- Home

- Monetary Policy

- Monetary Transmission Mechanism

The Monetary Transmission Mechanism (with Graphs)

The monetary transmission mechanism refers to a process of complex, and sometime subtle, changes in the economy that come about as a result of manipulating the money-supply as part of a short-term stabilization policy i.e. a policy to smooth out the boom-bust business cycle.

Right away it is important to know that this sort of short-term macroeconomic management fits in with the Keynesian school of thought, but Monetarist economists also favor this sort of economic management - they just have a slightly different target to Keynesians in that they emphasize monetary policy to control inflation rather than income/output (and, by association, unemployment).

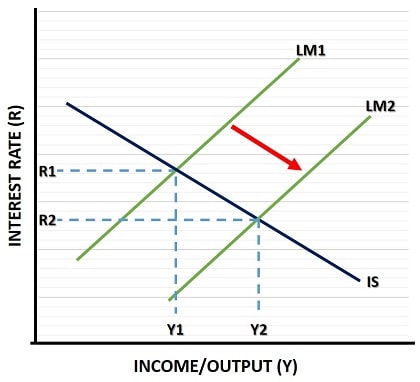

For illustration purposes, the IS-LM Model is once again useful for highlighting the main headline variables that are affected by monetary policy.

To gain a better understanding of this model, I highly recommend clicking the link above, because it really gets to the heart of short-term demand-management techniques.

Just for recap purposes, each LM curve represents a fixed real money-supply, and therefore a fixed level of purchasing power.

If the government increases the nominal money-supply, a rightward shift of the LM curve occurs, and income/output will increase whilst the interest rate will fall.

For simplicity we keep the price level fixed (i.e. we assume that the economy is operating on the horizontal section of the aggregate supply curve).

On this page, I'll explain in greater depth the whole range of changes in both the financial asset market and the goods market following a money-supply boost. I do this to help better understand the process, i.e. the monetary transmission mechanism, that induces changes in interest rates and income/output.

The Keynesian Monetary Transmission Mechanism in Four Stages

The basic Keynesian transmission mechanism of monetary policy is a very straightforward four step process, as summarized in the picture below. The first step involves the central bank increasing the nominal money supply, and whilst this step also needs some explanation, it is not the focus of this page, and will be discussed separately on my page about:

- Open Market Operations

Step 4 in the monetary transmission mechanism is simply the results stage of process and since we are holding prices constant there's nothing too controversial about the end results. That leaves us with steps 2 and 3, and it is these steps that are of particular interest.

The Four Stages of the Monetary Transmission Mechanism

The Four Stages of the Monetary Transmission MechanismTerm Structure of Interest Rates

By increasing the monetary base i.e., bank reserves, the central bank buys up short-term securities in the financial system, typically these are Treasury bills and some commercial bills. To do this, the holders of those securities must be enticed to sell, and so the central bank offers a higher price than the current market clearing rate for those securities.

I did say that we are holding prices constant, but that is with regard to the general level of prices in the goods/services market i.e. inflation, but the financial assets market is treated independently of the goods/services market.

As the price of these short-term securities rises, the whole structure of securities of all terms to maturity are adjusted in order to re-balance the expected returns from these assets for their associated risk levels given the higher price of short term securities.

Since these assets have a fixed nominal return, any increase in their selling price translates as a reduction in the assets' implied interest rate, and so the whole term structure of interest rates is reduced by the central bank paying a higher price for short-term securities.

Again, just to reiterate, we are holding the general price level in the goods market constant - so the interest rate changes here are 'real interest rate' changes, not merely nominal changes.

Investment, Spending, and Foreign Trade

On related pages I have explained how lower interest rates will chiefly affect investment levels due to the fact that they make borrowing cheaper and thereby more investment projects viable, this is true but it is particularly true for smaller businesses. Large firms rely on retained profits, issues of corporate bonds, or floating new shares on the stock market in order to obtain funds for new investment, but these opportunities are not always available for small enterprises.

Small and medium sized enterprises (SMEs) usually account for about half of all employment in developed economies, so any detrimental effect on their investment choices is still significant. Additionally, long-term macroeconomic growth rates may be more dependent on SMEs than on larger firms, which usually operate in more mature industries.

Another component of aggregate demand that will increase with an interest rate reduction is consumption. This increase may be funded either via an increase in personal loans and credit card usage, or it may simply be that households have more purchasing power because some of their existing debt becomes cheaper e.g. falling mortgage costs.

Finally, a lower interest rate on domestic securities will lead to less demand for those securities in the international money-market. Since these markets control huge flows of money, any movement in demand will cause noticeable changes in the domestic country's exchange. For example, if the international money-market demands fewer domestic securities, it will by extension demand a smaller amount of domestic currency with which to buy those securities, and a falling demand for the currency will reduce its price relative to other currencies.

The resulting exchange rate depreciation will, over time, lead to imports becoming more expensive as foreign sellers start to demand a larger amount of domestic currency to compensate for its lower exchange value. Similarly, exported goods can be sold for a larger profit margin, so domestic exporters will benefit from the lower interest rate.

The combined effects of more expensive imports, and more competitive exports will lead to an improvement in the domestic country's balance of trade. For a more in-depth discussion of the effects of foreign trade on the IS-LM framework, have a look at my page about:

The monetary transmission mechanism, following a reduction in the interest rate, will lead to significant changes in different parts of the domestic economy that can be difficult to foresee. However, what is not difficult to foresee is that the economy as a whole will grow significantly from the interest rate reduction, and employment levels will increase because of it.

Later Developments and Summary

Research since the 1970s has been focused on building new and emerging economic theories into the monetary transmission mechanism in order to further refine it. With regard to a monetary contraction, rather than an expansion as described on this page, New-Keynesian economists have attempted to build wage rigidity into the model.

The rational expectations school has similarly attempted to merge its ideas into the model, whilst the Monetarist school have always had a somewhat different idea of the transmission mechanism of monetary policy.

In summary, whilst we can be confident of the end results of expansionary/contractionary monetary policy (at least with regard to the short-run), the exact micro-processes that take us to that end are somewhat unknown, and likely to differ significantly depending on circumstance.

The current focus of research into the monetary transmission mechanism is likely to be dominated by its functioning when interest rates are at or around zero, and in this regard it will link in with work relating to the liquidity trap.

The explanation given on this page is a reasonable approximation of the standard process, but you should be aware that monetary transmission mechanism is not fully understood, and neither, therefore, are the consequences of adopting its use - especially in the long run.

Sources:

Related Pages:

- The Money Multiplier

- Types of Money

- The IS-LM Model

- The Interest Rate & Money Supply Tradeoff

- Investment Spending

- The Liquidity Trap

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.