- Home

- Perfect Competition

- Market Equilibrium

Market Equilibrium (Graph & Real-World Examples)

Market equilibrium occurs when the quantity of a good demanded by consumers equals the quantity supplied by producers at a specific price, resulting in a stable market condition with no excess or shortage. It represents a theoretical balance point where, absent external changes, prices should remain steady.

In contrast, the related concept ‘price discovery’ refers to the active, fluid process through which markets determine prices based on evolving interactions between buyers and sellers. While price discovery can move buyers and sellers toward market equilibrium, equilibrium itself is a static concept rather than the fluid, often volatile path that markets take in response to new information and changing behavior.

When supply equals demand, the market equilibrium occurs, leading to efficient outcomes that benefit both producers and consumers. Yet, this balance can be easily disrupted by various factors, ranging from shifts in consumer preferences to external economic shocks.

- Supply refers to the quantity of a good or service that producers are willing and able to offer for sale at different price levels. This willingness is influenced by factors such as production costs, technological advancements, and the availability of resources.

- Demand represents the quantity of a good or service that consumers are willing and able to purchase at various price points. Consumer preferences, income levels, and the prices of related goods all play a significant role in shaping demand.

If a product is in high demand but low in supply, prices tend to rise, encouraging producers to increase production and deterring some consumers from purchasing. Conversely, if the supply exceeds demand, prices fall, encouraging consumption and discouraging production.

Market

Equilibrium Graph

As stated above, market equilibrium occurs when the quantity of a good or service supplied equals the quantity demanded at a particular price level. This equilibrium price, often referred to as the market-clearing price, ensures that there are no unsold goods or shortages of goods in the market.

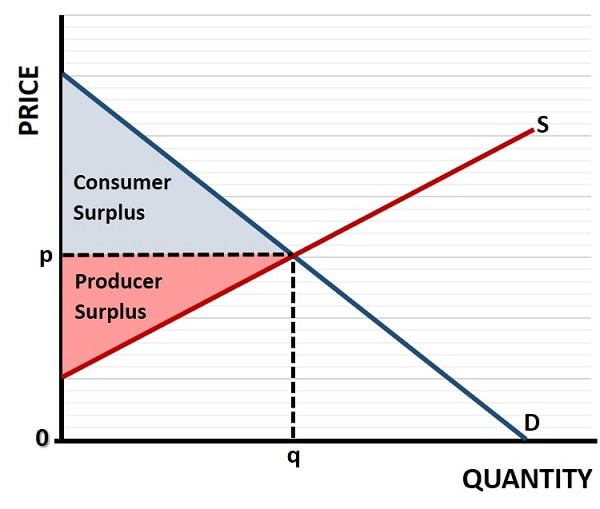

In other words, the amount of goods producers wish to sell precisely matches the amount consumers wish to buy, leading to a stable market condition where resources are allocated efficiently. This is illustrated in the graph below at a market-clearing price of p, and a quantity of q.

The graph also illustrates the consumer surplus and producer surplus that occurs at the market equilibrium, and a complete absence of deadweight loss. These are important concepts that relate to market equilibrium, so click the links for details.

Achieving market equilibrium is not always immediate. Markets often experience fluctuations as they adjust to changes in supply and demand, but see my article about price discovery for more information on this.

Real-World Examples

of Market Equilibrium

Understanding real-world market equilibrium provides insight into how supply and demand align under ideal conditions to establish a stable price and quantity in a market. Though real economies are rarely static, the concept of equilibrium remains a fundamental analytical tool in economics. It represents a state of balance where the quantity of a good demanded equals the quantity supplied – resulting in no inherent tendency for change. Examining how real markets approximate, deviate from, or return to this balance helps economists interpret market behavior and guide policy decisions.

- The Housing Market – market equilibrium is shaped by long-term structural factors such as population growth, income distribution, interest rates, and the costs of construction and land use. When conditions shift, the market may move away from equilibrium temporarily, but the concept itself provides a clear reference point for assessing whether the market is overheated or undersupplied. For example, during an economic expansion, increased demand can push the prices above the market equilibrium, while a downturn may leave prices below it.

