- Home

- Business Cycle

- Sacrifice Ratio

The Sacrifice Ratio, Explained (with Formula Graph & Example)

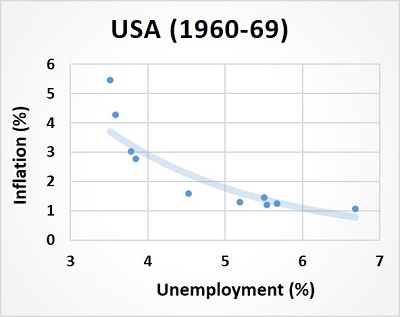

The sacrifice ratio in economics was first developed in the 1950s in association with the Phillips curve, a curve that depicted a negative relationship between inflation and unemployment. Originally this relationship was thought to be permanent, but that was proven wrong during the 1970s and the events thereafter, and has since been modified to fit a short-term perspective.

Essentially, the sacrifice ratio measures an amount of economic production that must be cut (thereby increasing unemployment) in order to reduce the inflation rate by a given amount (usually one percentage point).

For more background information on the development of these concepts, and subsequent adaptation of the Phillips Curve, have a look at these two articles:

Since the Sacrifice Ratio still has relevance today, both in its relationship to short term output cuts and in its influence on future inflationary expectations, it remains a useful tool for economic policy formulation.

How to work out the sacrifice ratio

While in theory it is a relatively simple concept to understand, it is almost impossible to calculate the sacrifice ratio with absolute precision. The problem is that we are trying to measure moving targets, and we only have estimates of those targets in the first place.

In order to calculate the sacrifice ratio we would need to know precisely what the current level of economic output is, what it would be with a constant rate of inflation, and also what it would be with the inflation rate reduced by 1 percentage point. Of course, we only have estimates of inflation and output to work with, and economic forecasts are notoriously inaccurate.

Nevertheless, despite these difficulties economists do use a branch of statistics called econometrics to try and work these numbers out.

Okun's Law estimates the relationship between output and unemployment, and the short-run Phillips curve estimates the relationship between inflation and unemployment. Using these measures we can derive some idea of the sacrifice ratio formula.

Sacrifice Ratio Formula

Using the short-run Phillips curve with inflation expectations held constant, we can estimate how much the unemployment rate will rise when the inflation rate falls by one percentage point.

Next, Using Okun's law, we can estimate how much output will fall given a one percentage point increase in unemployment.

We then simply multiply those two ratios together:

Sacrifice Ratio = Phillips ratio x Okun's ratio

Naturally, this gives only a very rough idea of what the sacrifice ratio is.

Sacrifice Ratio Example

Econometric research by Ball in 1993 (see link below) estimates historic sacrifice ratios in the United States to have been about 2.4, meaning that a policy to reduce the trend inflation rate by 1 percentage point would have caused a fall in output (GDP) of about 2.4 percentage points in that period. For other western countries Ball estimated that the ratios were significantly lower, indicating that there are different tradeoffs depending on local circumstances at a given point in time.

Okun's law, using data from the 1960s, estimates that a 1 percentage point fall in unemployment is associated with a 2 percentage point fall in output.

Using OECD data from the 1960s, the Phillips curve at that time shows that the tradeoff between inflation and unemployment in the United States was bowed. This meant that, when inflation was high, reductions in its rate could be achieved with relatively less impact on unemployment compared to when inflation was low. The average tradeoff over the period appears to have been roughly 1:1.

Combining the Phillips curve tradeoff of the 1960s with Okun's law would, via the formula above, give a sacrifice ratio of about 2.0 for the 1960s, which is reasonably consistent with Ball's research.

That lost GDP may come in terms of lost growth, or an actual fall in nominal GDP.

However, the lost economic output cannot be distributed over too many years if the sacrifice ratio is to hold, because the ratio is built using a short-run Phillips curve. If too much time elapses, inflationary expectations will be affected and the ratio will break down. For more information about the influence of inflationary expectations, see my article about the NAIRU .

Sacrifice Ratios and Core Inflation

In times when inflation is high, it also tends to be more volatile. Sacrifice ratios will also appear to be volatile in these circumstances because the output will not be as volatile. In fact, even in more stable times it may be better to use core inflation as the variable for calculating sacrifice ratios because it is inherently less volatile. Measuring core inflation means excluding the influence of food and energy from the date, since those items are particularly volatile.

Policy Lessons for the Modern Economy

In 2022, with inflation rates soaring to levels not seen since the 1970s, most western countries are facing some very difficult choices in the years ahead. Reducing inflation is going to be necessary if a complete collapse of the fiat monetary system is to be avoided. However, production levels in the economy are already low in the wake of the Covid-19 global pandemic, even if official unemployment measures fail to record that fact. The labor force participation rate is a better indicator, and that shows that people are not engaging in work at the same rate as before the pandemic.

Add to that the enormous national debt, and ongoing global supply chain difficulties made even worse by the war in Ukraine, and we end up in a situation where the sacrifice ratio may be at historically high levels. It seems that the economy may be facing a catastrophic recession of a magnitude not seen since the Great Depression of the 1930s may be on the horizon.

Sources:

Related Pages:

- What is Inflation, and why is it bad?

- What Causes Inflation?

- Sticky Wages & Prices

- Creeping Inflation

- Galloping Inflation

- Does Quantitative Easing cause Inflation?

- The Business Cycle

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.