- Home

- Circular Flow Diagram

- National Income Accounting

National Income Accounting Explained (with Graph & Charts)

The topic of national income accounting does not often deliver a nail-bitingly engaging experience for any but the most enthusiastic students of economics, but it does have its uses and should not be overlooked. I will make it as interesting as I can, and deliver a few original insights in this article.

Right from the beginning you should keep in mind that national income accounting can be divided into three approaches i.e. the income, output, and expenditure models. All three are different ways of calculating the same thing, so all should approximate the same figure.

The demand side of the national income accounting process is concerned with expenditure on goods and services i.e. C+I+G+(X-M) which I've explained below.

The supply side is focused on the factors of production and the various factor payments that they earn e.g. wages for labor, interest for capital, rent for land, and business profits for entrepreneurs.

The Circular Flow of Income, Output, and Expenditure

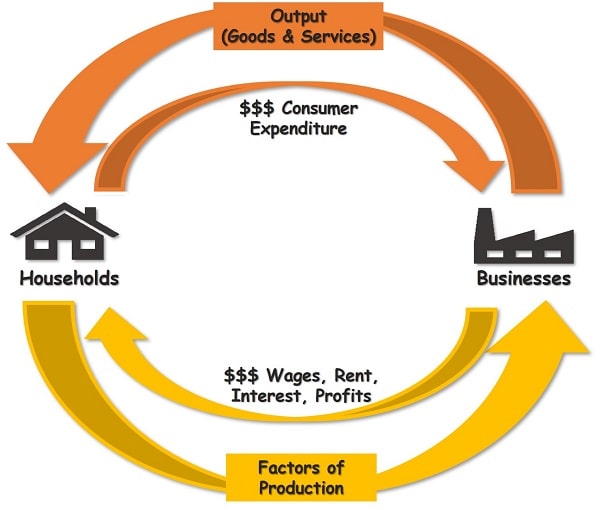

The diagram below illustrates the circular flow of income, output, and expenditure in a simple economy with no government or foreign trade. Starting from the bottom arrow and working up, households provide the factors of production for businesses in return for money income. Households then use that income as expenditure to purchase the output i.e. goods and services that businesses created with the factors of production.

National income can be estimated by totaling the values of either income, output, or expenditure, and all three methods are routinely used.

The uses of National Income Accounting

The primary use of national income accounting is to provide a benchmark assessment of economic performance. The civil service in all countries around the world are continually estimating and revising important economic data so that the figures compiled can be provided for policymakers as information to act upon.

In this sense, national income statistics provide the raw data that underlies macroeconomic theory and policy, but this is not its only use. It is also useful simply as a means of comparing the standard of living in a country with that of its neighbors and competitors.

The key measures are:

- Gross Domestic Product (GDP) - GDP is the most widely quoted measure and it estimates the total value of all output produced within an economy. The figure arrived at will relate to a certain period of time, usually a year. Sometimes it is quoted as a 'per capita' figure, i.e. averaged per person.

- Gross National Product (GNP) - This is also a popular measure, it differs with GDP slightly because it adds profits earned by assets owned in other countries (and deducts profits earned by foreign owned assets within the home country). It is therefore gives a slightly more accurate income estimate than GDP.

- Net National Product (NNP) - You won't often see this figure quoted, but it reduces the GNP figure by the estimated cost of depreciated (worn out) assets that need replacing. Similarly, NDP (not NNP) would make the same deduction but from GDP instead of GNP. NNP is the most accurate of the national income measures listed here.

|NOTE| Just for added confusion the 'P' in these terms is sometimes dropped for an 'I' (which stands for Income instead of Product), so GDP, GNP and NNP are interchangeable with GDI, GNI and NNI.

