- Home

- Perfect Competition

- Homogeneous Products

Homogeneous Products Explained (Real-World Examples)

Homogeneous products are defined by their indistinguishability from one another in the eyes of consumers. This lack of differentiation means that products within this category are seen as perfect substitutes.

Whether produced by different manufacturers or sold by various vendors, these goods are characterized by uniform quality, function, and utility. For example, agricultural products like wheat, corn, and rice are often cited as classic examples of homogeneous goods.

The uniformity ensures that consumers do not prefer one producer's product over another's, provided the price is the same.

Another key characteristic of homogeneous products is their fungibility. This means that units of the product can be interchanged with one another without any loss of value. For instance, one barrel of crude oil is essentially identical to another, making it easy for buyers and sellers to trade without concern for differences in quality.

This interchangeability simplifies the trading process and enhances market liquidity, as there is no need for detailed inspections or quality assessments for each transaction.

The transparency in pricing is also a hallmark of homogeneous products. Since consumers view these products as identical, price becomes the primary factor influencing purchasing decisions. This leads to a high degree of price competition among sellers, as any price variation can quickly shift consumer demand.

Markets for homogeneous goods often feature standard pricing mechanisms, such as commodity exchanges, where the price discovery forces of supply and demand operate in a highly efficient manner. Transparency ensures that all market participants have access to the same pricing information, fostering a competitive environment.

The Role of

Homogeneous Products in Perfect Competition

In economics, the concept of ‘perfect competition’ describes a market structure where numerous small firms compete against each other, and homogeneous products play a crucial role in this scenario. In a perfectly competitive market, no single firm has the power to influence the market price of the product - hence these firms are referred to as price-takers.

Instead, prices are determined by the collective actions of all firms and consumers in the market. The existence of homogeneous products ensures that consumers have no preference for one firm over another, reinforcing the competitive nature of the market.

The lack of barriers to entry and exit in markets characterized by homogeneous products further contributes to the conditions of perfect competition. Firms can enter the market without facing significant barriers, as there is no need to develop unique products or establish brand loyalty. Similarly, firms can exit the market without incurring substantial losses, as they can sell off their inventory of homogeneous goods at market prices.

This fluidity in market entry and exit ensures that resources are allocated efficiently, as firms that are unable to compete effectively will naturally be phased out.

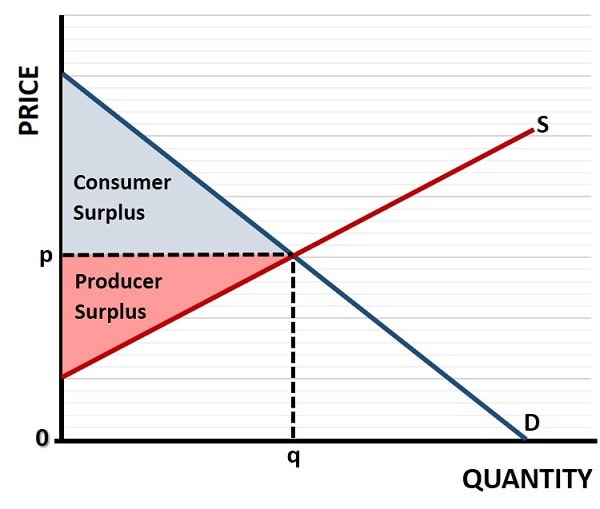

Moreover, since all firms produce identical goods, resources are directed towards the most efficient producers, driving overall productive efficiency. The intense price competition forces firms to minimize costs and innovate in their production processes, leading to lower prices and higher-quality products for consumers. This dynamic promotes overall economic efficiency, as resources are utilized in a manner that maximizes consumer surplus and producer surplus without incurring any undue deadweight loss to society.

Price

Discovery and Homogeneous Products

The dynamics of markets featuring homogeneous products are shaped by the fundamental forces of supply and demand. In such markets, the price of the product is determined by the market equilibrium (at price and output point p, q in the graph below) point where the quantity supplied equals the quantity demanded.

Any shift in supply or demand will lead to a corresponding change in price. For example, a bumper crop in an agricultural market can lead to an excess supply of a homogeneous product like wheat, driving prices down. Conversely, a poor harvest can result in a supply shortage, pushing prices up.

Price elasticity of demand is another critical factor in the price discovery process involving homogeneous products. Generally, these products tend to have high price elasticity, meaning that even small changes in price can lead to significant changes in the quantity demanded. This sensitivity to price fluctuations can create volatile market conditions, where prices can swing dramatically in response to changes in supply and demand.

The role of information also plays a significant part in the dynamics of markets with homogeneous products. Since price is the primary differentiator, having timely and accurate information about market conditions becomes crucial for both buyers and sellers. Market participants rely on various sources, such as commodity exchanges, market reports, and economic forecasts, to make informed decisions. Information symmetry helps to level the playing field, ensuring that all participants have a fair chance to compete and benefit from market opportunities.

