What is Stagflation in Economics?

The term 'Stagflation' is an amalgam of words stagnation & inflation. It was popularized in the 1970s due the difficult economic circumstances at the time, with both rising inflation and rising unemployment occurring together for the first time in modern history.

The economic models of the day were unable to explain how such a thing was possible, but it happened nonetheless. The missing link in those old models was the role of inflationary expectations and, while I won't be explaining that in this article, I have explained it fully in my article about the non-accelerating inflation rate of unemployment NAIRU.

Suffice it to say here that inflation today is not just about excess demand relative to supply today, but also about previous levels of inflation. If there was high inflation in the previous period, people will expect high inflation in the next period, and that expectation becomes a self-fulfilling prophecy.

Stagflation of the 1970s

The stagflation of the 1970s, that occurred throughout the western world, resulted from a combination of bad economic policy and significant supply-side cost increases in the form of higher oil prices.

I'll start with the bad economic policy that led to the collapse of the Bretton Woods System.

Bretton Woods Collapse

Some economists argue that the main cause of stagflation in the 1970s, and subsequent rise to prominence of supply-side economics, was the collapse of the fixed exchange rate arrangement known as the Bretton Woods System.

This system was operated by member countries agreeing to peg the value of their currencies to the US Dollar, while the dollar was pegged to gold at $35 per ounce. However, maintaining these pegs became increasingly difficult in the 1960s due to increased US government spending on social programs, and on the Vietnam War.

Increased government spending, particularly on foreign wars, is known to cause inflation because the extra spending is never matched by extra production of consumer goods. It creates a mismatch between supply and demand with demand accelerating beyond productive capacity (supply can even contract if enough resources are devoted to military goods at the expense of consumer goods).

Inflationary pressure is particularly amplified when the extra spending is funded by money-printing, and by 1971 a significant amount of extra dollars had been printed. Unfortunately for the US government, it was not able to print extra gold! As the supply of dollars increased relative to gold reserves, pressure on the dollar to devalue also increased.

With inflation in the US steadily rising throughout the 1960s, interest rates were raised to fight the rising price level, but it wasn't enough to protect the dollar. A growing trade deficit on the balance of payments was becoming impossible to ignore, and US gold reserves were rapidly declining as it flowed out of the country in settlement of the trade deficit.

On 15th August 1971, President Nixon 'temporarily' suspended convertibility of the dollar into gold at the agreed price of $35 per ounce of gold. That convertibility was never restored. The level of money-printing, on the other hand, continued to grow and add fuel to the inflation fire that was already raging by the early 1970s.

The OPEC Oil Price Rises

The 1973 OPEC oil embargo that was imposed on the west as a result of US support for Israel during the Yom Kippur war meant that supplies of oil were heavily restricted, and prices rose sharply. This delivered a sharp contraction in economic output at the same time as feeding into price rises for many other goods (i.e., oil costs are a very important component of the overall cost of production for many goods & services).

Moreover, there was already falling aggregate demand due to the policy of reducing the budget deficits that were built up during the Vietnam War years. This, combined with a significant contraction of aggregate supply, and already high levels of inflation, was sufficient to cause the inflation rate to start increasing again even as the economy fell into a sharp recession i.e. stagflation.

The experience of stagflation caused a shift in policy thinking at the Federal Reserve, culminating in the acceptance that mere inflationary expectations were enough to actually cause more inflation in future. However, it wasn't until Paul Volcker was appointed Chairman of the Federal Reserve in 1979 that monetary policy was eventually tightened enough to finally bring inflation under control.

What Causes Stagflation?

Any unforeseen business change (i.e. a shock) that makes it more expensive to supply goods and services to the market can be described as a negative supply-side change. Businesses usually respond by cutting back on production and laying off workers, and if left unchecked this can turn into a recession.

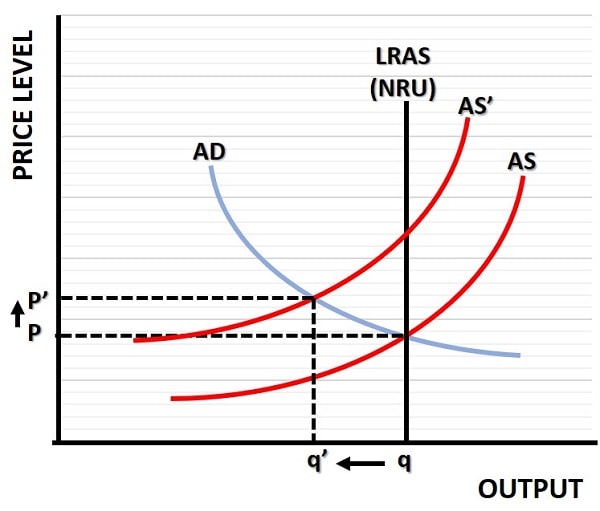

In the graph above, starting with an output level of q that is consistent with the natural rate of unemployment and a stable price level of p, a contraction of aggregate supply from AS to AS' causes the price level to rise to p' while output falls to q'. At the lower output level, firms will cut back on jobs and unemployment will increase causing stagflation.

Supply-Side shocks to the economy are the most likely culprit for causing stagflation, but it is possible that a combination of other factors could also cause it.

For example, a series of bad government policies that lead to unsustainable output and national debt levels, combined with an irresponsible fractional reserve banking system and a central bank that has held interest rates well below market rates since 2008, might just do the trick!

Stagflation vs Recession

Thankfully, it is quite rare for aggregate supply to contract significantly or for any prolonged period of time, so occurrences of stagflation have been rare. Most economic downturns come as a result of falling aggregate demand, but that has the effect of easing pressure on inflation, so recession rather than stagflation is much more common.

How to Beat Stagflation

Unfortunately, there is no easy solution for beating stagflation. The aftermath of the 1970s did allow supply-side economics to gain traction, because anything that can be done to boost aggregate supply after it has contracted would be an obvious benefit. However, supply-side policies are not really an antidote to aggregate supply contractions, any improvement to supply is desirable in all economic circumstances, not just when stagflation occurs.

Prevention is far better than cure, but that would require a much better economic system that restricts government incompetence, restricts excessive lending by the fractional reserve banking system, allows the free-market to determine interest rates, and prevents perpetual budget deficits from turning into nightmare levels of national debt.

If we find a way to cure those problems then we'll automatically beat stagflation by preventing it from arising, as well as the worst of our other economic problems.

Related Pages:

- What is Inflation?

- What Causes Inflation?

- How to Stop Inflation

- How to beat Stagflation

- Adaptive Expectations

- Hyperinflation

- Is Stagflation worse than Recession?

- Stagflation vs Stagnation

- What happens to House Prices during Stagflation?

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.