What is Imported

Inflation?

The term ‘imported inflation’ refers to a situation where a country is experiencing higher costs for the goods and services that it buys from other countries. For large economies like the United States this has relatively little effect, but smaller economies tend to trade much larger proportions of their GDP, making imported inflation much more serious.

Domestic price inflation i.e., the steady rise in the general price level of all goods and services, imported or not, is influenced by many factors. Not all of those factors relate to circumstances within the domestic economy, there are many outside forces that also play a significant role.

In this article I will explain the concept of imported inflation. In particular, I will focus on how a strong US dollar works to export inflation from the US to other countries around the world.

Causes of Imported Inflation

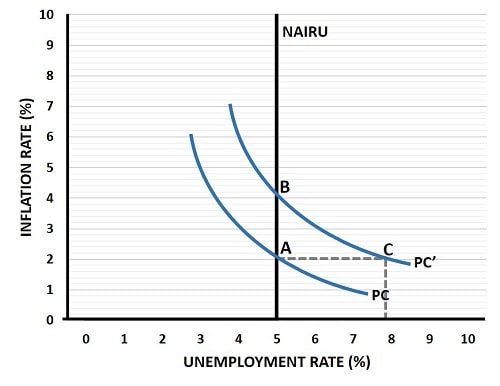

In the graph below, an economy starting at point A has a stable 5% unemployment rate, and a stable 2% inflation rate. Unfortunately, it experiences imported inflation via a fall in the value of the domestic currency relative to other currencies. As a result, imported goods and raw materials become more expensive, which in turn causes an increase in inflationary expectations going forward.

This is represented in the graph via a shift in the Phillips curve from PC to PC', and the economy moves to point B with a higher inflation rate at around 4%. For a deeper explanation of this process, see my article about:

At point B the government and central bank have a difficult problem to solve; if they do nothing then they will face a permanently higher inflation rate. Alternatively, if they act to reduce inflation, then they will likely cause a recession and rising unemployment. This is depicted by the move from point B to point C in the graph.

Recession, and rising unemployment (to around 8% in the graph) may be the only way to get inflationary pressures under control and bring inflationary expectations back down to their original level. This would allow the economy to recover and move back to point A but, in the meantime, a great deal of economic hardship is suffered.

Several factors cause imported inflation:

- Exchange Rates: The most significant driver of imported inflation is fluctuations in exchange rates. When a country's currency depreciates against other currencies, the cost of importing goods denominated in foreign currencies rises. For instance, if the domestic currency depreciates by 10% against the US dollar, the cost of importing goods priced in dollars will tend to increase by a similar percentage.

- Commodity Prices: Many countries, particularly smaller countries, are highly dependent on imported commodities like oil, metals, and agricultural products. When commodity prices rise globally, it directly impacts the cost of imports and can lead to higher inflation in the importing country.

- Trade Policies and Global Supply-Chains: Changes in trade policies, such as tariffs and quotas, can influence the cost of imported goods. Global supply-chain problems e.g., such as occurred after the Covid-19 pandemic lockdowns, can cause large fluctuations in prices for traded goods. Thankfully, these sorts of disruptions are relatively uncommon.

- Transportation Costs: Fluctuations in transportation costs, influenced by factors like fuel prices and logistical challenges, can affect the final cost of imported goods.

How do you Fix Imported Inflation?

Central banks play a crucial role in managing imported inflation and maintaining price stability in an economy. Most importantly, they use interest rates i.e., monetary policy, to manage liquidity in the financial system. By adjusting interest rates, central banks can influence borrowing costs, consumer spending, and investment levels, thereby impacting inflationary pressures.

In the context of imported inflation, they also consider the impact of currency exchange rate fluctuations on overall inflation. If the domestic currency depreciates significantly, leading to higher imported inflation, central banks may need to adopt a tighter monetary policy stance to curb inflationary pressures. This can involve raising interest rates or reducing liquidity in the financial system.