- Oil – the market equilibrium price can be distorted by geopolitical events, OPEC production decisions, or technological innovations. Economists use equilibrium models to evaluate what the price should be if no disruptions existed.

- Agricultural Commodities – such as wheat or soybeans, are highly sensitive to factors like weather, seasonal cycles, and international trade policies. While real-world prices fluctuate due to these influences, the concept of market equilibrium helps identify whether prices are high due to supply constraints or low due to overproduction. For instance, a drought may cause prices to rise above the equilibrium level, while a bumper crop can cause them to fall below.

Government

Intervention and its Disruption of Equilibrium

Government policies often impact the natural equilibrium of a market by introducing artificial constraints or incentives. Though intended to correct inefficiencies or promote socially optimal outcomes, such interventions often move markets away from their equilibrium state, so care needs to be taken that there is some sort of market failure that is being corrected before enacting these policies.

Taxes and subsidies shift supply or demand, altering the price-quantity outcome from what it would be under market equilibrium. For example, a tax on sugary drinks raises production costs, resulting in a new price and quantity different from the original equilibrium.

Price controls, such as rent ceilings or minimum wages, directly interfere with market equilibrium. A price ceiling below equilibrium causes shortages, while a price floor above equilibrium leads to surpluses.

Market

Equilibrium as a Pillar of Economic Stability

Although real markets rarely remain at equilibrium for long, the concept provides a crucial anchor for understanding economic stability. When a market is close to equilibrium, resources are usually used efficiently, shortages and surpluses are minimized, and prices reflect the true scarcity of goods and services.

Stable markets aligned with equilibrium principles enable predictable planning, investment, and consumption. They reduce uncertainty for producers and consumers alike. Conversely, persistent deviations from equilibrium (caused by shocks or policy missteps) can lead to inefficiencies, misallocated resources, and instability.

FAQs

What are the main assumptions behind market equilibrium in

economic theory?

What are the main assumptions behind market equilibrium in economic theory?

Market equilibrium assumes perfect competition, rational behavior, full information, and no externalities. These conditions rarely hold in real-world markets, but they provide a useful baseline for economic analysis.

How does market disequilibrium affect consumers and

producers?

How does market disequilibrium affect consumers and producers?

Market disequilibrium can lead to inefficiencies like shortages (hurting consumers) or surpluses (hurting producers), often resulting in lost revenue, misallocated resources, and unpredictable pricing.

Can monopolies or oligopolies reach market equilibrium?

Can monopolies or oligopolies reach market equilibrium?

In imperfectly competitive markets like monopolies or oligopolies, equilibrium can still exist but is often distorted. The market-clearing price may not reflect true supply and demand dynamics due to price-setting power.

How does behavioral economics challenge traditional market

equilibrium theory?

How does behavioral economics challenge traditional market equilibrium theory?

Behavioral economics suggests that consumers and producers don’t always act rationally. Biases, heuristics, and emotions can prevent markets from reaching or sustaining equilibrium, contradicting neoclassical assumptions.

How do expectations

about future prices influence current market equilibrium?

How do expectations

about future prices influence current market equilibrium?

If consumers or producers expect prices to rise, current demand may increase or supply may contract, shifting the market away from its current equilibrium in anticipation of future gains or losses.

Is it possible to

calculate market equilibrium numerically in real-world scenarios?

Is it possible to

calculate market equilibrium numerically in real-world scenarios?

Yes, economists use supply and demand equations or simulation models to estimate equilibrium price and quantity, though real-world data variability makes precise calculation challenging.

Conclusion

Market equilibrium is not a literal description of everyday economic activity, but a powerful theoretical model that helps us analyze how markets function. It provides a static reference point, a “target” state of balance against which real-world market conditions can be compared.

Related Pages:

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.