Examples of

Homogeneous Products in Various Industries

Homogeneous products can be found across a wide range of industries, each with its unique characteristics and market dynamics:

- In the agricultural sector, commodities like wheat, corn, and soybeans are classic examples of homogeneous goods. These crops are grown by numerous farmers and traded on global commodity exchanges, where prices are determined by supply and demand conditions.

- In the energy industry, crude oil is another prominent example of a homogeneous product. Crude oil from different sources may have varying qualities, but it is generally considered a uniform commodity that can be refined into various petroleum products. The global oil market is highly interconnected, and the fungibility of crude oil allows for efficient trading and distribution.

- The manufacturing industry also features homogeneous products, particularly in the production of raw materials. Steel, for instance, is produced by numerous manufacturers and used in a wide variety of applications, from construction to automotive manufacturing. The standardized nature of steel ensures that it can be traded and utilized without concern for differences in quality.

Impacts of

Homogeneous Products on Pricing Strategies

As mentioned, since homogeneous products are indistinguishable from one another, price competition becomes the primary factor influencing consumer purchasing decisions. This forces firms to adopt pricing strategies that maximize their competitiveness while maintaining profitability.

- Cost-Plus pricing is a common approach; this is where firms set prices based on their production costs plus a fixed margin. This strategy ensures that prices cover costs while providing a reasonable profit.

- Penetration pricing involves setting lower prices to gain market share quickly, especially when entering a new market. By offering lower prices, firms can attract price-sensitive consumers and establish a foothold in the market. Once a significant market share is achieved, firms may gradually increase prices to improve profitability.

- Price matching is also a prevalent strategy in markets with homogeneous products. To remain competitive, firms often monitor competitors' prices and adjust their own prices accordingly. This practice ensures that they do not lose customers to competitors offering lower prices.

Homogeneous

Products vs. Differentiated Products

The distinction between homogeneous and differentiated products is a fundamental concept in microeconomics. While homogeneous products are indistinguishable from one another, differentiated products possess unique attributes that set them apart from competitors.

These differences can be based on quality, features, branding, or other factors that influence consumer preferences. The presence of differentiated products allows firms to compete on factors other than price; non-price competition around things like product innovation, customer service, and brand reputation are important for differentiated products.

In markets with differentiated products, firms have greater flexibility in their pricing strategies. Unlike homogeneous products, where price is the primary differentiator, differentiated products can command premium prices based on their unique attributes. For example, a smartphone with advanced features and a strong brand reputation can be sold at a higher price than a basic model. This ability to differentiate allows firms to target specific market segments and build brand loyalty, reducing the intensity of price competition.

However, the process of differentiation requires significant investment in research and development, marketing, and customer engagement. Firms must continually innovate and improve their products to maintain their competitive advantage.

FAQs

What are the main

risks of relying heavily on homogeneous product markets?

What are the main

risks of relying heavily on homogeneous product markets?

Markets dominated by homogeneous products can expose producers to intense price competition, low profit margins, and high vulnerability to external shocks such as commodity price swings or trade policy changes. This can make long-term revenue stability difficult.

How can producers of

homogeneous goods create competitive advantages without differentiating the

product itself?

How can producers of

homogeneous goods create competitive advantages without differentiating the

product itself?

They can compete on operational efficiency, supply chain reliability, customer service, or value-added services like faster delivery or favorable contract terms—even if the product remains identical.

What role do futures

contracts play in homogeneous product markets?

What role do futures

contracts play in homogeneous product markets?

Futures contracts allow buyers and sellers to lock in prices for delivery at a future date, reducing uncertainty and price volatility. They are common in agricultural commodities, energy, and metals markets.

How do government

subsidies impact the competitiveness of homogeneous product markets?

How do government

subsidies impact the competitiveness of homogeneous product markets?

Subsidies for producers, such as those for certain crops, can distort supply levels, influence global prices, create deadweight loss, and alter the competitive balance between domestic and foreign producers.

How does currency

exchange rate fluctuation affect homogeneous product trade?

How does currency

exchange rate fluctuation affect homogeneous product trade?

Since many homogeneous goods are traded internationally, shifts in exchange rates can make exports more or less competitive, even if the base commodity price stays constant.

How do homogeneous

product markets respond to demand-side shocks?

How do homogeneous

product markets respond to demand-side shocks?

Events like changes in dietary trends, shifts in industrial demand, or global economic slowdowns can reduce demand sharply, causing rapid price drops given the lack of product differentiation.

Conclusion

Understanding homogeneous products is essential for grasping the complexities of market dynamics in various industries. These products, characterized by their uniformity and lack of differentiation, ensure that markets operate efficiently, with prices determined by supply and demand forces.

The role of homogeneous products in perfect competition highlights the importance of market structures in economic theory. These products facilitate efficient resource allocation and promote economic efficiency, benefiting both producers and consumers.

Related Pages:

- Price Takers

- Consumer Sovereignty

- Perfect Competition

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.