Does

Government Spending Cause Inflation?

Does government spending cause inflation? The short answer is that it often does, but not in a simple or mechanical way. Inflation is shaped by many forces at once, which makes it tempting to dismiss government spending as just one variable among many.

However, when government spending increases faster than the economy’s ability to produce real goods and services, it adds inflationary pressure that cannot be wished away.

The key issue is not whether government spending exists, but how it operates in practice. Government spending injects purchasing power into the economy immediately, while the value it creates is uncertain, delayed, or in many cases never fully realized. This creates an imbalance between money and output that tends to push prices higher over time.

That does not mean every increase in government spending leads directly to rising prices, nor does it mean inflation can be traced neatly to a single budget decision. The economy is noisy, complex, and influenced by many overlapping factors. But complexity should not be confused with neutrality. When examined through the lens of incentives, resource use, and real-world outcomes, government spending is rarely inflation-free.

The sections below explain how and why government spending affects inflation, why the relationship is often obscured in the data, and what recent real-world examples reveal about the limits of fiscal expansion as a tool for economic stability.

Does Government Spending Cause Inflation in Practice?

Government spending, as it is typically carried out, tends to widen the gap between the amount of money circulating in the economy and the value of the products that are available for purchase. This does indeed create inflationary pressure, but it is often obscured by many other factors.

Some economists argue that government spending is non-inflationary when unused capacity exists, but this assumption often breaks down in real economies with rigid supply and political constraints.

The problem is one of productive efficiency.

Private sector spending is motivated by getting the absolute most value possible from the goods and services that it purchases, and those purchases then send a clear message to producers that profits are to be made in increasing the supply of those ‘in demand’ products.

In contrast, government spending is motivated by political concerns, and it usually fails to deliver equivalent value. Without the discipline of profit and loss, projects continue even when they generate little value. Costs are socialized, while benefits are difficult to measure. As a result, the economy ends up with more money circulating than additional output to absorb it.

This excess demand does not instantly raise prices in every case, but it creates persistent inflationary pressure that shows up once supply constraints tighten or expectations adjust. The effect can be delayed, obscured, or offset by other forces, but it does not disappear.

This is why asking 'does government spending cause inflation' is ultimately a question about incentives and output, not just budgets or money supply.

Why Wasteful Government Spending Causes Inflation

In theory, government spending could be non-inflationary if it consistently generated real value equal to its monetary cost. In reality, this is highly unlikely.

Government spending is structurally wasteful, not necessarily due to corruption, but because of incentive problems. Decision-makers do not bear the cost of failure. Feedback is slow or nonexistent. Projects are chosen for political visibility rather than economic return.

The result is predictable. Government spending injects more monetary units into the economy than it creates goods and services. Over time, this imbalance leads to price inflation as more money competes for limited output.

How

Government Spending Affects Inflation Through Resource Use

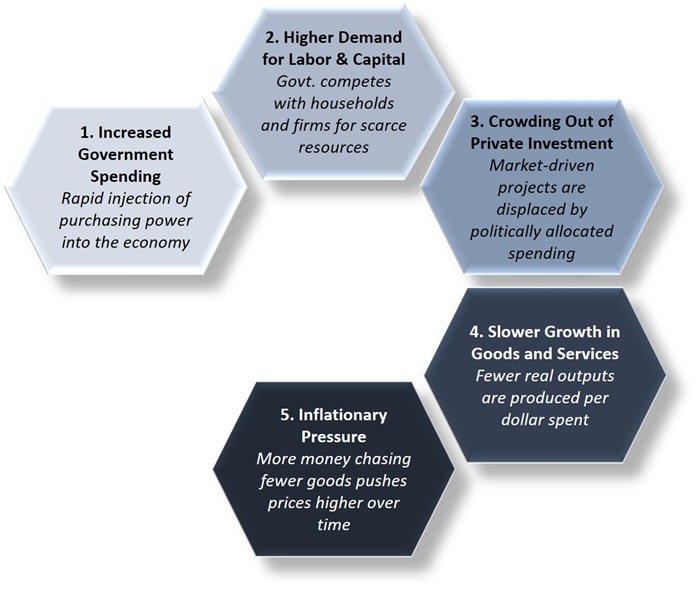

How government spending can raise inflation by increasing demand while crowding out private investment and limiting supply growth.

