- Home

- Consumer Behavior

- Cross Price Elasticity

Cross Price

Elasticity of Demand (XED) Graph & Examples

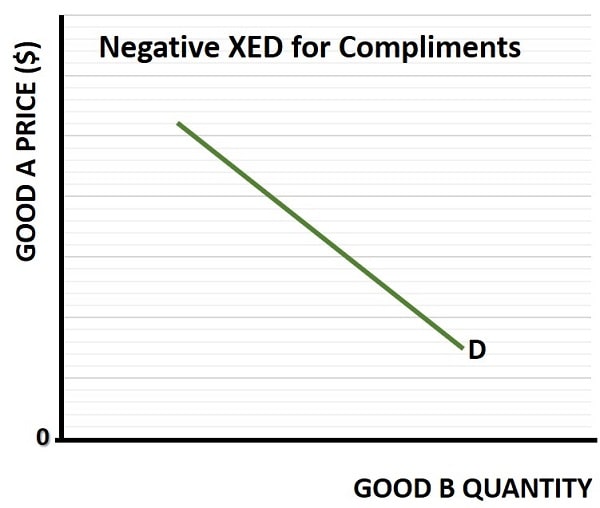

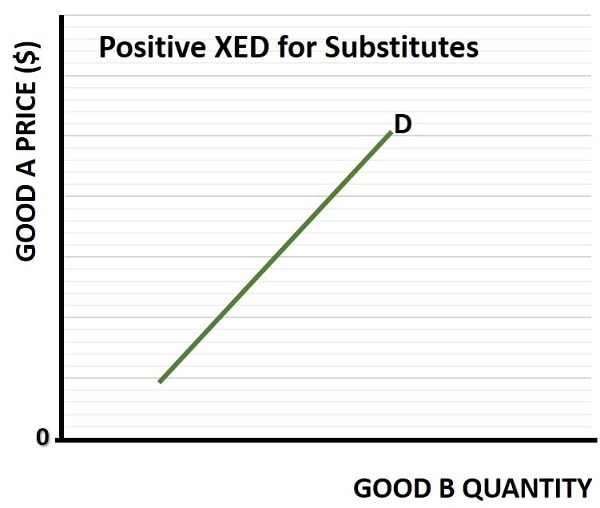

The cross price elasticity of demand measures the extent to which a change in the price of one product affects the demand for another. For instance, when the price of coffee rises, does it lead you to seek out tea instead? These two goods are clearly related to each other and so the price of one will affect the demand for the other.

The majority of goods, however, are not related in this way, and for these goods there is no significant cross price elasticity of demand. The concept therefore only applies to those goods which are complements to each other, or substitutes for one another.

For more information on these two types of goods, see my article:

General price elasticity of demand is influenced by several factors, including the availability of substitutes & complements, the proportion of income spent on the good, and the time period under consideration. Cross price elasticity of demand extends this concept by examining the relationship between the price of one good and the demand for another.

This is useful businesses and policymakers because it provides insights into consumer behavior and market dynamics. For example, if a company knows that its product has a high positive cross price elasticity with a competitor's product, it can anticipate changes in demand based on the competitor's pricing strategies.

Cross Price Elasticity of Demand

formula

The cross price elasticity of demand formula is expressed as the percentage change in the quantity demanded of good A (QA) divided by the percentage change in the price of good B (PB). In mathematical notation this is written as:

XED = (ΔQA/QA)/(ΔPB/PB)

Where Δ denotes 'change' i.e., if the price of coffee increases from 20 cents per sachet to 25 cents, the change is 5 cents.

The formula may result in either a positive number or a negative number, indicating that the two goods are either substitutes or complements respectively. Of course, if there is no relationship between the two goods then the number will be zero (or very close to zero).

Coffee and creamer are complements, meaning that an increase in the price of either will reduce demand for the other, meaning that the XED between these two goods is negative.

Coke and Pepsi on the other hand are examples of substitutes because an increase in the price of one will likely increase demand for the other i.e., the XED is positive between these two goods.

Examples of

Cross Price Elasticity in Different Industries

Due to the nature of how cross price elasticity works, it is most applicable to larger businesses that actively consider how their competitors will react to their pricing strategies. This means that it relates more to firms in monopolistic competition or oligopoly market structures. It applies less to competitive market structures since the firms there are small with respect to their market share, meaning that they are price-takers.

