- Home

- Production Possibilities Curve

- Price Elasticity of Supply

Price Elasticity of Supply (PES) Graphs & Examples

Price elasticity of supply measures how the quantity of a good supplied by producers changes in response to a change in the good's price. When we talk about supply elasticity, we are essentially asking - If the price of a product increases, by how much will the quantity supplied increase? Conversely, if the price decreases, how much will the quantity supplied decrease?

If the quantity supplied changes significantly in response to a price change, the supply is considered elastic. Conversely, if the quantity supplied changes very little, the supply is deemed inelastic. This measure helps us predict how changes in market conditions can influence production levels and availability of products.

Understanding the price elasticity of supply is not only important for economists but also for businesses and policymakers. For businesses, knowing how responsive their supply is to price changes can inform production decisions, pricing strategies, and inventory management. For policymakers, understanding supply elasticity can help in designing effective regulations and policies that can stabilize markets and avoid issues like shortages or surpluses.

Defining Price

Elasticity of Supply

The terms ‘elasticity of supply’ and ‘price elasticity of supply’ are often used interchangeably in economics, but there is a distinction. Elasticity of supply is a general term that refers to how much the quantity supplied of a good responds to changes in any factor, not just price. Supply is responsive to many determinants, the most important of which are:

- Price (most common)

- Wages (in labor supply)

- Costs of production inputs

- Technology changes, etc.

Price elasticity of supply (PES) is therefore a specific concept that measures how much the quantity supplied changes in response to a change in price alone, holding all else constant. This is usually what's meant in basic supply and demand analysis unless otherwise stated.

In practice, in introductory economics textbooks, ‘elasticity of supply’ usually refers to price elasticity, and these terms are treated as synonyms. In technical or advanced economic contexts, it's better to use ‘price elasticity of supply’ to be precise.

Factors

Affecting Price Elasticity of Supply

One of the primary factors affecting price elasticity of demand is the availability of production inputs. Note here that I am not referring to the costs of these inputs, but their availability at a given cost. If the inputs required to produce a good are readily available and can be easily accessed, the supply is likely to be more elastic. For example, if a manufacturer can quickly source raw materials and labor at a given cost, they can ramp up production of a good in response to a price increase for that good.

Another significant factor is the time period under consideration. Supply elasticity tends to be more elastic in the long run than in the short run. In the short run, producers may face constraints such as limited production capacity or fixed contracts that prevent them from adjusting their output quickly. Over time, however, they can expand their production facilities, and adapt their supply chains, making the supply more responsive to price changes.

Another major determinant of price elasticity is market structure.

Market

Structure

Different market structures influence the price elasticity of supply by affecting how easily and quickly producers can respond to price changes:

- Perfect Competition – Comprises many small firms with easy entry and exit to and from an industry. Firms here are price takers meaning that they can sell as much as they want at the market price. In the long run, resources can move freely between industries, making supply more responsive to price.

- Monopolistic Competition – Again comprises many firms, but products are differentiated. Firms have some price-setting power, but they face significant competition from alternative products. Entry and exit is relatively easy, so supply can easily adjust in the long run.

- Oligopoly – Comprises a few large firms that dominate the market, and strategic behavior between these firms (e.g., price wars, collusion) can lead to rigid supply responses. High barriers to entry (e.g., capital, brand, regulation) limit new supply making supply relatively price inelastic.

- Monopoly – The monopolist maximizes profit based on marginal cost and demand, not just by reacting to price. In a monopoly, there is significant market power to maintain a high price and resist price decreases. This is achieved by restricting supply, so supply may be volatile, but price elasticity of supply is low (inelastic) since price itself is stable.

Types of Price

Elasticity of Supply

Elasticity of supply can be categorized into different types based on the degree of responsiveness to price changes. These are:

- Perfectly elastic supply (PES = ∞)

- Perfectly inelastic supply (PES = 0)

- Unitary elastic supply (PES = 1)

- Elastic supply (PES > 1)

- Inelastic supply (PES < 1)