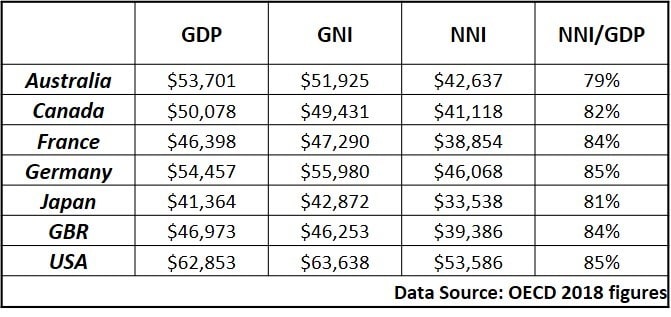

The differences between these various income measures are usually minor in the major economies of the world, but not always. Countries with larger manufacturing bases have more machinery and therefore more depreciation, meaning that their NNP measures are significantly lower than GDP and GNP. Also, the variance in the figures can be much more significant for smaller countries because international trade and capital flows tend to be proportionately larger influences on their economies.

As you can see from the table above, some countries have NNI estimates that are relatively closer to their GDP figures than others.

In economics textbooks there is not usually much focus given to the discrepancies between these measures, and so long as you remember that they are all just estimates of a country's national income you probably won't need to concern yourself with the details as it doesn't affect the study of economics in general.

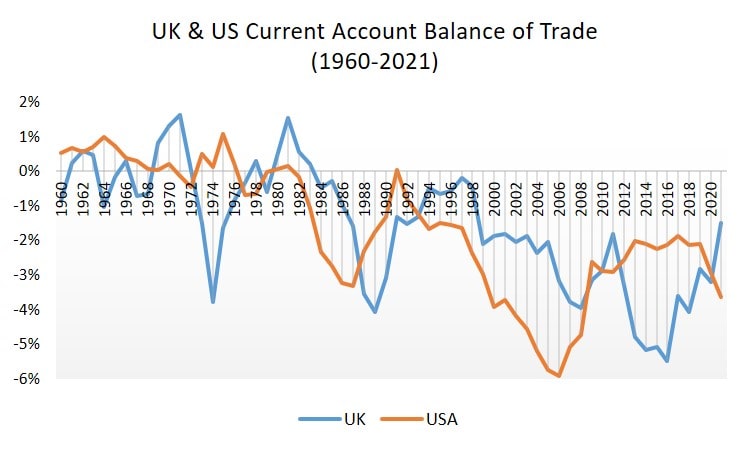

Turning to matters of concern, it's worth remembering that net property income from abroad was once in surplus in the USA and the UK, but it is now negative, and the shortfall looks set to increase due to persistent trade deficits. The root cause of persistent trade deficits is the mainstream economic obsession with maximizing consumption in the present (at the expense of sensible levels of saving), and I've explained this in more detail on my page about:

GDP & Trade Deficit Problems

There is a serious concern in many western countries about the expanding shortfall in their net earnings on foreign assets. It certainly looks set to grow to an ever more significant level in future years, and this threatens to reduce the standard of living in the countries affected.

Much of the western world (including the USA and the UK) have been running large and persistent trade deficits for decades, and the effect of this has led to a huge net surplus of foreign money pouring in to to purchase US and UK assets (i.e. foreign companies have used much of their earnings to invest in western financial assets). This process incurs a future net outflow of resources from a country in the direction of the country that owns those income-generating assets.

By way of example, let's consider the US trade deficit. Consider what foreign companies will do with the US dollars that they earn from selling their products in the USA. They could take the dollars to the bank and exchange them for their local currency, and thereby increase the demand for local currency relative to US dollars. Ultimately this would put pressure on the US exchange rate until a currency depreciation made US products cheap enough to compete with foreign imports. At this point there would be no more trade deficit, but the standard of living in the US would decline because the US currency has lost value in the world economy.

Alternatively, if the foreign businesses decide not to exchange their dollar earnings into local currency, they could use them to purchase US income-generating assets. This would generate a permanent outflow of resources from the US to the foreign owners of those assets (and a wider gap between GNP and GDP). Those foreign owners could then start to convert their US incomes into local currency (again causing a dollar depreciation and lower standards of living) or they could purchase US goods and services to be shipped overseas. Either way the US will ultimately suffer a permanent drain on its economy if it cannot reverse its trade deficit.

