Types of Price Controls in Economics?

Government price controls are a direct intervention in a free market economy, they are usually done in order to prevent the official prices of targeted goods and services from rising. They are frequently resorted to at times of high, and accelerating, rates of inflation.

In other circumstances, price controls are sometimes used as a support mechanism for particular industries that the government wishes to 'protect' from market forces, or perhaps to correct certain market failures in order to attain socially optimal output. These interventions take the form of a price floor which guarantees a higher price to firms via subsidy payments, which then helps to support extra production.

Returning to the more common type of control, where a price ceiling is used to forbid firms from charging anything higher than the stipulated ceiling price in order to tackle inflation, these controls cannot by themselves fix any of the underlying causes that created the inflation problem in the first place. To be effective they must be accompanied by other restrictive economic policies.

Most importantly, when fighting inflation, there will need to be higher interest rates and a contraction of the money supply, in order to reduce spending in the economy and thereby ease up on demand-pull inflation factors.

Price controls are usually enacted at a fairly late stage of an inflation crisis, and are often used for political reasons rather than as any sort of serious attempt at controlling inflation, and for this reason their track record of success is very low.

In this report I will explain the economics of different types of price controls, and some consequences that crop up whenever these policies are used in any meaningful way i.e., deadweight losses to society and, occasionally, black markets in the informal sector of the economy.

Finally, I will give an example of their use in recent decades i.e., the Nixon price controls of the 1970s. In a separate report, I will give detailed information about the most common type of price ceiling, i.e. rent control.

Why do price ceilings often create black markets?

When the maximum price limit is set below the equilibrium price, it creates a shortage in the market. This shortage can lead to rationing, black markets, and a decrease in quality.

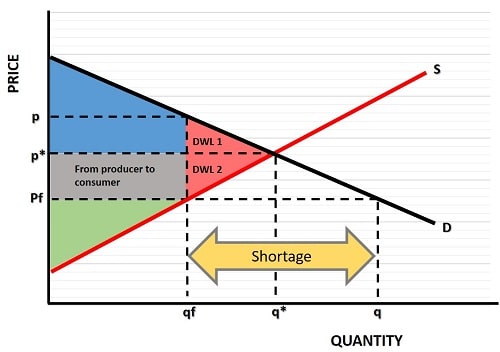

In the graph above, a fixed price ceiling (Pf) is set below the market price of P*. As a result, producers are only willing to supply a quantity of qf goods, well below the quantity that consumers would like to purchase at the fixed price.

Those consumers who are able to obtain goods at the fixed price do gain some consumer surplus at such a low price, and part of that surplus comes at the expense of producers, but overall there are deadweight losses to society as illustrated by the red areas in the graph. For more explanation of this graph, see my article about excess demand.

Black markets, also called the informal sector of the economy, operate outside of the official controls. This is because the price that some consumers are willing to pay to obtain goods is higher than the price ceiling. This is, of course, illegal.

Price controls can generate inequities because poorer consumers may have to deal with shortages while richer consumers are able to obtain goods via black markets.

When policymakers impose these sorts of price controls they often use rationing measures alongside them so that no one consumer can purchase more than their allotted fair share - at least not officially!

Price ceilings may be effective in the short-term, but in the long-term buyers and sellers will circumvent them via black markets. This is why price controls don't work in the long run.

Examples of Price Ceilings

Rent control is a common example of a price ceiling. Governments often implement rent control policies to protect tenants from rapidly increasing rental prices. By setting a maximum price that landlords can charge, governments aim to ensure affordable housing options for residents.

However, critics argue that rent control can lead to a decrease in the quality and availability of rental housing. Landlords may be less incentivized to maintain or invest in their properties if they are unable to charge market rates.

Another example of a price ceiling is the maximum price limit set on certain pharmaceutical drugs. Governments may implement price ceilings to ensure that essential medications remain affordable for patients.

However, this can create challenges for pharmaceutical companies, as they may face reduced profitability and fewer resources for research and development.

Price Ceilings on Monopolies

A special mention needs to be made about monopolies and the price ceilings that are sometimes placed upon them. Importantly, they have nothing to do with inflation. Rather, they are used as a means to prevent excessive profits from being charged to consumers on account of the significant market power that these organizations sometimes enjoy.

Price controls on goods can be set by independent regulatory bodies and, while they are not legally binding, they can end up with legal action being taken on anti-competition laws if they are not respected.

The Nixon Wage and Price Controls and more

The Nixon wage and price controls of the 1970s were introduced as part of the 'Economic Stabilization Act'. It imposed a 90-day freeze on wages and prices in order to try and tackle the high inflation at that time.

The Carter price and wage controls were introduced in 1978 for similar reasons to the Nixon wage and price controls of 1970. Annual wage increases were restricted to 7% while goods price rises were restricted to 5.75%. However, these were voluntary, and exceptions were intended for some markets e.g., for low earners.

Neither of these measures were successful and inflation continued to soar. This is not to say that such measures cannot work, but they do need to be accompanied by much more fundamental solutions. This is explained in my article about Wage and Price Controls.

Price Floor Inefficiencies

Price floors are a type of price control that establishes a minimum price for a particular good or service. The intention behind implementing a price floor is to ensure that producers receive a fair income and to protect certain industries from price volatility.

For example, the agricultural sector often relies on price floors to support farmers by guaranteeing a minimum price for their produce. By setting a price floor, the government can stabilize prices and provide a safety net for producers.

However, price floors can also have unintended consequences. While they may protect producers, they can lead to inefficiencies in the market. When the price floor is set above the equilibrium price, it creates a surplus as the quantity supplied exceeds the quantity demanded. This surplus can result in wastage, as producers are unable to sell their goods at the inflated price.

For more details of the resulting deadweight losses, have a look at my article about excess supply.

Examples of Price Floors

Minimum Wage Policies

One notable example of a price floor is the minimum wage policy. Governments often implement minimum wage laws to ensure that workers receive a fair wage for their labor.

By setting a minimum wage, the government aims to improve the standard of living for workers and reduce income inequality.

However, critics argue that minimum wage laws can lead to job losses, as businesses may be unable to afford higher wages.

OPEC Oil Price Floors

Another example of a price floor is the OPEC (Organization of the Petroleum Exporting Countries) oil price floor. OPEC, a cartel consisting of major oil-producing countries, often sets a minimum price for oil to stabilize prices and protect the interests of its member countries.

By implementing a price floor, OPEC aims to prevent oil prices from falling too low, which would have detrimental effects on the economies of oil-producing nations.

However, this policy can also lead to higher oil prices for consumers, as the price floor limits competition.

Tariffs and Trade Restrictions

Governments may impose tariffs and trade restrictions on imported goods to protect domestic industries and ensure fair competition. These price controls can impact the availability and cost of imported goods, influencing consumer choices and market dynamics.

Conclusion: Finding the Right Balance in Price Controls

Price controls, whether in the form of price floors or price ceilings, are powerful tools that can shape market dynamics and impact businesses and consumers in the short-term, but they tend to fail in the long-term due to the inefficiencies that they create.

Price floors can provide stability and security for certain industries, but they must be carefully implemented to avoid adverse effects on the market. Balancing the needs of producers and maintaining market efficiency is key to navigating price floors successfully.

Price ceilings can protect consumers and ensure affordability, but they must also be carefully implemented to avoid shortages and reduced quality. In terms of their ability to fight inflation, price ceilings can only work as part of a more fundamental package of policies aimed at solving the root causes of inflation.

Ultimately, finding the right balance in price controls is a complex task that requires a deep understanding of economic principles and the ability to adapt to changing market conditions.

Sources:

Related Pages:

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.