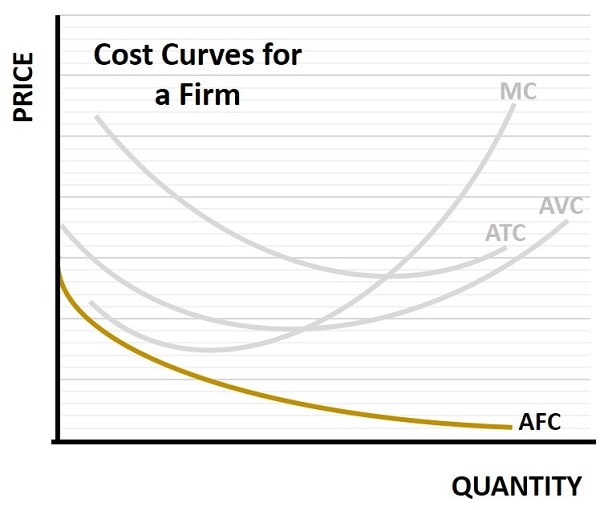

The average fixed cost curve is illustrated in the graph below. As you will notice, the curve starts at a high cost and rapidly diminishes as output increases. This is consistent with the explanation given on this page i.e., that total fixed costs are a constant, so total fixed costs divided by output, which gives average fixed costs, is constantly falling.

I have illustrated the other associated short-run cost curves in the diagram, but I have greyed them out so as to focus on the AFC curve. However, for full information about those other cost curves, have a look at my articles:

Average

Fixed Cost Formula

The formula for calculating average fixed cost is straightforward in economic analysis. It is represented as:

AFC = Total Fixed Costs / Total Output

Example of

Average Fixed Cost

Real-world examples help to contextualize the concept of average fixed cost, making it more relatable and understandable. Consider a small bakery that has fixed costs such as rent ($2,000), salaries of permanent staff ($3,000), and equipment depreciation ($1,000) totaling $6,000 per month. If the bakery produces 3,000 loaves of bread in a month, the AFC would be:

AFC = $6,000 / 3,000 loaves = $2 per loaf

Now, if the bakery increases production to 6,000 loaves, the AFC decreases to $1 per loaf. This reduction demonstrates the benefit of spreading fixed costs over a larger output, reducing the cost burden per unit.

NOTE: in this example it is important to notice that salaries were considered a fixed cost, that’s because they related to permanent salaried staff. It is more typically the case that labor costs are considered variable costs, because workers are not often permanent employees – they can usually be recruited or released depending on how much labor is needed to produce a desired output.

Importance

of AFC in Business Decisions

Average fixed cost calculations are instrumental in break-even analysis. The break-even point is where total revenue equals total costs, resulting in neither profit nor loss. By incorporating AFC into this analysis, businesses can determine the minimum output level required to cover all fixed and variable costs. This knowledge is vital for startups and established businesses alike, helping them to understand the viability of their operations and the scale required to achieve profitability.

In addition, AFC provides insights into operational efficiency. A high AFC might indicate underutilization of resources, prompting managers to explore ways to increase production or optimize resource allocation. Conversely, a low AFC suggests effective utilization of fixed assets, potentially leading to economies of scale and competitive advantages.

How Average

Fixed Cost Affects Pricing Strategies

Pricing strategies are integral to business success, and average fixed cost plays a crucial role in shaping these strategies. Knowing the AFC helps businesses ensure that their pricing covers all costs and contributes to profitability. When setting prices, businesses must account for both variable costs (costs that vary with production levels) and fixed costs.

A well-calculated AFC allows businesses to determine the minimum price at which they can sell their product without incurring losses. This is particularly important in competitive markets where pricing power is limited. By understanding the fixed cost per unit, businesses can set prices that are competitive yet sustainable, ensuring that all costs are covered and a profit margin is maintained.

Moreover, AFC influences pricing during different stages of the product lifecycle. For instance, in the introduction phase, businesses might set higher prices to recover fixed costs quickly. As production scales up and AFC decreases, prices can be adjusted to remain competitive while still covering costs. This dynamic pricing strategy helps businesses adapt to market conditions and optimize profitability throughout the product lifecycle.

Common

Misconceptions about AFC

Despite its simplicity, average fixed cost is often misunderstood, leading to two main misconceptions that can impact business decisions.

- The first misconception is that a low AFC always indicates better business performance. While a lower AFC typically suggests efficient utilization of fixed assets, it is important to consider the other, non-fixed, costs of production. A low AFC might be the result of high production volumes, but if variable costs are excessively high, the overall cost efficiency might still be compromised.

- The second misconception is that AFC is irrelevant for output decisions, because a firm will always choose to produce a unit of output if its marginal cost is less than the marginal revenue that can be earned for producing it. This is true in the short-term, but in the long-term the price that consumers pay must be high enough to cover all costs. If it is not, ultimately, that firm will not reinvest in the business and will ultimately have to cease production.

FAQs about

Average Fixed Cost

How does average fixed cost behave in capital-intensive

industries versus labor-intensive industries?

How does average fixed cost behave in capital-intensive industries versus labor-intensive industries?

In capital-intensive industries (like manufacturing or utilities), AFC tends to be high initially due to large fixed investments (machinery, infrastructure). In contrast, labor-intensive industries (like services) often have lower fixed costs, making AFC less significant and more variable in strategic planning.

Can average fixed cost ever increase, and under what

conditions might this happen?

Can average fixed cost ever increase, and under what conditions might this happen?

While AFC typically decreases with higher output, it may rise if total output falls significantly while fixed costs remain the same. For example, during a downturn or supply chain disruption, lower production volumes could cause AFC to temporarily increase.

How does automation affect average fixed cost in modern

businesses?

How does automation affect average fixed cost in modern businesses?

Automation often increases fixed costs (investment in software, machinery) while reducing variable labor costs. This shift makes AFC more critical to monitor, as businesses need to spread larger fixed costs across a high enough output to maintain profitability.

How can average fixed cost influence outsourcing decisions?

How can average fixed cost influence outsourcing decisions?

If AFC is high due to in-house fixed investments (e.g., owning a warehouse), firms may consider outsourcing to convert some fixed costs into variable costs. This helps reduce financial risk and improve flexibility in scaling operations up or down.

Can government policy or regulation influence a firm’s

average fixed cost?

Can government policy or regulation influence a firm’s average fixed cost?

Yes. Policies that require compliance investments (e.g., environmental standards, safety regulations) can increase fixed costs. This, in turn, raises the AFC unless firms can scale up production or secure subsidies to offset these additional costs.

Related Pages:

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.