The only other alternative is that the government increases its borrowing from foreign countries in order to plug the gap in its balance of payments, but this doesn't change the consequences. Whichever way you cut it, countries that have a persistent trade deficit are living beyond their means.

This cannot last forever; at some point we'll need to pay the piper!

Accounting Identities

As mentioned above, you can forget about the particular definition of national income when using the standard economic models, so from here on just regard output as synonymous with whichever definition you prefer.

The letter 'Y' is usually denoted to indicate national income. For simplicity, depreciation is ignored so that gross investment is the same as net investment, this doesn't affect the analysis that follows, but you should be aware of these simplifying practices.

The most fundamental accounting identity in mainstream macroeconomics is:

Y = C + I + G + (X - M)

In words this means that national income equals the sum of consumption, investment, government spending and exports minus imports (the trade deficit/surplus).

Government spending here does not include transfer payments from one person to another, e.g. welfare payments, because that transfer will be counted within consumption when the receiving person spends the welfare money. Additionally, if some economic output is left unsold it will lead to firms inventory stocks increasing, and this is classed as a form of investment.

Savings and Investment

In an economy with no foreign trade and no no government, the relationship between private sector savings (S) and investment (I) is clear because saving is simply non-consumption, and only that part of national income that is not consumed can be used for investment. Essentially this means that savings and investment must be equal (S=I). If you remember that unsold output counts as investment then this relationship will make more sense.

In other words Y=C+I is the same as Y=C+S in an economy with no government or foreign trade.

Now, adding government and trade back into the equation complicates matters and leads to a situation where private sector investment can be very different from savings. A government deficit can be funded by borrowing private sector savings (effectively 'crowding out' private sector investment), and a high private consumption level necessarily implies low savings, which leads to lots of imports being bought and thus a larger trade deficit - which in turn can increase foreign investment in domestic assets as explained above.

Typically, foreign firms will use the majority of their earnings from selling their goods to the west to purchase interest-earning western government bonds (adding to our external national debt). If our government is running a budget deficit at the same time that there is a trade deficit then it may be that the cash outflow related to the trade deficit is effectively lent back to our government to plug the gap in its finances.

If the government were to cut its spending to eliminate its budget deficit, the economy would slow down to a level with less consumption but with the potential for increased private sector investment. This is because less consumption of goods would include less consumption of imports, and so the trade deficit would also be reduced. Whilst this might be the responsible thing to do, it probably wouldn't be the vote-maximizing thing to do, hence the mess that we find ourselves in with regard to the persistent budget and trade deficits in much of the western world.

This point really needs to be rammed home - excessive government spending kills growth and investment. In Japan, the most heavily indebted country in the world after decades of excessive government spending, there has been zero economic growth since the mid-1990s, and that has happened despite having a strong trade surplus!

A government deficit, i.e. spending greater than tax receipts, might occur because the government is investing in extra infrastructure (usually paying way over the odds and failing to deliver value for money), or just because it wants to artificially boost the economy ahead of an election. The point is that government spending 'crowds-out' private sector investment by using private sector savings to pay for it.

Expressed as an equation this leads to another important national income accounting identity (TR and TA in the equation below stand for government transfers and tax receipts, so the bit in parentheses amounts to the government's budget deficit/surplus):

S - I = (G + TR - TA) + NX

In words it means that if savings are lower than investment, it must be that either a government deficit, or a trade deficit (NX means net-exports), is affecting private sector savings and/or investment.

It could be that the citizens of a country are buying too many imports relative to the exports that they sell, and that they should save more money instead. It could also be that the government of that country is running too high a budget deficit and is running up the national debt by continually borrowing money from the private sector.