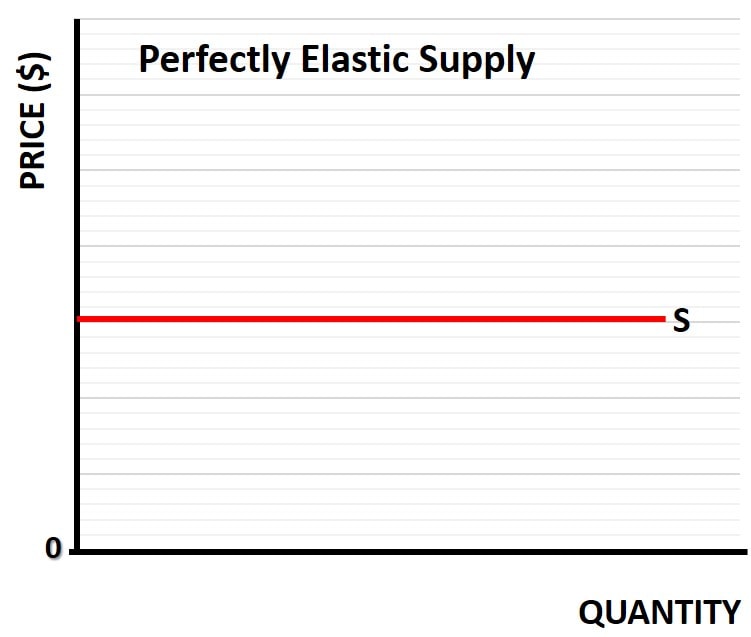

Perfectly elastic supply occurs when a small change in price leads to an infinite change in quantity supplied. In this scenario, producers are willing to supply any amount of the good at a specific price but nothing at a slightly lower price. This type of supply is theoretical and rarely observed in real-world markets.

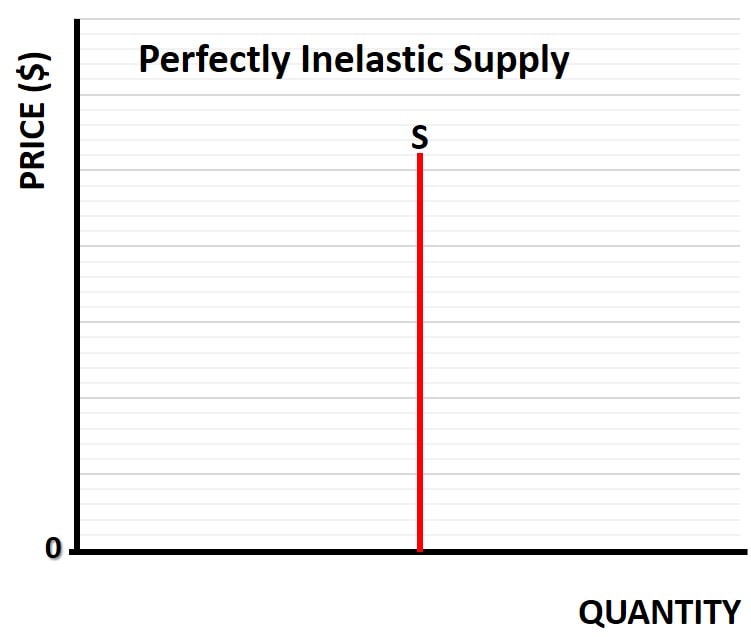

On the other end of the spectrum, perfectly inelastic supply indicates that the quantity supplied remains constant regardless of price changes. This situation arises when production capacity is fixed, and no additional output can be generated.

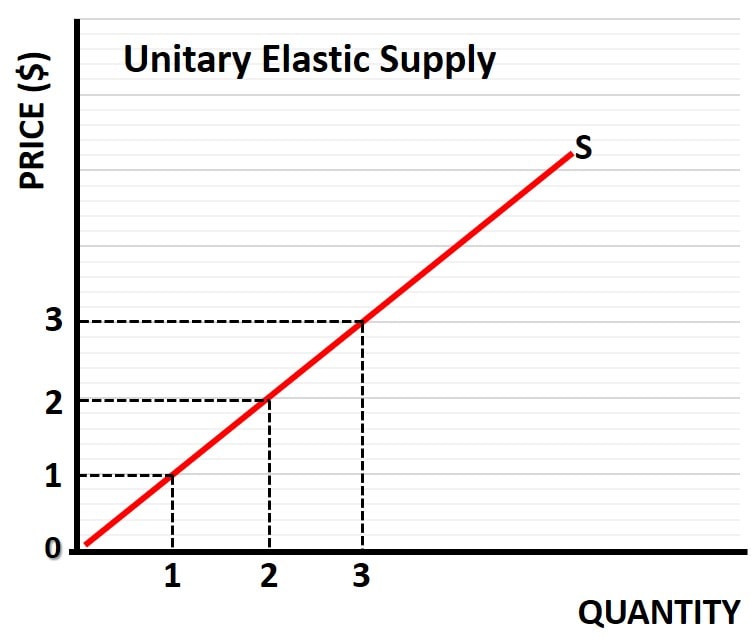

Unitary elastic supply refers to a proportional change in quantity supplied in response to a price change. Here, the percentage change in quantity supplied equals the percentage change in price, resulting in an elasticity coefficient of one.