How government spending can raise inflation by increasing demand while crowding out private investment and limiting supply growth.How does government spending cause inflation? It does so by changing how scarce resources are allocated across the economy. Labor, capital, land, energy, and materials are limited at any given time. When the government increases spending, it draws on the same resource pool as households and private firms.

This is where the crowding out effect becomes important. Crowding out occurs when government spending displaces private sector activity by bidding resources away from market-driven uses. Even if total spending in the economy rises, the composition of that spending shifts toward government-selected projects rather than those guided by consumer demand and price signals.

From an inflation perspective, this matters because private sector investment is generally more efficient at converting resources into valuable goods and services. When government spending crowds out private activity, the economy produces less output per unit of input. In other words, more money is spent, but fewer real goods and services are created.

The crowding out effect does not require full employment to operate. In practice, many resources are specialized and cannot be easily redeployed. A government infrastructure project may hire engineers, construction firms, and materials that would otherwise be used in housing, energy, or manufacturing. The private projects that do not happen are invisible, but their absence reduces future supply.

This reduction in supply is what links crowding out to inflation. Government spending increases demand immediately, but by diverting resources from productive private uses, it can weaken the economy’s ability to expand output over time. Prices then rise not only because demand is higher, but because supply growth has been impaired.

The inflationary effect may be delayed, but it accumulates as productive investment spending is gradually displaced.

This helps explain why economies can experience rising prices even when growth is weak. Government spending can raise nominal demand while simultaneously reducing real productive capacity. The result is higher prices rather than sustained increases in living standards.

Government

Spending and Inflation: Real-World Examples and Economic 'Noise'

U.S. and U.K. inflation in the post-Covid environment illustrates the issue clearly. Large-scale fiscal spending increased demand rapidly, while supply chains, housing, and labor markets were constrained.

Prices rose not because of a single policy, but because demand was pushed beyond what the economy could realistically supply (especially so since much of the economy had been in lockdown and unable to produce anything).

That said, tracing a clean line between spending and inflation is difficult. Productivity changes, energy prices, trade disruptions, demographics, regulation, and monetary policy all create noise in the data.

This complexity does not invalidate the relationship. It simply means inflation is a cumulative outcome rather than a single-variable event.

Did

Government Spending Cause Inflation in the U.S. After Covid?

Did government spending cause inflation in the U.S. after Covid? It was not the only factor, but it played a significant role in creating the conditions that allowed inflation to surge once the economy reopened.

Between 2020 and 2021, federal spending increased at an unprecedented pace. Large stimulus checks, expanded unemployment benefits, business support programs, and state transfers injected trillions of dollars of new purchasing power into the economy in a very short period of time. This spending was funded primarily through deficits that were absorbed by the financial system with support from the Federal Reserve.

At the same time, the economy’s ability to produce goods and services was constrained. Supply chains were disrupted, labor participation fell, housing construction lagged demand, and energy production faced regulatory and logistical limits. Government spending boosted demand aggressively, but it did not and could not expand real output at the same speed.

For a time, inflation remained muted because lockdowns suppressed certain types of consumption and savings rates rose. Once restrictions eased, that stored-up purchasing power collided with limited supply. Prices rose sharply across housing, food, energy, vehicles, and services.

This does not mean every dollar of Covid-era spending translated directly into higher prices, nor does it mean inflation was purely a fiscal phenomenon. Monetary policy, global supply shocks, and behavioral changes all mattered. But without the scale and structure of government spending during the period, the inflation that followed would almost certainly have been smaller.

The Covid episode illustrates why asking whether government spending causes inflation cannot be answered by looking only at the moment the spending occurs. The inflationary effects often appear later, once demand is unleashed into an economy that cannot easily expand supply.

