- Home

- Market Failure

- Marginal Social Benefit

Marginal Social Benefit & Private Benefit (With Graphs)

A significant marginal social benefit sometimes comes with a good or service when third party citizens are positively affected by the sale and consumption of those products. These are referred to as positive external benefits since they are external to the original buyer/seller.

A free-market economy will tend to under produce/consume these sorts of goods and services because external benefits are not taken into account when deciding price and output levels.

Only marginal private benefit is considered by consumers when deciding how much to purchase, and producers only consider the fee that they can charge those buyers - they cannot charge third party citizens for any benefits that they may receive.

Examples of products that have a marginal social benefit include things like vaccinations (because unvaccinated people gain some protection from other people being vaccinated), research and development (which may be adapted for many uses beyond what the original researches paid for), healthy lifestyle & diet choices (that avoid unnecessary medical care that general taxpayers would be called upon to pay for).

The costs resulting from free-market price and output points are best illustrated by a graph.

Marginal Social Benefit Graph

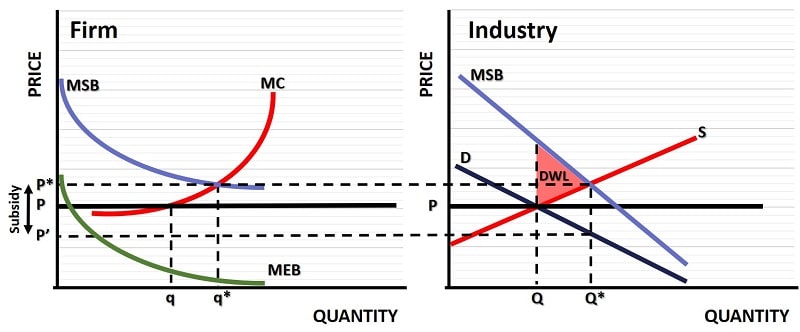

In the marginal social benefit graph above I've illustrated the price/output decisions that will be arrived at via the free-market, and compared that to the optimal point. Starting with an individual competitive firm on the left-side of the graph, we assume that the firm has no market power to raise or lower the price of its product.

In other words, the competitive free-market price is determined by the industry supply and demand curves. These are illustrated on the right-side of the graph, and they intersect at a price of P and production of Q. The individual firm, given a price of P, will set its production to the point where its marginal cost curve intersects that horizontal price line. This occurs at a production rate of q.

If this was an industry that did not produce any external benefits for society, we would have achieved an optimal price and output level, but we assume here that there are indeed significant external benefits. These benefits are illustrated by the downward sloping green MEB curve for the firm.

The MEB curve (and by association the MSB curve) is downward sloping because we assume that the external benefits that society gains from the product are limited. For example, if a third person gets a benefit from some people being vaccinated, there will be a point when so many people are vaccinated that the third person's probably of being infected is reduced as low as possible, and further vaccinations for other people will yield no further benefits for that third person.

Marginal Private Benefit

Marginal social benefit is illustrated in the graph above to show that it is equal to marginal external benefit plus marginal private benefit i.e.:

MSB = MEB + MPB

You can see this on the left-side of the graph, but you need to realize that private marginal benefits are simply the marginal revenue for the firm i.e. the price that it receives for each unit of output. So, the MSB curve is higher than the MEB curve because price is added to it.

Optimal Marginal Social Benefit & DWL Costs

You can see from the right-side of the graph that there is a red deadweight loss (DWL) area that represents the costs to society associated with the free-market price and output levels P and Q. These costs exist because there are social benefits from the product over and above the industry demand curve (which only reflects demand from buyers, rather than both buyers and third party beneficiaries).

The optimal price and output levels are determined by the intersection of the industry supply curve and the MSB curve. This occurs at a price of P* and Q* as shown.

Note, however, that this presents a problem. With an increased output of Q* each individual firm will need to increase its output from q to q*, but at this increased rate of production the firms will have to lower their prices to P' in order to attract enough buyers. You can see this from the industry demand curve, where Q* can only be sold at a price to buyers of P'.

To solve this problem the government will need to take action. This action will usually take the form of a Pigouvian subsidy for each unit of output that the firms sell. That subsidy will need to be large enough to fill the gap between P* and P' in order to encourage firms to produce at the desired output rate of q*.

If this is done successfully, then the industry will get rid of the deadweight loss economic costs and marginal social benefit will be optimized.

Economics & Demand Management

My regular readers will know that I generally take a negative view of government interventions in the economy, and that I much prefer to allow the forces of supply and demand to work out the best value outcomes. However, that sentiment generally applies to the demand-management policies that are commonly used to influence the business cycle.

When it comes to the permanent market failures associated with externalities, I do support interventions to improve social outcomes. The simple graphs and illustrations presented here are, however, very difficult to reproduce in the real world.

This means that, while in principle there is scope here to improve upon free-market outcomes, a great deal of care needs to be taken to avoid mistakes. The costs of evaluating real-world imperfections in free market economics, and then monitoring how they evolve over time, are often prohibitively expensive.

Related Pages:

- Marginal Social Cost &Private Cost

- Externalities in Economics

- Types of Market Failure

- Socially Optimal Quantity of Output

- Marginal External Cost

- Marginal External Benefit

- Thinking At The Margin

About the Author

Steve Bain is an economics writer and analyst with a BSc in Economics and experience in regional economic development for UK local government agencies. He explains economic theory and policy through clear, accessible writing informed by both academic training and real-world work.

Read Steve’s full bio

Recent Articles

-

What Happens to House Prices in a Recession?

Jan 11, 26 03:13 AM

What happens to house prices in a recession? Learn how different recessions affect housing, why 2008 was unique, and how policy responses change home values. -

Does Government Spending Cause Inflation?

Jan 10, 26 06:01 AM

Does government spending cause inflation? See how waste, crowding out, and stimulus spending quietly push prices higher over time. -

What Happens to Interest Rates During a Recession

Jan 08, 26 05:31 PM

What happens to interest rates during a recession? Explore why rates often fall, when they don’t, and how inflation, policy, and markets interact. -

Circular Flow Diagram in Economics: How Money Flows

Jan 03, 26 04:57 AM

See how money flows through the economy using the circular flow diagram, and how spending, saving, and policy shape real economic outcomes. -

What Happens to House Prices During Stagflation?

Jan 02, 26 09:39 AM

Discover how house prices and real estate behave during stagflation, with historical examples and key factors shaping the housing market.