- Home

- Aggregate Demand

- Crowding Out

The Crowding Out Effect Explained (Graphs & Example)

The notion of a crowding out effect in economics has been around for well over a hundred years, and was originally used as an argument against the use of excessive government borrowing.

The idea is that the finite amount of funds available for borrowing would mean that any excessive government borrowing would necessarily reduce private sector borrowing for investment by swallowing up too much of the loanable-funds pot.

This is, of course, only directly related to that part of private sector investment that is funded from borrowing, since retained profits can also be used for investment purposes without the need to borrow any of those loanable-funds.

With that said, you could also develop an argument to show that even retained profits might be diverted if excessive government borrowing causes interest rates to rise - because financial asset purchases would become a relatively more attractive alternative to investing in business ventures, and clearly that would partially subdue business investment.

Fiscal Expansion and Interest Rates Graph

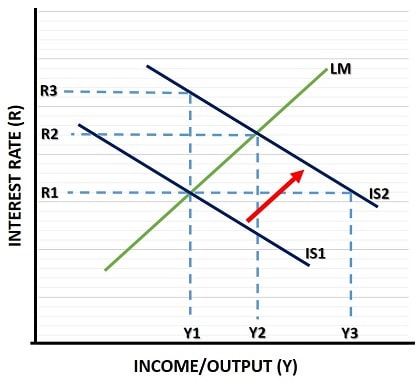

Using the IS-LM model graph (click the link for details on how the model works) we can illustrate how an expansive discretionary fiscal policy might lead to higher interest rates.

The idea here is that, in times of economic slowdowns/recession, the government will act to increase income/output in the economy in order to boost jobs and reduce unemployment.

If this is done via an increase in government spending to stimulate the economy, the effect will be to shift the IS curve to the right as illustrated in the graph.

Now, this will indeed increase income/output, and at a higher income level most people are likely to want to hold more cash in order to increase their purchasing power. For any given money supply, the extra demand should increase the price of holding money i.e. the interest rate will rise.

The extent to which income/output grows depends on the slope of the LM curve, which in turn depends on the responsiveness of money-demand to interest rates. Given the LM curve used in the graph, income rises from Y1 to Y2, and the Interest rate rises moderately from R1 to R2.

Consider, however, what would have happened if the LM curve had been horizontal. In this case income/output would have grown all the way to Y3, and interest rates would have been completely unaffected. Alternatively, with a vertical LM curve the government would completely fail to raise income/output at all, but the interest rate would be pushed up all the way to R3.

The particularly extreme examples of vertical and horizontal LM curves will be the focus of another article, where I look into the sorts of economic situations in which this might happen. For details see:

The general case illustrates that crowding out occurs when expansionary fiscal policy leads to higher interest rates. In these circumstances, as people demand higher cash balances as their incomes rise, the relative scarcity of available money pushes up interest rates making some business investment projects become less viable. This is because the projected profits of some of those investments will no longer be enough to cover the extra cost of borrowing.

The crowding out is not restricted to business investment. Higher interest rates will also dampen consumer spending. Furthermore, since higher interest rates will push exchange rates higher, exports will also be depressed whilst imports will increase, both of which lead to a deteriorating balance of trade.

In short, the government's fiscal expansion has crowded out many types of spending, especially the most interest sensitive types, which we assume is mostly business investment.

Crowding Out & Price Level Increase Example

The above analysis adopted the usual Keynesian assumptions of the short-run economy i.e. that it is operating on the horizontal section of the aggregate supply curve meaning that income/output can expand without causing the price level to rise.

We now need to think about how the analysis changes with the more realistic assumption that there will actually be some upward pressure on prices following an expansionary fiscal policy.

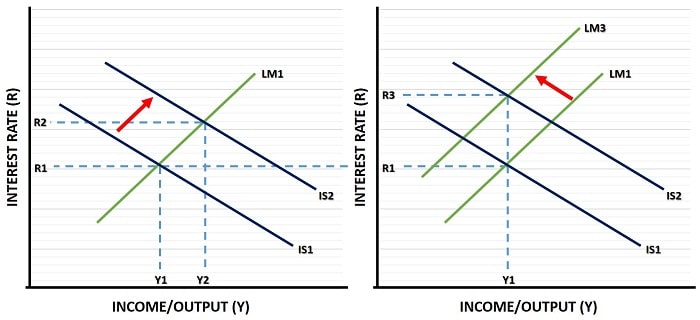

In the diagram below, when the government's expansionary fiscal policy shifts the IS curve to the right, income/output increases to Y2 just as before. This time, however, the extra demand for money not only causes a higher interest rate, the resulting extra spending also causes prices to start rising.

Rising prices as a result of expansionary fiscal policy, or any expansionary demand management policy, are likely to occur in most real-world economic situations due to capacity constraints. Even in times of recession this can happen because demand in the economy does not fall uniformly across all industries in a recession, and cannot be uniformly boosted via expansionary policies.

Consider a recession caused by a technological advancement in a competitor country that antiquates a domestic industry. Let's take fiber-optics as an example of a technological advancement in the competitor country, and copper wire production as the antiquated industry in the domestic country. A fiscal expansion to counteract job losses in the wake of a recession will not return the copper wire industry to profitability, it will simply cause disproportionate extra spending in other industries, some of which will respond by raising their prices.

Now, since the LM curve is drawn for a fixed real money-supply (meaning a fixed nominal money-supply and fixed price level for constant purchasing power), rising prices will reduce purchasing power with the effect that the LM curve will shift to the left - causing an even higher increase in the interest rate. This process is illustrated on the left side of the diagram where income/output simply returns back to its original level leaving the fiscal expansion pointless in the long run.

I should point out that the LM curve will only fully neutralize the fiscal expansion if the economy was initially already producing at the long run natural rate of unemployment, but even if it were performing somewhat below that level there would still be some price level increase and therefore some leftward movement of the LM curve. Only if the Keynesian assumption that the economy is performing on the horizontal part of the aggregate supply curve will there be zero effect on the LM curve but, as explained above, it seems quite unlikely that all industries would fit in with that assumption.

The only remaining question relates to what should count as 'crowding out'. Should it only relate to the spending that was crowded out via higher interest rates, or should it also include that which was reduced by a higher price level? Different economists may differ in their opinions here, but the effect on income/output seems clear enough - in the vast majority of real world situations, expansionary fiscal policies will lead to a lower level of private sector spending, particularly investment levels.

The overall impact of crowding out and price level increases is this: A higher proportion of the economy will move away from private sector production in favor of government run projects, and the government does not have a good track record when it comes to efficiency or value for money! The only significant exceptions here occur with economies that have large amounts of spare capacity i.e., those experiencing severe recession or those belonging to the developing world. In these cases, the 'Crowding In Effect' may dominate.

Sources:

Related Pages:

- Crowding In

- Loanable Funds Theory

- The IS Curve

- The IS-LM Model

- Liquidity Trap & Classical Case

- The AD-AS Model

- Discretionary Fiscal Policy

- Cyclical Unemployment

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.