- Home

- Monetary Policy

- Real Balance Effect

The Real Balance Effect Explained (with Graphs)

The Real Balance Effect in economics has its origins in the work of Cecil Pigou in the 1930s and 40s. In essence that work was intended as a sort of add-on to Keynes' ideas in his 'General Theory', but it also challenged that theory in some important ways.

We should recall that Keynes's work came as a response to the Great Depression of the 1930s, and was a sort of critique of Classical economics insisting that, left to its own devices, a free-market economy would result in a deflationary recession with persistently high unemployment as a natural consequence of that recession.

The natural prelude to that period of deflationary depression is usually thought to be a period of zero (or near zero) interest rates whereby the Federal Reserve loses its ability to boost the economy via a monetary stimulus package. This is a situation known as the 'liquidity trap', and Pigou's Real Balance Effect presents a counter-argument to this situation by showing that even when interest rates are zero, monetary policy can still have an influence on the economy.

In this article I will explain this idea, sometimes called the 'Pigou Effect', in more detail. The basic idea is quite simple and doesn't need much prior understanding, but to fully appreciate the concept it is advisable to become acquainted with the theory surrounding it. As a minimum you will need to understand how the IS-LM Model works, so be sure to read up on that.

Throughout the article I'll also link to some of the other key economic concepts that relate to the Real Balance Effect, because it does form a fundamental dividing line between some of the main schools of economic thought.

The Pigou Effect vs The Keynes Effect

As you will have noticed from my opening paragraphs, there is some controversy about the workings of Keynes' general theory in certain situations. As is often the case, much of the disagreement is less about direct refutation and more about timeframe. Keynesians are primarily focused on the short-term while their main opponents (the classical economists) look more at the long-term.

The question often boils down to how long the long-term is and whether or not it is long enough to justify some sort of government intervention rather than just leaving the free market to fix itself.

With its focus on the short-term, the Keynes effect describes how (holding all other factors constant) a falling price level will increase the purchasing power of any given money supply, and (as explained in my article about the LM Curve) this causes real balances to shift rightwards along the money demand curve, intercepting it at a new, lower interest rate. The effect of this is to create a rightward shift of the LM curve which, in normal times, will intercept a downward sloping IS Curve at a higher national income.

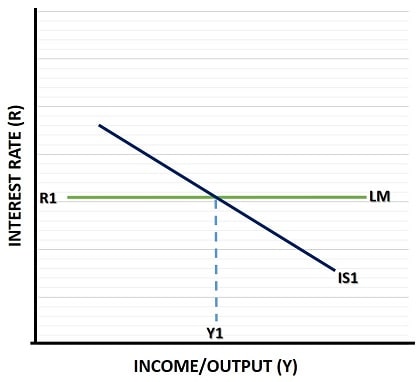

However, this gives rise to two theoretical possibilities where national income is not affected. The first occurs when the IS curve is vertical, the second occurs when the LM curve is horizontal.

I have already explained the case of a horizontal LM curve on my page about the liquidity trap, so see that article for details. Here I will explain the vertical IS curve problem.

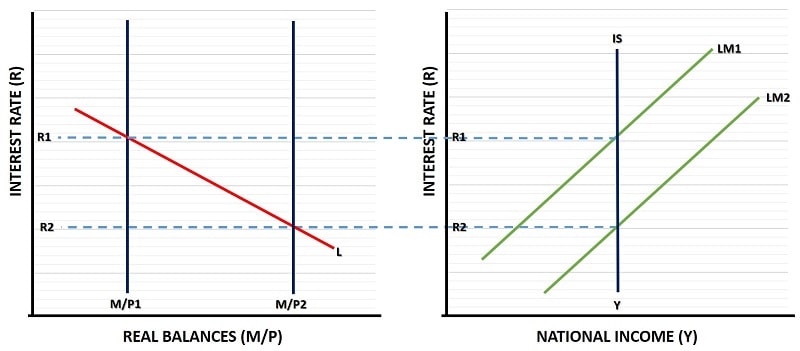

In the graph below we start with the left side where a falling price level from P1 to P2 increases the purchasing power of a given money supply. The extra purchasing power is illustrated as a rightward shift of the real balance line (M/P). This new line intercepts the downward sloping money demand line (L) at a lower interest rate (from R1 down to R2).