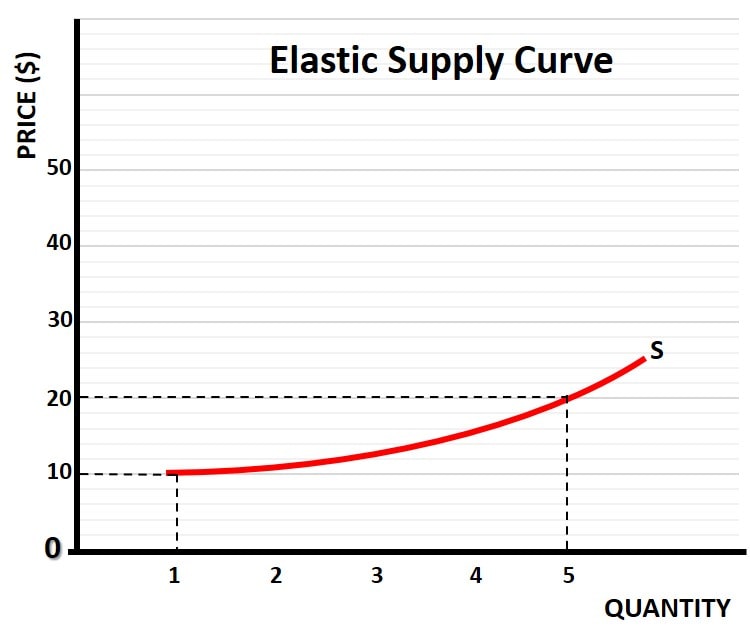

Elastic supply occurs when the percentage change in quantity supplied is greater than the percentage change in price, indicating high responsiveness.

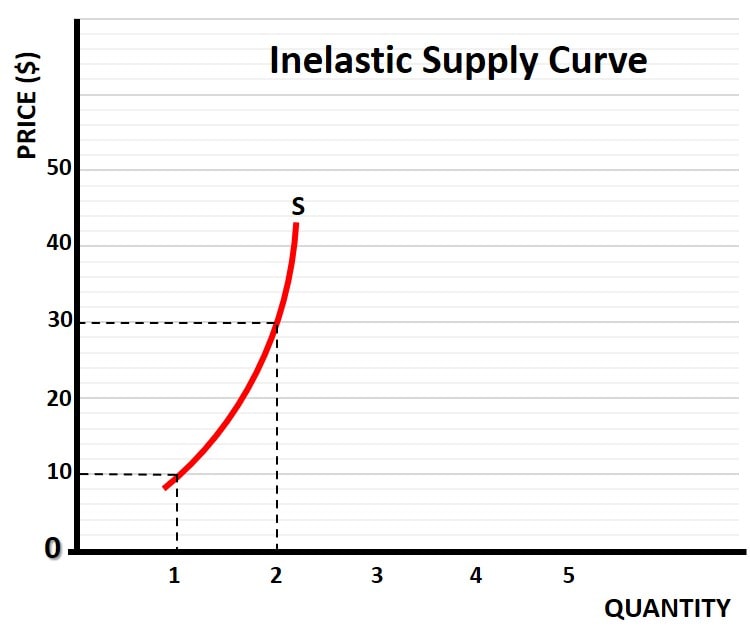

Conversely, inelastic supply signifies that the quantity supplied changes by a smaller percentage than the price change, suggesting low responsiveness. Understanding these types helps in analyzing different market scenarios and predicting supply behavior accurately.

Price

Elasticity of Supply Formula and Calculations

To measure the elasticity of supply, economists use a specific formula that involves calculating the percentage change in quantity supplied and the percentage change in price. The triangle Δ below is mathematical notation for a ‘change in’, so the elasticity of supply (PES) is expressed as:

PES = %ΔS / %ΔP

To calculate the percentage change in quantity supplied, we use the formula:

(New Quantity – Old Quantity) / Old Quantity

Similarly, the percentage change in price is calculated as:

(New Price – Old Price) / Old Price

By plugging these percentage changes into the PES formula, we can determine the price elasticity of supply. For example, if the price of a product increases from $10 to $12, and the quantity supplied increases from 100 units to 150 units, the percentage change in quantity supplied is 50%, and the percentage change in price is 20%. Thus PES would be 50/20 = 2.5, indicating a price elastic supply since 2.5 is greater than 1.

This calculation is crucial for businesses and economists as it provides a quantitative measure of how supply responds to price changes. Businesses can use this calculation to make informed decisions regarding production levels, pricing strategies, and market entry. It also helps in forecasting market behavior and planning for future demand and supply scenarios.

Challenges

in Calculating Price Elasticity of Supply

Assessing the elasticity of supply poses several challenges due to the complexity of market dynamics and external factors. One of the primary challenges is the availability and accuracy of data. Reliable data on production costs, input availability, and market conditions are essential for calculating supply elasticity accurately. However, obtaining such data can be difficult, especially in industries with limited transparency or rapidly changing market conditions.