For instance, if a large business knows that its product has high cross price elasticity with a competitor's product, it might choose to implement price cuts in order to attract price-sensitive consumers from its competitors and thereby increase market share. The firm will need to act with caution though, because it’s price cuts might spark a price war with its competitors. These considerations fall into the realm of strategic behavior and game theory, and knowledge of cross price elasticity is fundamental to that.

In addition to competitive pricing, businesses can use cross price elasticity to identify opportunities for bundling products. By offering complementary goods as a package at a discounted price, companies can capitalize on the negative cross price elasticity between the products. For example, a company selling printers might bundle them with ink cartridges, encouraging consumers to purchase both items together and increasing overall sales.

Companies offering complementary products may collaborate or form partnerships to enhance their market position. For instance, a smartphone manufacturer might collaborate with a telecommunications provider to offer bundled deals, leveraging the negative cross price elasticity between their products. Such partnerships can create synergies that benefit both parties and strengthen their competitive advantage.

Consumer preferences and perceptions also influence cross price elasticity. Products that are perceived as unique or having strong brand loyalty may exhibit lower cross price elasticity because consumers are less likely to switch to alternatives based on price changes.

Additionally, the availability of information about prices and alternatives can impact cross price elasticity. In markets where consumers have easy access to price comparisons and alternative options, cross price elasticity is likely to be higher as consumers can make more informed decisions.

FAQs about

Cross Price Elasticity

How does cross price elasticity of demand interact with

income elasticity of demand?

How does cross price elasticity of demand interact with income elasticity of demand?

While cross price elasticity (XED) measures how the price of one good affects the demand for another, income elasticity of demand (YED) measures how demand changes with consumer income. Together, they offer a fuller picture of consumer behavior: for instance, luxury substitutes may show both high XED and high YED.

Can cross price elasticity of demand be asymmetric between

two goods?

Can cross price elasticity of demand be asymmetric between two goods?

Yes, XED can be asymmetric. For example, a price change in Coke might significantly affect Pepsi's demand, but a price change in Pepsi may have a smaller impact on Coke due to stronger brand loyalty. The relationship isn't always reciprocal or equal in strength.

What role does seasonality play in cross price elasticity of

demand?

What role does seasonality play in cross price elasticity of demand?

Seasonal trends can temporarily alter the XED between products. For example, the cross price elasticity between sunscreen and beachwear may spike in summer but be negligible in winter, meaning context and timing matter when analyzing XED data.

Can advertising affect the measured cross price elasticity

of two goods?

Can advertising affect the measured cross price elasticity of two goods?

Yes. Effective advertising can reduce the substitutability of a product by reinforcing brand loyalty or perceived uniqueness, lowering the XED even if the goods are technically substitutes.

How does product differentiation affect cross price

elasticity?

How does product differentiation affect cross price elasticity?

Highly differentiated products tend to have lower XED because consumers perceive them as less interchangeable. Commoditized products with few differences typically exhibit higher XED values with their substitutes.

How should businesses interpret zero or near-zero XED values

in their data?

How should businesses interpret zero or near-zero XED values in their data?

A near-zero XED suggests no significant relationship between products. This can inform decisions to avoid bundling or co-marketing, and to focus efforts on improving internal product synergy or targeting more closely linked goods.

Conclusion

Understanding cross price elasticity is essential for both consumers and businesses, as it provides valuable insights into how changes in pricing affect demand for related products.

For consumers, awareness of cross price elasticity helps in making informed purchasing decisions, allowing them to maximize their utility while managing costs.

For businesses, cross price elasticity is a powerful tool for developing strategic pricing, marketing, and product development plans. By analyzing the cross price elasticity of their products in relation to competitors and complementary goods, companies can anticipate market trends, optimize pricing strategies, and identify opportunities for growth.

In the broader context of economics, cross price elasticity contributes to a deeper understanding of market dynamics and consumer behavior. Policymakers and economists use cross price elasticity to analyze the impact of pricing policies, market regulations, and economic conditions on demand for various products.

Related Pages:

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.