Demand Pull Inflation Economics

Demand-pull inflation occurs when the price level rises due to excessive spending in the economy i.e. when goods and services are being bought faster than firms can produce them. This usually happens during unsustainable economic boom periods.

Fluctuations in the overall level of demand in the economy are thought to be the most important cause of inflation and unemployment. There is no doubt that in our current economic system (with fractional reserve banking, fiat currency, and a central bank that controls interest rates) does experience the boom-bust business cycle most frequently because of fluctuating levels of demand.

However, there are compelling arguments from the Austrian school of economics that puts the blame for business cycles on the shoulders of the government and the central bank, due to their incompetent management of fiscal and monetary policy in regulating demand levels.

I won't go too far into that debate here, but for readers who want to know more about how demand could be easily moderated by free-markets, have a look at my article about Full Reserve Banking.

In this article I will explain how an increase in aggregate demand leads to higher inflation, and how it can become a problem if it is allowed to increase economic output beyond its sustainable rate. As is often the case in economics, the best way to start is with a graph.

Demand Pull Inflation Graph

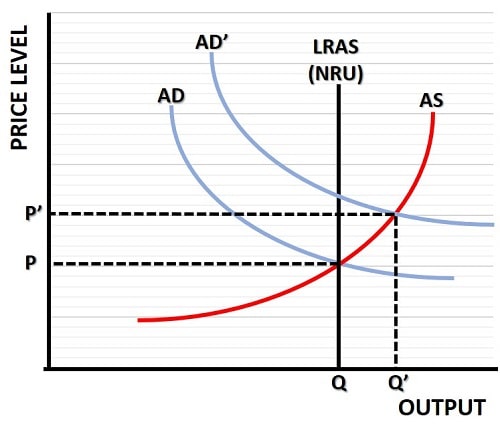

In the demand-pull inflation graph below I have illustrated what happens when aggregate demand increases beyond a level that the economy can sustain in the long run. It inevitably causes the price level to rise as firms struggle to supply enough goods and services to meet the increased demand.

Starting from a position of full employment, which economists call the Natural Rate of Unemployment (NRU) and is illustrated in the graph by the vertical Long-Run Aggregate Supply curve, we can see that a further increase in aggregate demand from AD to AD' will temporarily increase output from Q to Q'. This will actually reduce unemployment below the NRU as firms hire more workers to produce the extra output.

Additionally, existing workers will be paid overtime rates to work extra hours, as well as weekend work or night-shift work. However, not all of the extra demand will be satisfied, and the competition to buy goods will bid prices up from P to P'.

This is the start of demand-pull inflation, and it happens because there is insufficient spare capacity in the economy to be able to raise production enough to satisfy all the extra demand. If there had been sufficient spare capacity, the aggregate demand curve would have been intersecting the red short-run aggregate supply curve to the left of the NRU, and output could have risen enough to satisfy most of the extra demand without too much impact on prices.

The problem with the actual expansion beyond the NRU is that it cannot be sustained forever. At an output rate of Q' workers will start to demand higher wages to compensate them for the rising cost of living due to higher prices (P'). However, the additional workers that were recruited do not have a high enough marginal productivity to justify the higher wages. Similarly, increased overtime rates and weekend rates cannot be justified, so workers will start to decline the extra hours offered by employers.

Ultimately equilibrium will be restored, but the more that workers successfully negotiate higher wages, the more that further price level increases in future will be necessary in order to maintain profitability.

This cycle of higher prices leading to higher wage demands also leads to increased inflationary expectations, and thereby persistent inflation. This process is explained in my article about the Non-Accelerating Inflation Rate of Unemployment.

Causes of Demand Pull Inflation

Demand-pull inflation is caused by increased spending from either consumers, firms, the government, or from overseas trading partners. Aggregate demand is the sum of C + I + G + (X - M) and in words this simply means consumption plus investment plus government spending plus exports minus imports.

Keynesian economists regard investment as being the most volatile of these components, and believe that it is when business and consumer confidence is highest that investment levels can increase enough to create demand-pull inflation. This, they argue, is the justification for active demand management policy.

What the Keynesians consistently fail to recognize is that excessive consumer and business confidence, and resulting investment levels, stems from inappropriate interest rates. Inflation is always a lagging phenomena, and the monetary authority (i.e. the Federal Reserve) has more or less never been able to spot unsustainable boom-periods in advance, and thereby take appropriate corrective action by raising interest rates in order to deter excessive borrowing and spending.

If the free-market were allowed to determine interest rates, such corrective action would occur automatically because interest rates would adjust to equate the level of saving to the level of lending. Unfortunately, this link is broken with a fractional reserve system and unresponsive interest rate policy from the Fed.

In this sense, the ultimate cause of demand-pull inflation is usually the Fed, because it is simply incapable of determining the appropriate interest rate at any given moment.

Examples of Demand Pull Inflation

The best example of demand-pull inflation occurred between 1965 and 1970 when President Lyndon B. Johnson increased government spending on his 'Great Society' program. At the same time , US involvement in the Vietnam war escalated to its peak, as did the expenses that it entailed. The solution, as always, was to borrow more money and print more money.

Inflation soared from 1.6% in 1965, to 5.8% in 1970.

More recently, between 2002 and 2008 the US rate of inflation increased from 1.6% to 3.8% in the run up to the financial crisis. However, the CPI measure of inflation masked the true extent of demand-pull inflation because it failed to accurately reflect the extent of the housing and real estate boom that was occurring. The figures were also skewed by inclusion of increasing amounts of cheap imported goods from China and elsewhere.

By the time the Federal Reserve recognized the true extent of the demand-pull inflation bubble that had developed, the crash that followed was so severe that it threatened to destroy the global financial system.

The increasing rate of inflation in 2022 occurred due to a combination of cost-push and demand-pull factors. The excess demand came primarily from the huge fiscal stimulus checks sent out during the pandemic lockdowns, first by the Trump administration, and then by the Biden administration. Additionally, the loose monetary policy and extensive packages of quantitative easing boosted the money-supply from 2008 right up to 2022, with huge inflation in real estate prices as well as stocks and shares.

Whether or not inflation returns throughout the 2020s will depend in large part on whether or not the Fed pivots on its commitment to high interest rates too soon. For details of the threats posed by this, see my article about Reflation.

Sources:

Related Pages:

- Cost Push Inflation

- What Causes Inflation?

- Does Quantitative Easing Cause Inflation?

- The Quantity Theory of Money

- Does Government Spending Cause Inflation?

- What is Inflation, and why is it bad?

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.