- Home

- Perfect Competition

- Profit Maximization

Profit Maximization (Graph, Formula & Real Examples)

Profit maximization refers to the process of identifying the most efficient level of production and pricing that yields the highest possible profit. This entails a thorough understanding of cost structures, revenue streams, and market demand dynamics.

Moreover, the concept of profit maximization involves strategic decision-making and anticipation of market movements. Businesses must evaluate and adjust their production levels, pricing strategies, and cost management continuously.

Profit maximization is not just a goal but a necessity for businesses operating in competitive markets. It serves as a driving force behind economic growth and development, influencing everything from investment decisions to employment rates. When businesses maximize their profits, they generate more funds, which can be reinvested into expanding operations, innovating products, and improving services.

This reinvestment cycle fuels economic activity and contributes to overall prosperity.

On a macroeconomic level, profit maximization impacts government policies and economic stability. Profitable businesses contribute significantly to tax revenues, which fund public services and infrastructure development. Additionally, strong corporate profits bolster investor confidence, attract foreign direct investment, and promote a healthy financial market.

Different

Approaches to Profit Maximization

Businesses can adopt various approaches to achieve profit maximization, each tailored to their unique circumstances and market conditions. One common method is cost minimization, where firms focus on reducing production and operational expenses. By streamlining processes, negotiating better supplier contracts, and adopting efficient technologies, companies can lower their costs of production, thereby increasing their profit margins.

Another approach is revenue maximization, which involves strategies to boost sales and generate higher income. This can be achieved through aggressive marketing campaigns, expanding product lines, entering new markets, or enhancing customer service. By increasing the volume of sales or commanding higher prices, businesses can drive revenue growth and, consequently, maximize profits.

Most firms adopt a balanced approach, simultaneously focusing on cost reduction and revenue enhancement. This dual strategy allows businesses to optimize both sides of the profit equation, ensuring a comprehensive approach to profit maximization.

Profit

Maximization Formula

The simple formula for profit is:

Profit = Total Revenue - Total Cost

Total revenue is derived from the price at which goods or services are sold multiplied by the quantity sold, while total cost encompasses both fixed costs and variable costs associated with production.

The Role of

Marginal Cost and Marginal Revenue

Marginal cost and marginal revenue are pivotal concepts in the pursuit of profit maximization. Marginal cost refers to the additional cost incurred from producing one more unit of a good or service. It is a critical factor in decision-making, as it helps businesses determine the optimal level of production. If the marginal cost of producing an additional unit is lower than the price at which it can be sold, the firm should increase production to maximize profit.

Conversely, marginal revenue is the additional revenue generated from selling one more unit of a good or service. To achieve profit maximization, a firm must equate marginal cost with marginal revenue. When these two metrics are balanced, the firm is operating at its most efficient level, ensuring that each unit produced contributes positively to overall profit.

The Profit

Maximization Graph

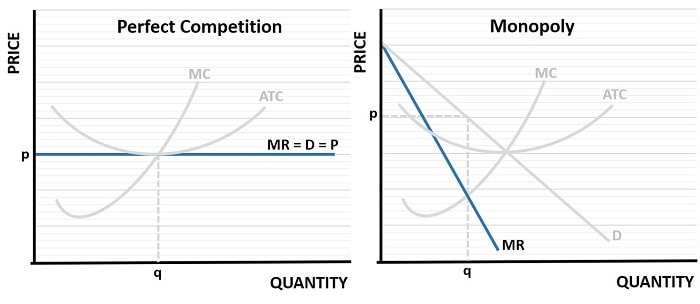

In the profit maximization graph below, the price and output level that a firm optimizes its profit is always achieved where marginal revenue curve (MR) intersects the marginal cost curve (MC). This is true whether a firm is operating in perfect competition or monopoly, or any other market structure.

Understanding the interplay between marginal cost and marginal revenue allows businesses to make informed decisions about scaling production, adjusting prices, and managing resources. It provides a framework for evaluating the profitability of incremental changes, ensuring that firms can respond swiftly to market demands and maintain optimal profit levels.

Factors

Influencing Profit Maximization Strategies

Several factors influence the strategies businesses adopt to maximize profits.

- Market structure is a primary determinant, with different competitive environments requiring distinct approaches. In monopolistic markets, firms have greater pricing power and can set higher prices to maximize profits, whereas in highly competitive markets, businesses must focus on cost efficiency and differentiation to gain an edge.

- Consumer behavior also significantly impacts profit maximization strategies. Understanding customer preferences, purchasing patterns, and price sensitivity enables firms to tailor their offerings and pricing strategies effectively. Conducting market research, analyzing data, and leveraging customer feedback are essential practices for gaining insights into consumer behavior and making informed strategic decisions.

- Technological advancements play a crucial role in shaping profit maximization strategies. Innovations in production processes, supply chain management, and data analytics can significantly reduce costs and enhance operational efficiency. Embracing technology and staying abreast of industry trends allow businesses to optimize their operations, improve product quality, and respond swiftly to market changes, thereby maximizing profits.

