- Home

- Market Failure

- Edgeworth Box

The Edgeworth Box Diagram Explained (With Example)

The Edgeworth box is a graphical tool used in microeconomics to analyze the distribution of goods or resources between two agents in an economy. It helps in understanding how these agents can exchange goods or resources with each other to reach a more efficient allocation, given their preferences and initial endowments.

The model here is based on an adaptation of the more commonly understood model on indifference curves. For a refresher on that model, have a look at my main article:

In this article, I'll explain how Edgeworth Box diagram can be used to illustrate how economic agents can achieve efficiency gains via trading with each other. Given the limitations of two-dimensional graphs it is not possible to illustrate on a graph how this would work for more than two individuals, but the points made are directly applicable to larger populations

Key components of the Edgeworth box

The Edgeworth box illustrates a simplified economy with only two individuals (two producers or two consumers) and two goods or resources. For simplicity, I'll proceed with an example of two consumers who can exchange two goods, cheese and biscuits, with each other.

Each consumer (John and Jane) has their own unique preferences over these two goods in terms of the relative amounts of them that they like to consume. These preferences are illustrated via their respective indifference curves.

An Edgeworth Box Diagram Example

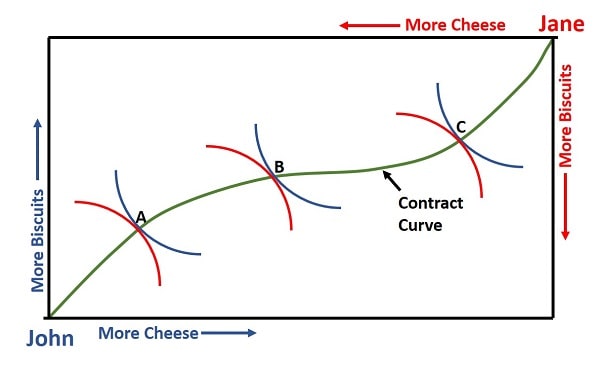

Edgeworth Box diagram showing how two consumers can trade two goods and reach Pareto-efficient allocations in a simple exchange economy.

Edgeworth Box diagram showing how two consumers can trade two goods and reach Pareto-efficient allocations in a simple exchange economy.The box’s dimensions represent the total quantity of cheese and biscuits available in the economy. The horizontal axis shows the quantity of cheese, and the vertical axis shows the quantity of biscuits.

Each consumer starts with a specific allocation or endowment of the two goods, represented as a point in the box.

Each agent’s preferences are represented by indifference curves, which show combinations of cheese and biscuits that provide the same level of satisfaction (or utility). Higher indifference curves represent higher utility levels.

Pareto Efficiency

The Edgeworth box helps identify Pareto efficient allocations, where it’s impossible to make one consumer better off without making the other worse off.

These points lie on the contract curve, which runs between the two consumers’ indifference curves where their marginal rates of substitution (MRS) are equal.

For more details on this, see my main article:

How the Edgeworth Box Works

The Edgeworth box diagram above is formed by plotting the total amount of cheese on the horizontal axis and the total amount of biscuits on the vertical axis. John's origin is placed at the lower left, while Jane's origin is at the upper right, effectively flipping her indifference curve.

By analyzing the indifference curves of both consumers, economists can see how they might benefit from trading goods with each other.

The contract curve inside the box shows the set of efficient allocations that maximize the welfare of both agents, it occurs at the points where John's indifference curve just touches Jane's indifference curve.

The Edgeworth box is commonly used to illustrate the concept of gains from trade, market equilibria, and welfare economics, as it visualizes how two individuals can potentially reach mutually beneficial agreements by trading goods until they reach a Pareto efficient allocation.

For more explanation of how the trading process between John and Jane will naturally lead to these efficient allocations, with tangential indifference curves as illustrated in the Edgeworth Box diagram above, have a look at my article about Allocative Efficiency.

Related Pages:

- Pareto Efficiency

- Allocative Efficiency

- Productive Efficiency

- Dynamic Efficiency

- Economic Efficiency

- Market Failure

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.