Another challenge is the influence of external factors, such as government policies and regulations. Policies such as subsidies, tariffs, and trade restrictions can significantly impact the responsiveness of supply to price changes. For example, government subsidies for renewable energy projects can increase the supply elasticity of solar panels by making production more economically viable. Conversely, trade restrictions on raw materials can reduce supply elasticity by limiting access to essential inputs.

Additionally, supply elasticity can vary over time and across different market segments, making it challenging to assess consistently. Factors such as technological advancements, changes in consumer preferences, and shifts in global supply chains can all influence supply elasticity.

Real-World

Examples of PES

Real-world examples of price elasticity of supply can be observed across various industries and products. One notable example is the agricultural sector. Agricultural products often exhibit inelastic supply due to the time required for cultivation and harvesting. For instance, if the price of wheat increases, farmers cannot immediately increase the quantity supplied because it takes time to grow and harvest the crop. As a result, the supply remains relatively fixed in the short term, leading to inelastic supply.

In contrast, electronic goods tend to have more elastic supply. Manufacturers in the electronics industry can quickly adjust their production levels in response to price changes. If the price of smartphones rises, producers can ramp up production by sourcing more components and utilizing existing manufacturing facilities. This responsiveness results in a more elastic supply, where the quantity supplied can increase significantly with price changes.

The oil industry provides another interesting example. In the short term, the supply of oil is relatively price inelastic due to the complexities involved in extraction and refining processes. However, over the long term, the supply can become more elastic as new oil fields are discovered, and production technologies improve.

Business

Decision-Making

Understanding the price elasticity of supply is crucial for businesses when making strategic decisions. One of the primary applications is in pricing strategies. If a business knows that the supply of its product is price elastic, it can implement competitive pricing to attract more customers without worrying about supply constraints. Conversely, if the supply is price inelastic, the business might opt for premium pricing to maximize revenue from the limited quantity available.

PES also plays a vital role in inventory management. For businesses with a high elasticity, maintaining a flexible inventory system is essential to quickly respond to changes in demand and price. This flexibility ensures that the business can meet customer needs without overstocking or facing shortages. In contrast, businesses with inelastic supply need to carefully plan their inventory to avoid excess stock that cannot be sold quickly, or shortages that could lead to lost sales.

FAQs about

Price Elasticity of Supply

How does the availability of substitute goods impact the

price elasticity of supply?

How does the availability of substitute goods impact the price elasticity of supply?

While substitutes primarily affect demand, they indirectly impact PES by influencing production flexibility. If producers can easily switch to making substitute goods when prices shift, supply tends to be more elastic. This is common in industries with adaptable production lines, like consumer electronics or textiles.

Can government intervention artificially alter the

elasticity of supply in a market?

Can government intervention artificially alter the elasticity of supply in a market?

Yes, through subsidies, tariffs, or price controls, governments can either enhance or restrict supply responsiveness. For example, subsidies may make it easier for firms to ramp up production, increasing elasticity, while price ceilings may discourage additional supply, reducing elasticity.

How does automation and AI affect the long-run price

elasticity of supply?

How does automation and AI affect the long-run price elasticity of supply?

Automation and AI increase long-run elasticity by enabling faster and more scalable production adjustments. With predictive algorithms and smart manufacturing, businesses can anticipate price changes and align output more efficiently, making supply more responsive over time.

What role does supply chain resilience play in influencing

PES during global disruptions?

What role does supply chain resilience play in influencing PES during global disruptions?

Supply chains that are diversified and resilient enable faster responses to price signals, thus increasing PES. During disruptions like pandemics or geopolitical conflicts, rigid supply chains lower elasticity, while flexible logistics networks preserve or enhance it.

Does the elasticity of supply affect inflationary pressures

in the economy?

Does the elasticity of supply affect inflationary pressures in the economy?

Yes, when supply is inelastic, price increases due to demand surges aren’t met with increased output, intensifying inflation. More elastic supply can absorb demand shocks and help stabilize prices, acting as a buffer against inflation.

Conclusion

In conclusion, price elasticity of supply is a critical concept that provides valuable insights into how producers respond to price changes in the marketplace. By understanding the factors that influence supply elasticity, businesses and policymakers can make informed decisions that optimize production, pricing, and inventory management.

Looking to the future, advancements in technology and changes in global supply chains will continue to shape the price elasticity of supply across different sectors. As businesses adopt new production techniques and leverage data analytics, they will be better equipped to respond to market fluctuations and meet consumer demand effectively.

Related Pages:

- Price Elasticity of Demand

- The Supply Curve

- Income Elasticity of Demand

- Cross Price Elasticity

- Say's Law

- Producer Surplus

- Costs of Production

- Production Possibilities Curve

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.