- Home

- Aggregate Demand

- How to Calculate

How To Calculate Aggregate Demand

The only way how to calculate aggregate demand in an economy over a given time-period (usually a calendar year) is to add up all of the expenditures that have occurred over that time-period. The 'expenditure model' is one of three measures of national income that economists use to keep track of economic output.

The three models of national income accounting are:

- The Expenditure Approach

- The Income Approach

- The Output Approach

All three methods are used, and together they form an accounting identity:

Expenditure = Income = Output

The reason for this is that all of these methods are essentially measuring the same things but from different perspectives.

Aggregate demand calculation is, of course, subject to some error. However, these errors are relatively small, and when compared against the other measures of national income it is possible for economists to form a reasonable estimate of an economy's size, and how it has grown/shrunk over previous periods.

For a more detailed understanding of general concepts, have a look at my main article via the link:

The Aggregate Expenditure Model

You should note that the relevant expenditures are those on domestically produced goods and services, meaning that spending on imported goods, whilst constituting part of domestic aggregate demand, does not count towards domestic national income as it is actually part of another country's output. Similarly, foreigner's spending on our goods does count.

There are slightly different measures of national income definition e.g. GDP, GNP, NNP and so on that include different layers of accounting, but the basic approach is the same.

Economists do not actually calculate aggregate demand directly, except in so far as it equates to measuring national income. Instead they are interested in building theoretical models about how it interacts with aggregate supply in order that we can make better sense of related concepts like inflation and unemployment. Those related concepts are definitely measured, and form the basis of economic policy actions, which is why we need to construct theories of how these things interact.

By observing prices, output levels, and unemployment levels, we can infer (rather than calculate) where the aggregate demand and supply curves are, and how they are moving. From that, economists can form policy advice about how best to manage the economy.

Related to 'How to calculate aggregate demand'

- How do lower taxes affect aggregate demand?

- How does government spending affect aggregate demand?

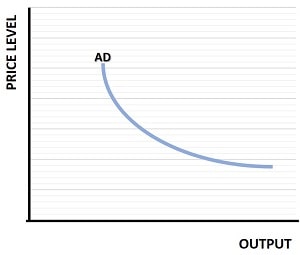

- The Aggregate Demand Curve

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.