Real-World Profit

Maximization Examples

- Apple Inc. – through a combination of innovative product design, premium pricing, and efficient supply chain management, Apple has consistently achieved high profit margins. The company's focus on creating a strong brand identity and delivering exceptional customer experiences has further solidified its market position and profitability.

- Amazon – has leveraged economies of scale and technological advancements to maximize profits. By optimizing its logistics network, utilizing data analytics, and expanding its product offerings, Amazon has significantly reduced costs and increased revenue. The company's emphasis on customer satisfaction and continuous innovation has also contributed to its sustained profitability and market dominance.

- Toyota – has demonstrated successful profit maximization through its lean manufacturing principles. By implementing just-in-time production, continuous improvement, and waste reduction strategies, Toyota has achieved significant cost savings and operational efficiency. These practices have enabled the company to maintain competitive pricing, enhance product quality, and maximize profits over the long term.

Limitations

and Misaligned Incentives

While profit maximization is a central objective in economic theory, several real-world limitations can hinder a firm's ability to achieve this ideal. One significant constraint arises from the misalignment of incentives between a company's owners (shareholders) and its management team – a phenomenon known as the principal-agent problem.

In theory, managers are appointed to act in the best interests of shareholders by making decisions that maximize profits. However, in practice, managers may pursue goals that benefit themselves rather than the firm. These may include prioritizing job security, expanding the business unnecessarily to increase their own power and prestige, or focusing on short-term earnings to trigger performance-based bonuses – all of which may diverge from long-term profit maximization.

This misalignment is exacerbated by information asymmetry, where managers possess more detailed knowledge of the firm's operations than owners do. This gap makes it difficult for shareholders to monitor managerial behavior closely and ensure that decisions align with the firm's financial objectives. Additionally, differences in risk preferences may arise: shareholders can diversify their investments and may prefer riskier, high-return strategies, while managers, whose income and reputation are tied to a single firm, tend to act more conservatively.

To address these challenges, firms often implement governance mechanisms such as performance-based compensation, regular financial disclosures, oversight by boards of directors, and shareholder voting rights. These tools are designed to align managerial behavior with shareholder interests, but they are not foolproof. The effectiveness of such mechanisms can vary widely depending on organizational culture, legal frameworks, and industry norms.

FAQs

How does profit maximization differ between short-run and

long-run decision-making?

How does profit maximization differ between short-run and long-run decision-making?

In the short run, firms may face fixed inputs and capacity limits, so profit maximization focuses on variable cost management. In the long run, all inputs are adjustable, allowing firms to rethink scale, enter/exit markets, or adopt new technologies for sustainable profitability.

Can profit maximization lead to negative externalities in

the economy?

Can profit maximization lead to negative externalities in the economy?

Yes, firms focused solely on profit maximization may overlook social costs, such as pollution or labor exploitation, leading to negative externalities. This is why regulatory frameworks and corporate social responsibility initiatives are essential.

What is the relationship between profit maximization and

shareholder value?

What is the relationship between profit maximization and shareholder value?

While profit maximization contributes to shareholder value, the two are not identical. Shareholder value also includes long-term growth, risk mitigation, and reputation management. A narrow focus on short-term profit can undermine broader shareholder interests.

How does behavioral

economics challenge traditional profit maximization models?

How does behavioral

economics challenge traditional profit maximization models?

Behavioral economics suggests that firms and consumers don't always act rationally. Managers may be influenced by cognitive biases, and consumers by emotions, introducing inefficiencies that diverge from the idealized profit-maximizing model.

How does profit

maximization differ in service-based businesses versus product-based

businesses?

How does profit

maximization differ in service-based businesses versus product-based

businesses?

Service businesses often have lower variable costs and focus more on labor efficiency and customer experience, while product-based firms emphasize supply chains and inventory management. The metrics and levers for profit differ accordingly.

What’s the difference

between accounting profit and economic profit in the context of profit

maximization?

What’s the difference

between accounting profit and economic profit in the context of profit

maximization?

Accounting profit considers only explicit costs, while economic profit includes both explicit and implicit (opportunity) costs. A firm may appear profitable on paper but not be truly maximizing economic value if opportunity costs are ignored.

Conclusion

Profit maximization remains a cornerstone of business strategy and economic theory, offering a clear objective for firms operating in competitive markets. However, as this article has explored, achieving maximum profitability involves more than simply increasing revenue or cutting costs—it requires a deep understanding of market conditions, consumer behavior, internal efficiency, and organizational dynamics. Moreover, limitations such as misaligned incentives and managerial discretion highlight the complexities that firms face in practice.

Ultimately, successful profit maximization demands a balanced, adaptive, and strategic approach. Businesses that can navigate these challenges while remaining aligned with long-term goals are better positioned to sustain profitability, drive innovation, and contribute meaningfully to economic growth.

Related Pages:

- Consumer Behavior

- Long-Run Average Cost Curve

- Economic Profit vs Accounting Profit

- Thinking At The Margin

- Deadweight Loss

- Market Equilibrium

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.