Does Cutting

Government Spending Reduce Inflation?

Reducing government spending can lower inflationary pressure, but here again the effect is neither immediate nor guaranteed. Inflation depends on expectations, monetary conditions, and real supply constraints.

Spending cuts are most effective when they reduce excess demand without harming productive capacity. Credibility also matters. If markets believe spending restraint will last, inflation expectations adjust more quickly.

Without broader fiscal and monetary discipline, however, cutting spending alone may have limited impact on price stability.

The following questions address related concerns about government spending and inflation that often arise alongside this discussion.

FAQs

How much does

government spending affect inflation compared to monetary policy?

How much does

government spending affect inflation compared to monetary policy?

Government spending and monetary policy interact, but they affect inflation through different channels. Monetary policy influences how easily money circulates through interest rates and credit conditions, while government spending directly injects demand into the economy. Large increases in spending can overwhelm tight monetary policy if they significantly expand demand without increasing supply, which is why fiscal and monetary policy must be evaluated together rather than in isolation.

Is government

spending the main cause of inflation?

Is government

spending the main cause of inflation?

Government spending is rarely the sole or dominant cause of inflation on its own. Inflation usually results from a combination of fiscal expansion, monetary conditions, supply constraints, and expectations. However, sustained increases in government spending can become a major contributing factor when they persist over time and are not matched by corresponding growth in productive capacity.

Can government

spending cause inflation even if taxes are increased?

Can government

spending cause inflation even if taxes are increased?

Yes, government spending can still be inflationary even when funded by higher taxes. Taxes reduce private sector purchasing power, but they also change incentives, investment behavior, and production decisions. If taxed resources are shifted into less productive government uses, the economy may end up with lower overall output, which can still result in upward pressure on prices.

Does increased

government spending always lead to inflation?

Does increased

government spending always lead to inflation?

Increased government spending does not always lead to immediate inflation. The effect depends on economic conditions, such as spare capacity, productivity trends, and supply flexibility. However, repeated or sustained increases in spending raise the risk of inflation over time, especially when spending outpaces the economy’s ability to expand real output.

Does government

spending affect inflation differently in developing and developed economies?

Does government

spending affect inflation differently in developing and developed economies?

Yes. Developed economies often experience delayed inflation because financial markets, global trade, and credible institutions can absorb fiscal expansion temporarily. In developing economies, inflation can appear more quickly due to weaker institutions, limited capital markets, and less flexible supply. The underlying mechanism is similar, but the timing and severity differ.

Conclusion:

Does Government Spending Cause Inflation?

So, does government spending cause inflation? While it is not the sole driver, increased government spending does add inflationary pressure because it typically injects more money into the economy than the real goods and services it creates.

When public spending replaces productive private activity, the inflationary effect is stronger over time, even if prices do not rise immediately. The economy ends up with more monetary claims and fewer market-tested outputs.

Inflation is complex and shaped by many forces, but the underlying mechanism remains simple: when spending expands demand without expanding supply, prices eventually adjust. That is why, in practice, government spending is rarely neutral and often inflationary.

Source:

Related Pages:

- Demand-Pull Inflation - Government spending contributes to demand-pull inflation by increasing total spending without a matching increase in goods and services.

- Capacity Constraints - Even during downturns, many resources are constrained or specialized, limiting how much additional output government spending can generate.

- Discretionary Fiscal Policy - Large spending programs are examples of discretionary fiscal policy, which can amplify inflation when poorly timed or inefficiently allocated.

- Cost-Push Inflation - By bidding up wages, materials, and energy, government projects can indirectly raise production costs across the economy.

- Productive Efficiency - Government spending often reduces productive efficiency by reallocating resources away from market-tested uses.

- Quantity Theory of Money - While simplistic on its own, the quantity theory helps explain why increases in spending without output growth tend to raise prices.

- Public Choice Theory - Public choice theory explains why government spending decisions are driven by political incentives rather than economic efficiency, increasing inflation risk.

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.