On the right side of the graph we show that the LM curve (which plots equilibrium in the money markets) shifts to the right as a result of the extra purchasing power of the money supply. In normal times the LM curve would intercept a downward sloping IS curve with an interest rate in between R1 and R2, and with an increased national income. This is the 'Keynes effect', but with a vertical IS curve national income remains unaffected and the Keynes effect does not work.

This means that a downturn in the economy i.e., a fall in national income, which causes prices to fall (i.e. deflation) will not self-correct, and monetary policy is ineffective. Keynes favored government intervention in the form of fiscal stimulus in such circumstances.

Real Balance Effect Graph

The Pigou Effect

The real balance effect, also called the Pigou effect (a term first coined by the economist Don Patinkin in 1948), contradicts the Keynes effect by arguing that the analysis above is not complete, and that there is another step to add in that the IS curve itself will eventually push rightwards as a result of the falling price level. This will occur in the case of a liquidity trap or a vertical IS curve.

In other words, even if a lower interest rate fails to boost investment spending via the Keynes effect, the goods market itself should gradually see some extra spending due to the lower prices. If this happens then national income will gradually recover any loss and the interest rate will gradually climb until its initial rate is restored.

The important question relates to how long this extra step will take, and if it will happen at all.

Keynesians argue that some prices in the economy, particularly wages, are sticky and reluctant to move downwards. This would mean that falling profit margins would not easily be offset by falling labor costs and thus it would take a long time for economic output to recover. Additionally, many economists believe that falling prices make consumers reluctant to spend more even though the purchasing power of their money increases as prices fall i.e. the 'wealth effect'. They argue that falling prices makes consumers hold off on spending today in anticipation of even lower prices at a later date.

There may be something to this argument, the reverse situation where a booming property market induces consumers to buy a house before it becomes too expensive certainly seems to hold true, but it is difficult to explain how anyone would ever purchase a smartphone, a computer, or any other high-tech device since these items are known to rapidly reduce in price over time. In reality, consumers readily purchase these devices.

Perhaps it is the case that falling/rising prices only influence consumer behavior if it is thought to be a temporary phenomena, and that once price stability is restored normal spending patterns will resume. It's impossible to say with certainty, the truth is that market sentiment at any given time, and in any given situation, is extremely difficult to predict at the macro level - especially in the short run.

Ultimately there will be a long run adjustment in the goods market that returns national income to its original level, but whether or not this happens within an acceptable timeframe remains unresolved. As Keynes himself famously quipped "In the long run we are all dead". Classical economists argue that the costs of intervention, with all its unintended consequences, are significant and that with 'rational expectations' we might expect economic agents to quickly react to the real balance effect.

The debate rages on.

Wealth, Aggregate Demand & Supply

The center of gravity with respect to the current application of these debates relates more to the liquidity trap problem than the vertical IS curve. In the aftermath of the 2008 financial meltdown interest rates have indeed been at or around zero in many western countries, and until 2021 the rate of inflation had been very low. Monetary policy was increasingly ineffective as a means of stimulating aggregate demand even after a decade of historically slow growth.

Then, at the outset of the Covid-19 global pandemic, our political elites chose to lockdown our economies whilst sending out massive fiscal stimulus packages to prop up demand - all at the same time that production in the economy i.e., supply, was mothballed. Global supply chains broke down, and inflation rates surged.

The introduction of Federal Reserve interest rate hikes, aimed at controlling inflation, come at the cost of demand destruction via falling asset prices i.e., falling stock markets. The resulting loss of wealth is impacting on spending levels via the wealth effect.

Of course, one man's lost wealth is another man's reduced debt, and Ricardian equivalence would have us believe that the overall effect on the macro economy is negligible, but it is scant consolation to the savers who have been punished for their responsible thriftiness to know that their profligate counterparts have benefited from having the real cost of their debts eroded by inflation.

None of this is to argue that it would have been better for the Fed to have done nothing, and simply allow the real balance effect to sort things out in the long run. Rather, it is a reflection of decades of irresponsible economic management on the part of successive governments that got into this mess in the first place.

Sources:

Related Pages:

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.