Conversely, if the domestic currency appreciates, reducing inflationary pressures, central banks may adopt a more accommodative monetary policy stance to support economic growth. This can involve lowering interest rates or injecting liquidity into the financial system to stimulate borrowing and spending.

How a strong

US Dollar exports inflation to other countries

As the global reserve currency, the US Dollar plays a pivotal role in international trade and finance. When the US Dollar strengthens against other currencies, it can have far-reaching effects on the world economy, one of which is the way in which it exports inflation to other countries. The main reason for this is because of exchange rate movements.

With most internationally traded products and commodities priced in terms of US dollars, a stronger dollar means that consumers outside the US will have to pay higher prices in terms of their domestic currencies. In other words, the exchange rate of their currencies will fall against the dollar, thereby contributing to international inflationary pressures.

There are two additional forces that influence this sort of inflation exporting, and they both relate to the flow of international investment funds. However, these two are competing forces meaning that, depending on which force dominates, the balance on exported inflation may be positive or negative:

- Demand for Safe-Haven Assets – During times of global economic uncertainty, the US Dollar often becomes a safe-haven currency for investors seeking stability. This increases the demand for dollars, which then increases its exchange rate and strengthens the exchange rate effects.

- Capital Flows and Investment – A strong US Dollar makes foreign assets cheaper for US investors. This can offset the demand for safe-haven assets and perhaps overwhelm it. This will mitigate the effects of a strong dollar and reduce the way it exports inflation.

The dominant overall effect is the exchange rate effect, and at times when international investors are less optimistic about the global economic environment, it is likely that the demand for safe-haven Us assets will dominate the appetite of US investors to buy the cut-price assets available in other countries. In these circumstances the effect of US exported inflation will be particularly significant.

Challenges

for Other Countries

When a strong US Dollar exports inflation to other countries, it presents several challenges:

- Price Instability - Imported inflation can create price instability in the importing countries, making it harder for businesses and consumers to plan and budget effectively.

- Central Bank Dilemma - Central banks in countries facing imported inflation have to strike a delicate balance between addressing inflationary pressures and safeguarding against recession.

- Lost Competitiveness - Higher import costs for raw materials and commodities can impact the competitiveness of domestic industries, particularly manufacturing. This can lead to potential trade imbalances.

Imported Inflation Example:

Brazil

The depreciation of the Brazilian real from 2010 to 2016 against major currencies, such as the US dollar, led to higher prices for imported goods. Additionally, supply disruptions, such as droughts affecting agricultural production, have further contributed to imported inflation since more expensive food imports had to replace domestic food products.

To manage the problem, the Central Bank of Brazil implemented various monetary policies. In particular, interest rates were increased to curb inflationary pressures and stabilize the currency. Additionally, the government implemented measures to promote local production and reduce reliance on imports, such as tax incentives for domestic industries.

Inflation, which had peaked at around 11% in 2016, had been reduced to around 2.5% by 2018. However, unemployment rose from a low of around 6.8% in 2014, to a high of almost 13% in 2017.

Final

Thoughts

Imported inflation is a critical factor influencing the economies of countries highly dependent on international trade. A strong US Dollar can export inflation to other nations through exchange rate movements, commodity pricing, and shifts in capital flows.

As global economies become increasingly interconnected, government and central bank policymakers need to account for the impact of exchange rate fluctuations, commodity prices, trade policies, global supply-chains, and transportation costs on domestic price levels.

Of particular importance is the exchange rate of the global reserve currency, the US dollar, because US exported inflation can be significant, and particularly so in smaller countries when investors are fearful of recession. Imported inflation adds to domestic price inflation, and controlling it can be very difficult because the necessary measures can cause recession.

Sources:

Related Pages:

- Effects of Inflation

- Demand-Pull Inflation

- Cost-Push Inflation

- Structural Inflation

- What Causes Inflation

- How to stop Inflation

- What is Inflation

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.