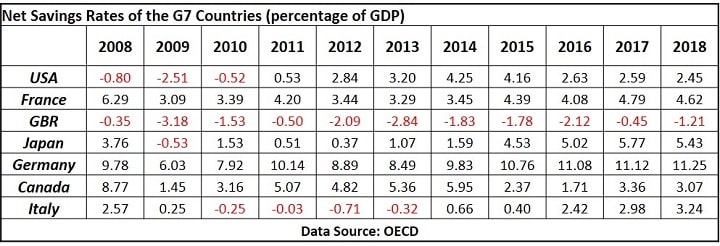

This has been particularly evident in the UK in recent years where something that at one time I might have regarded as impossible is actually happening i.e. recent years have actually seen a negative savings rate! This has been combined with both a large budget deficit and a large trade deficit. The irresponsibility and utter incompetence of successive UK governments is beyond my ability to communicate, but needless to say I'm not entirely pleased by it...

You might wonder how it is possible that savings can be negative - it doesn't mean that there are no savings. You need to remember that we are talking here about net private sector savings after capital depreciation, so savings lower than depreciation would be recorded as negative. In the table above you'll notice that a number of G7 countries have experienced negative savings rates in the aftermath of the 2008 financial meltdown, with Great Britain showing negative rates throughout the entire period.

Value Added & Inaccuracies

In order to avoid any double counting in the measurement of national income, the concept of 'value added' is used. If it were not used, imagine accounting for the output of a used car dealership - when selling a car for $20,000 the expenditure model would simply record the full $20,000 as national income. However, if the car dealer bought the car from an auction for $14,000 the same process would record that entire $14,000 as national income accruing from the auction. That makes a total of $34,000 for the same used car already - and you can trace this process back each time the ownership of the same car changes hands.

To remedy this problem, national income accounting would only include the value added at each stage. The used car dealer adds $6,000 of value to the car that he bought at auction by repairing it, cleaning and restoring it, providing a warranty to the new buyer, providing a convenient forecourt for potential buyers to browse around, providing test-drives and so on. This is all new and 'adds value' to the economy, so it is valid to count the $6,000 in the national income, but no more. The same logic applies to all businesses when accounting for their contribution to the national income.

Inaccuracies

National income accounting is not an exact science, and whilst it does still perform a useful function we need to keep in mind that there are a number of factors that give rise to inaccuracies in the statistics:

- As with inflation indexes, there is a problem when accounting for improvements in quality of output. Counting increases in the amounts of output produced is simple enough, but it's much harder to quantify the precise value added by a modern smartphone compared to one that is a few years out of date.

- There are quite a few activities that are not recorded by the official economic output data even though they have economic value. The classic example is childcare that is provided by parents (not counted) compared to professional carers (counted). There are many other examples that are counted or not counted depending on whether you perform an economically valuable task yourself or you pay a professional to do it.

- Some activities are not counted because they occur in the informal sector i.e. a black-market. These are not just illegal business activities relating to drugs and so on, it also includes legal activities that are done in secret in order to earn 'cash in hand' and avoid taxation.

- Many government activities are not correctly valued because they operate outside the price mechanism (i.e. a competitive market doesn't value their output via supply and demand forces). Instead government output is usually valued at cost - but only a fool would imagine that governments produce value equal to cost. Government's suffer endless bureaucratic inefficiency/incompetency that ensures costs are sky-high for the output they produce.

- 'Externalities' are poorly measured by national income accounting practices. If an industrial business pollutes the environment during its production process, and it is not possible to clean up the mess, the output of the firm will be incorrectly valued. That is unless the government can accurately measure the cost of the pollution and then levy a tax on the business to fully mitigate the pollution cost without under-taxing or over-taxing.

There are many more examples of inaccuracies in the national income accounting statistics, but I've listed the main types. The point is not to dismiss the figures, they still give a decent benchmark of national income that can be used to compare against different countries, or against different time-periods to see how an economy has performed.

Data Sources:

Related Pages:

- The Solow Growth Model

- Endogenous Growth Theory

- Balance of Payments Accounting

- Floating vs Fixed Exchange Rates

- The Economics of Decline

- The Circular Flow Model

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.